An Equity Payback is a large scale, long-dated financing agreement negotiated with enterprise, directly, for formula-based sharing in enterprise cash flows prioritized by contract for:

- suitability of the technology to the times;

- longevity of the social contract between the enterprise and popular choice over time; and

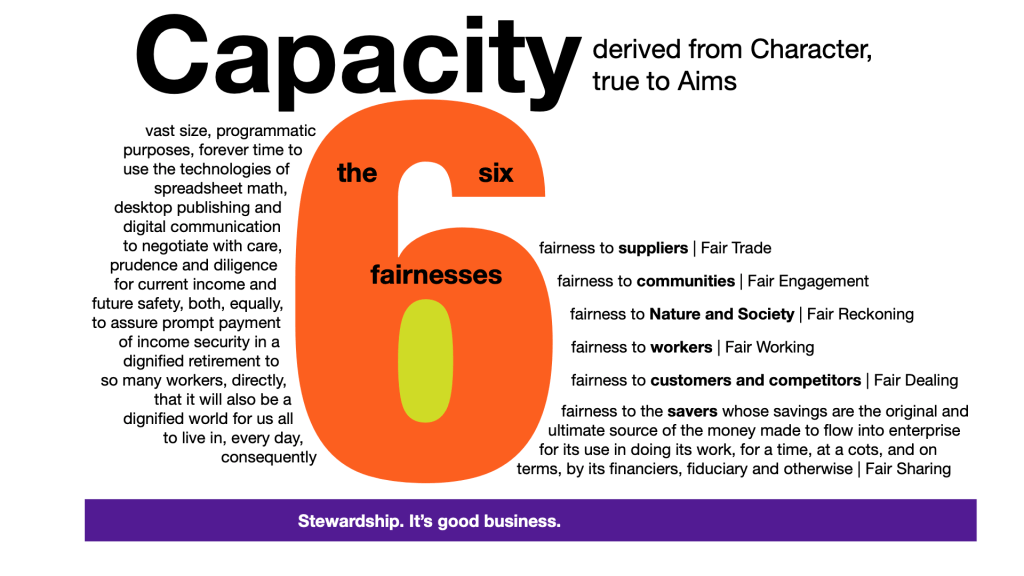

- fairness in how the business does business all the time, across all six vectors of fairness in business:

- fairness to suppliers (Fair Trade);

- fairness to communities, of place and of interest (Fair Engagement);

- fairness to Nature and Society and our shred Future (Fair Reckoning);

- fairness to workers, and in the workplace (Fair Working);

- fairness to customers, and competitors (Fair Dealing); and

- fairness to the savers whose savings are the original and ultimate source of the money made to flow into enterprise by its financiers (Fair Sharing).

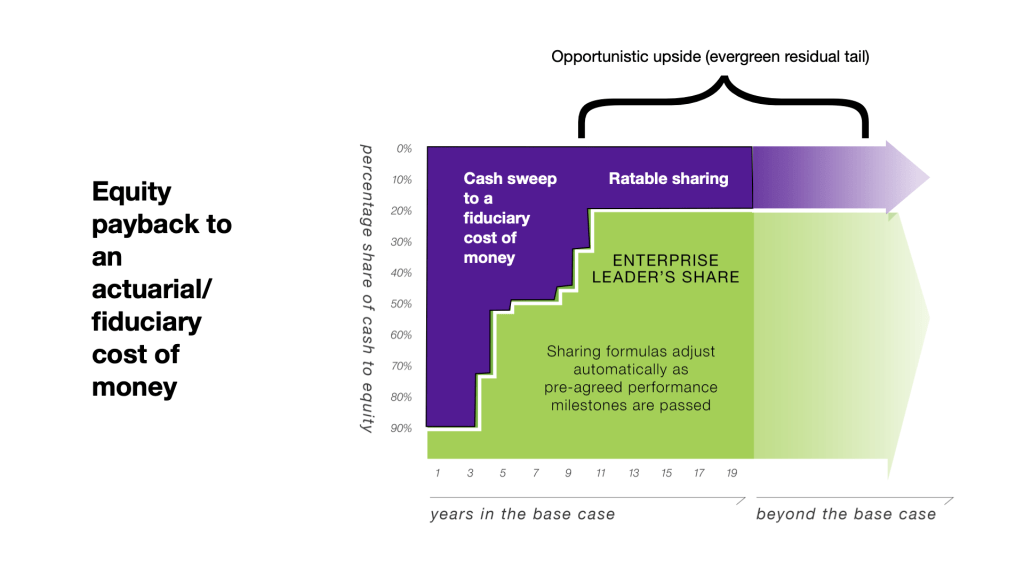

The agreed sharing formula is engineered to return the amounts supplied to the enterprise, through the financing, plus an agreed cost of money, within an expected number of years (called the base case), and opportunistic upside through evergreen residual sharing, beyond the base case.

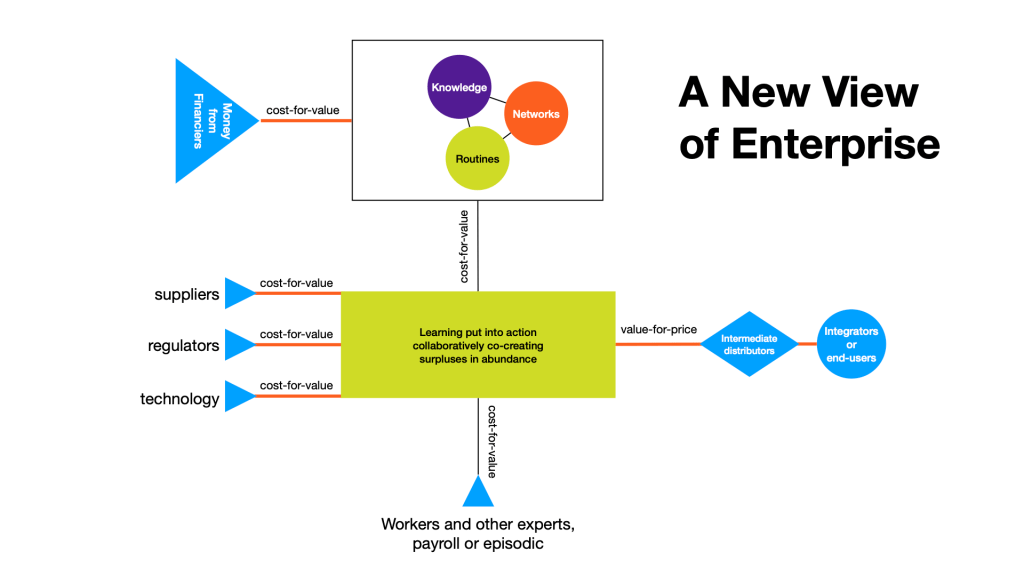

Financially engineering an Equity Payback begins with a theory of the enterprise, or firm, as

- a social configuration of physical Knowledge + Networks + Routines

- for converting cost-for-value into value-for-price

- by doing the work

- of putting technology

- as practical knowledge of how the world about us works in some specific way, and how we can take the world about us as we find it, in that way, and change it to be more a way we choose to make it, in that specific way,

- into action

- configuring a surplus of artifacts (as the work of human hands) as expressions of that technology, in abundance for sharing with others,

- for their use in making their own personal and private worlds more a way they choose to make them, in that specific way,

- in exchange for a price paid in money, or other value that can be converted into money, or that itself can be made to serve the function of money.

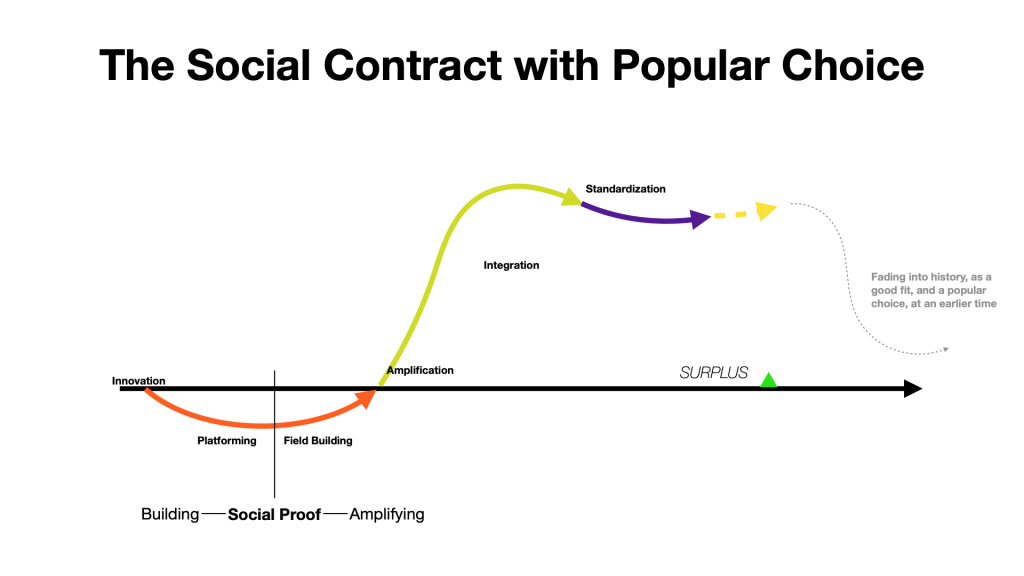

Every enterprise is seen to operate under a social license, or social contract, with popular choice that flourishes for a time, before fading in the fulness of time, as times change and humanity evolves prosperous adaptations to life’s constant changes, making new choices more popular, as better fit to the circumstances then prevailing, while letting previously popular choices fade into history as a good fit to the circumstances that prevailed at an earlier time, that begins with:

- innovation, and perception of the possibilities for putting new learning about the changing times into action sharing an abundance of technology solutions to the everyday problems of everyday people living our own best lives, as best we can, under the circumstances then prevailing, that proceeds through

- platform building to establish social proof of the social value of the technology, and of the enterprise as a supplier of artifacts as the expression of that technology to others, to

- field building to inspire the social conditions within which the technology can and will be used effectively and efficiently, according to its design specifications; continuing through

- amplification of the availability of the technology for purchase and use, and the

- integration of the technology into the economy, as a popular choice for its intended uses moving into

- standardization as the default solution of choice within specific populations for its specific use, before eventually falling into

- obsolescence, as times continuing changing and humanity continues adaptively evolving, making new choices available that become more popular under the circumstances then prevailing, while letting previously popular choices fade into history as a good fit to the circumstances that prevailed at an earlier time.

The risk in every financing for enterprise is that the enterprise will not realize sufficient price (by completing enough exchanges) to cover its costs (including its financing costs for the use of money to pay it s costs in anticipation of realizing its price), and keep itself ongoing through the flourish and fade of popular choice, on its journey from Innovation to Obsolescence.

Equity paybacks manage this risk through negotiated agreement on;

- line-item allowance in cost-of-work and price-at-volume budgets, to financially engineer cash flow expectation along an agreed base case; and

- self-adjusting formulas for allocating free cash flow (that is, price as actually realized after payment of costs as actually incurred) between the enterprise and its equity payback provider as a customized variation on the general theme of:

- high percentage allocations of free cash flow to a payback of the amounts advanced (the equity), until a cumulative total sharing to the financing equal 100% of those amounts advances (a simple return of “1x”, or MOI (multiple of invested amounts) of 1);

- thereafter declining to a less high “cash sweep” to the equity until cumulative distributions return the original amount advanced as equity, plus an agreed cost for that money (usually expressed as an interest-equivalent percentage or internal rate of return (IRR);

- thereafter declining to a lower ratable share that continues, as “upside to the equity”, for as long as the enterprise continues, or until the parties agree to a one time payment to terminate the financing.

Social Proof for Equity Paybacks

Equity paybacks evolved in Real Estate, where it became popular as a sociology for bringing equity in, alongside debt in the form of amortizing mortgage loans, to refinance developer + construction debt when a new building or complex was placed into service (received it’s Certificate of Occupancy (“CO”) from the local authorities) and successfully rented up to stabilized rents.

It was adapted for us in financing Affordable Housing as apartment complexes receiving government subsidies through tax credits, to become Tax Credit Equity in the US.

Tax Credit Equity got adapted for use in financing various qualifying Innovative and Renewable Energy technologies that are also subsidized through the tax code in the US.

Variations on the theme of Equity Paybacks are commonly used in many kinds of Project Finance, although a large amount of what is called Project Finance takes the form of 100% debt financing against contractually promised or government guaranteed cash flows, that are more in the nature of net lease than equitable payback financings.

The Equity Payback is the primary financing technology used by Private Equity, to finance private company roll-ups or public company going-private strategies, although Private Equity bends the arc of financial engineering away from INCOME with IMPACT and towards profit extraction through increased borrowing and as gain on sale.

The basic principle of negotiated agreement on a return over time from an agreed business strategy that sits at the core of the Equity Payback is commonly used in virtually every Mandate that every social trust awards to Asset Managers, although the terms of those mandates always bed the arc of loyalty away from INCOME with IMPACT and towards recklessly unreckoning profit extraction, primarily as gain on sale to other participants in the capital markets.

Restoring Loyalty to Social Purpose

The innovation in fiduciary finance the empowers the innovation of Fiduciary Activism bends the arc of loyalty back towards INCOME with IMPACT in the use of Equity Paybacks for the investment of fiduciary money aggregated into social trusts for the social purpose of socially provisioning the social safety nets of Workforce Pensions and Civil Society Endowments to assure income security in a dignified future to some, directly, as a private benefit (workers in their retirement, in the case of Pensions; Mission, in the case of Endowments), that will also be, of necessity a dignified present and future quality of life for us all, consequently, as a public good, by negotiating for equity paybacks to an actuarial/fiduciary cost of money, plus opportunistic upside, from, enterprise cash flows that are prioritized by contract for suitability of the technology to its times, longevity of the social contract between the enterprise and popular choice over time, and fairness in how the business does business all the time, for sufficiency to the longevity of the trust, and its ongoing ability to fund contractually calculated payments to contractually qualified recipients at contractually specified intervals, until its mission is complete.

The Innovation of Fiduciary Activism

As savers, as citizens, as taxpayers, and as people who care about our own sufficiency to our own longevity through social equity and respect for the laws of Nature, we each and all have a vested interest in the fiduciary faithfulness of those who have the legal right and responsibility to exercise discretionary control over the investment of money aggregated into social trusts for social purposes within the constraints of prudence in their exercise of the capacity they derive from their legally constituted character in undivided loyalty to their legally constituted aim, as specified in the private and public laws of their creation, because we are each and all directly impacted by the consequences of the investment choices these superfiduciaries do make.

That exposure to consequences gives us social standing to holding these superfiduciaries accountable for the investment policies they adopt and the investment choices that make, in their exercise of discretion within constraints.

It also gives us legal reason to participate in evolving our common sense, as prudent people familiar with such matters, under the circumstances then prevailing, of:

- the practical capacity that superfiduciary stewards of social trust actually derive from their legally constituted character of vast size, programmatic purpose and forever time;

- prudence in the exercise of that capacity that actually, practically possess;

- their aims, as specified in the private and public laws of their creation (including in virtually every case tax laws providing exemption for taxation as a subsidy paid for by the taxpayers in the jurisdiction(s) that grant those tax exemptions); and

- loyalty to those aims, in their exercise of the practical capacity they actually posses, under the circumstances then prevailing.

This is the innovation I call Fiduciary Activism, being active in articulating the adaptively evolving legal standards of prudence and loyalty that constrain these superfiduciaries in their exercise of discretion as to where and how to invest the money they control in the exercise of the capacity they possess, that they derive from the character they are given by the private and public laws of their creation and continuation.

This new activism requires the invention of new social safe spaces for making individual contributions to local community engagement in globally curated conversations investment policies, investment practices and investment choices by these superfiduciaries.

One way we can innovate such spaces is by adapting the proven practices and protocols of Deliberative Democracy in politics and policy and lawmaking to the evolution of fiduciary standards in social trust investing.

The first adaptation is in the qualifications to participate.

In politics, everyone is entitled to participate. And deliberative democracy has evolved a process called sortition for selecting randomly chosen participants from among a pool of possibilities that is designed to be demographically representative of the population within the governing jurisdiction, generally.

In fiduciary finance, only prudent people familiar with matters of capacity derived from character and aims as specified in the laws of their creation and continuation have standing to articulate standards of prudence and loyalty under the circumstances then prevailing.

Which means all of us who want to participate have to take the time and make the effort to make ourselves familiar with the aims, character, and capacity under the circumstances, of those who exercise discretionary control over society’s shared savings aggregated into social trusts for social purposes.

This is the technical stuff that gives us the right frame for seeing, and evaluating, the existential stuff.

The existential stuff is the details of the choices being considered and the circumstances then prevailing that requires briefing paper and other text within context to build a base of knowledge relevant to the question.

In addition, posters, animations and other artistic and art-like expressions can help us develop our sense of the choices and the consequences to be deliberated on.

Next, we need organized events for curated deliberation leading to a consensus decision (or non-decision, if a consensus cannot be agreed).

These can take the form of Mini-Publics ported from Deliberative Democracy, to provide guidance on evolving new investment policies, practices and choices to fit the changing circumstances then prevailing.

Or they can take the form of Advisory Trials, as a kind of courtroom drama, or law school-type mock trial, for evaluating existing policies, current practices and past choices, to pass judgment in the Court of Common Sense as to whether these policies, practices and choices are, or are not, fiduciary.

To amplify participation, a new kind of Solutions Journalism can be evolved for reporting to a wider community of shared interest on the proceedings in various events in various places.

Bargaining for Dignity describes a new kind of engagement between representative bodies – such as unions of workers – and specific social trusts, for conforming ongoing investment policies, practices and choices to the adaptively evolving common sense of prudence and loyalty as articulated through the curated deliberations process.

In cases of entrenched disagreement, litigation may be needed, to resolve differences through formal legal process.

There is a conversation under way through The Deliberation Gateway Network within the RSA-US to evolve this kind of curated deliberation process as an innovation in Fiduciary Activism.

You can learn about that here: