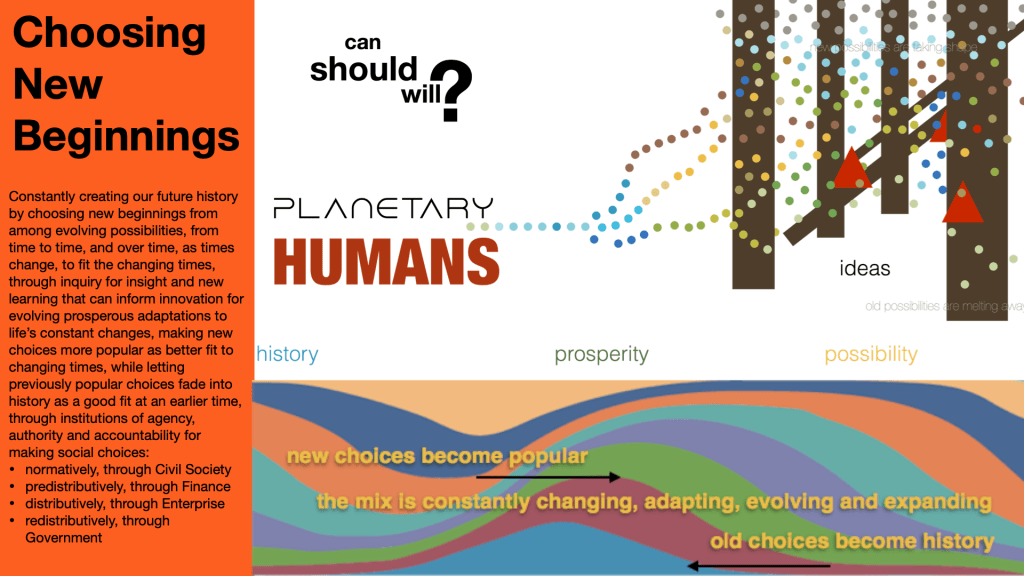

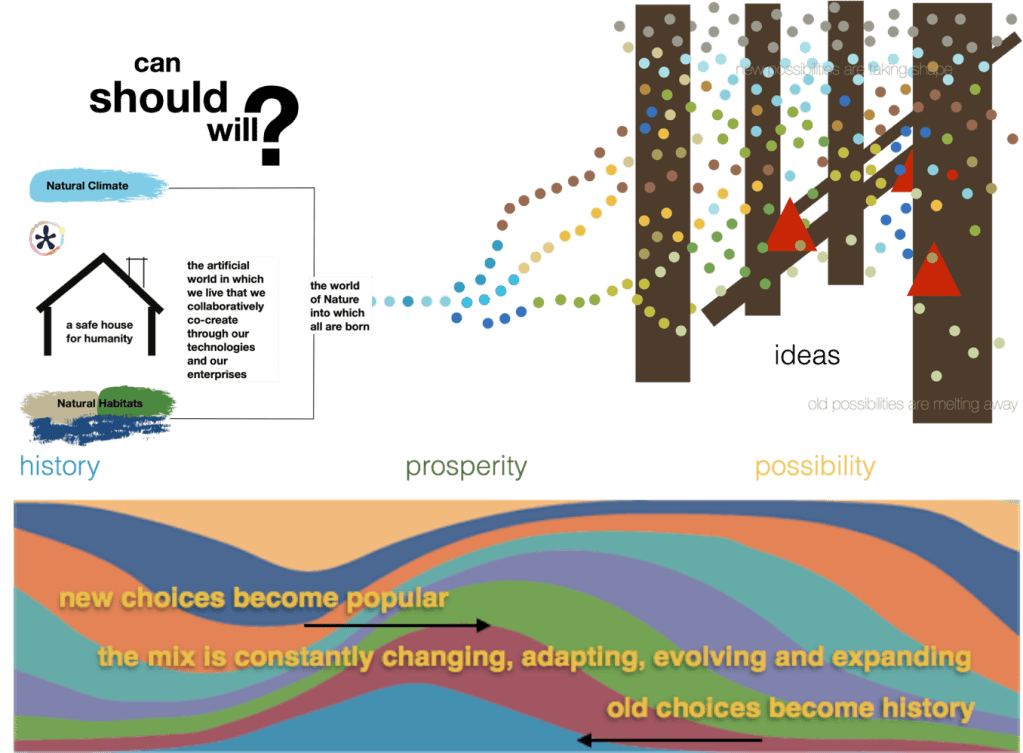

our uniquely human way of being in an artificial world that we make for ourselves, in which to live, through our technologies, out of the world of Nature into which we each and all are born, through waves of inquiry for insight and new learning that can inform innovation for evolving prosperous adaptations to life’s constant changes, making new choices more popular, as better fit to the circumstances then prevailing, while letting previously popular choices fade into history as a good fit to earlier circumstances

History (and pre-history) shows that at different times people have evolved different social structures for enterprise design through investment decision-making as fit to ways people lived in those times.

All these different historically evolved social structures continue in our time, in forms adapted to our times, as from time to time, new structures are evolved fit the changing needs of changing times.

Now is one of those times, when a new social structure needs to be evolved.

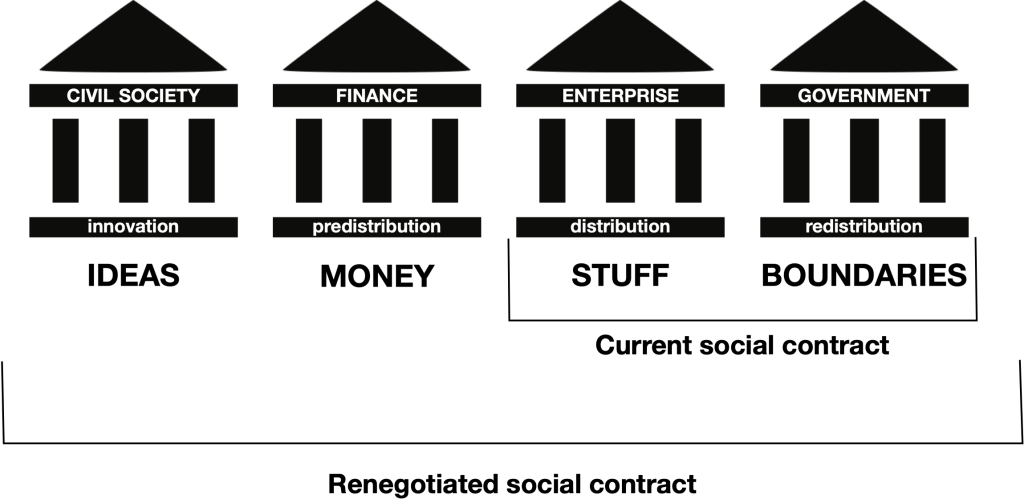

Our prevailing social contract show us a two-part power structure in society, comprised of Markets (good) and Government (bad), except that not everyone agrees that Government is always bad, or that Markets are always good.

That keeps us locked in an unresolvable conflict between Freedom (Markets) and Fairness (Government).

Markets

(Freedom)

Government

(Fairness)

The New Freedom, to be Fair

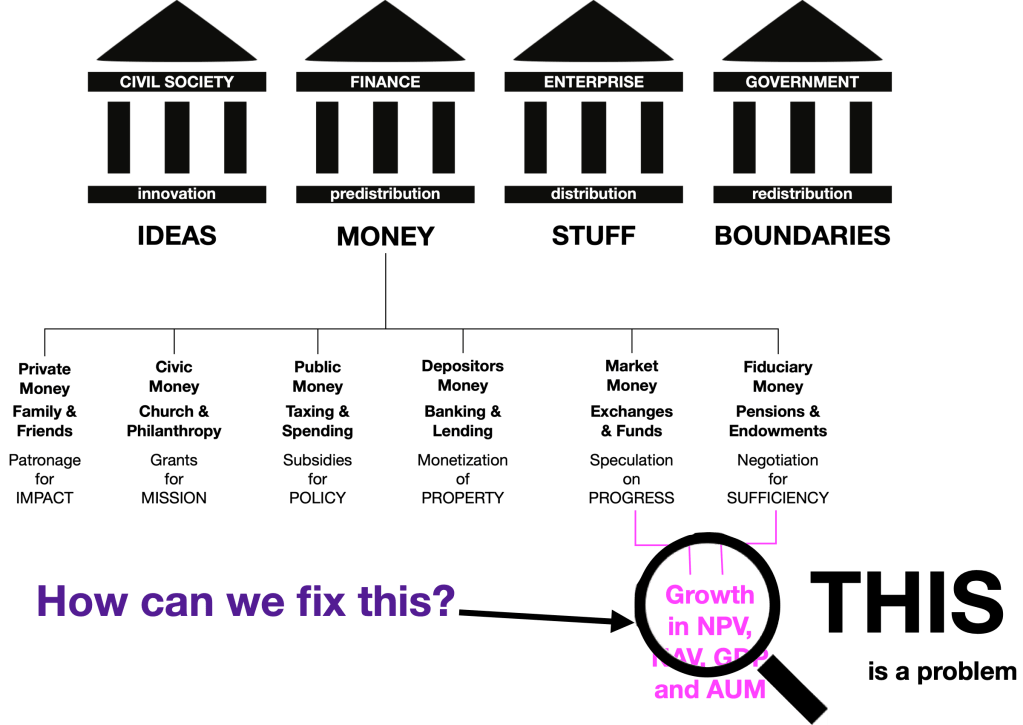

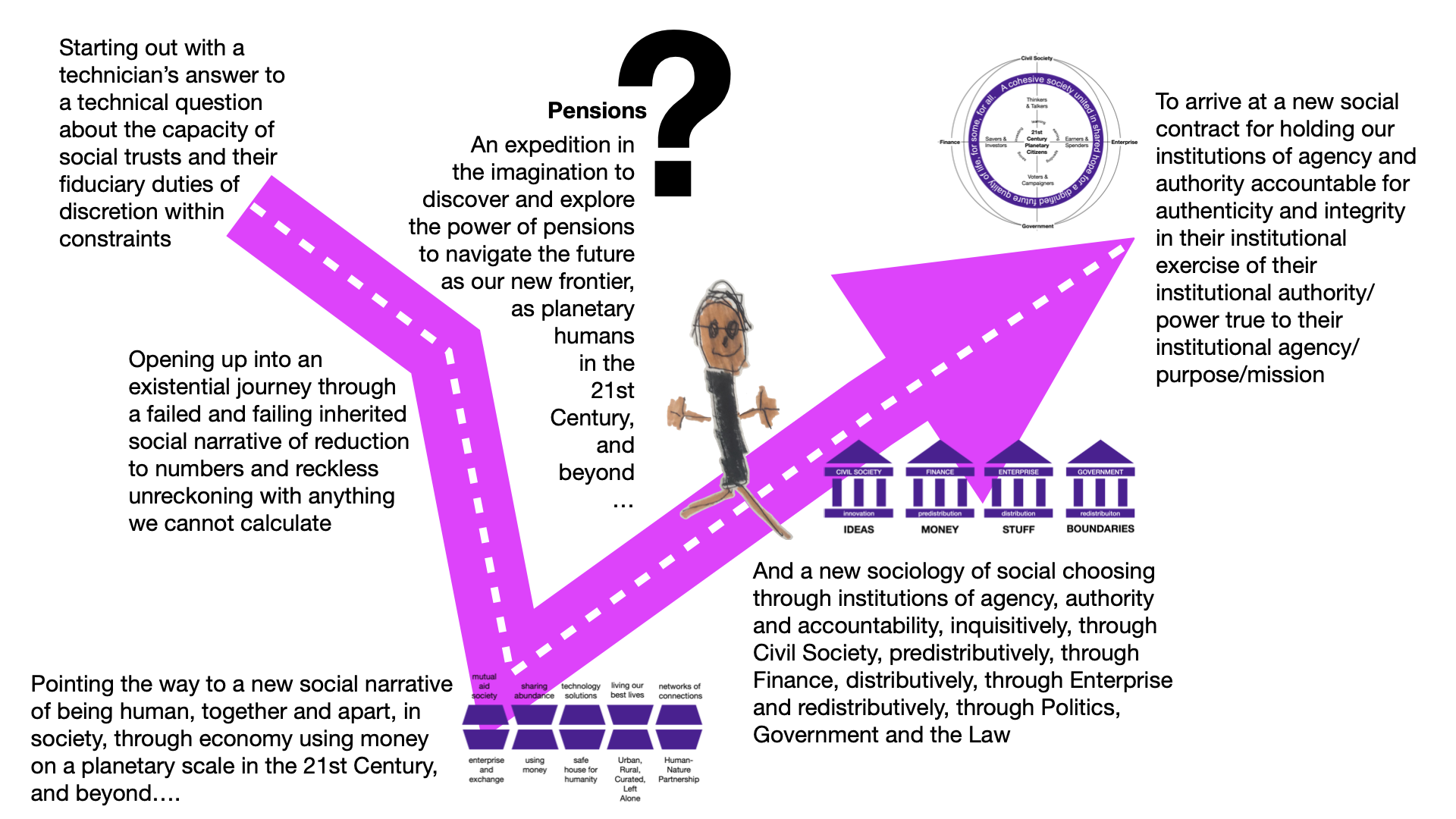

A new social contract can resolve that conflict by showing us two additional power structures that do exist in society but are not recognized in the prevailing ideology: Civil Society and Finance.

A Complete Inventory of Power Structures

Institutions of Agency, Authority and Accountability

for making social choices, socially

It can then make Finance as familiar to us as Politics, as something we all can and should have opinions about as new 21st Century Global Citizens in a new 21st Century Global Social Contract for redefining the economy as a mutual aid society shaped by institutions of agency, authority and accountability for making social choices for society, socially, through

- Civil Society/Innovation,

- Finance/Predistribution,

- Enterprise/Distribution and

- Government/Redistribution

inquiry for insight and new learning about

MONEY & POWER

We are living today within a social contract for defining the economy that is outdated, fundamentally flawed, and failing us. We need to replace it. Update and upgrade it. Correct its flaws, and make it fit for our purposes, and right for meeting the changing challenges of our changing times in the 21st Century, and beyond.

Problem is, this contract is what the Medievals would have called “incorporeal”. It has no physical form. We cannot see it, touch it, read it. It is not written down anywhere. There is no court of law in which it can be litigated, and enforced.

It is a social contract. It has only social being.

It is us.

Our shared expectations and common understandings.

Our tacit consent to the exercise of institutional agency/purpose and authority/power.

Our exercise of accountability for the institutional authenticity and integrity of authority/power true to agency/purpose,

It is created and continued by our learning, our thinking and our talking.

It can be re-created and dis-continued through new learning, new thinking about that new learning, and new talking about that new thinking.

In fact, that is the only way it can be re-created, and dis-continued.

The terms of that contract can be found only in our common sense, how we all agree to define the economy.

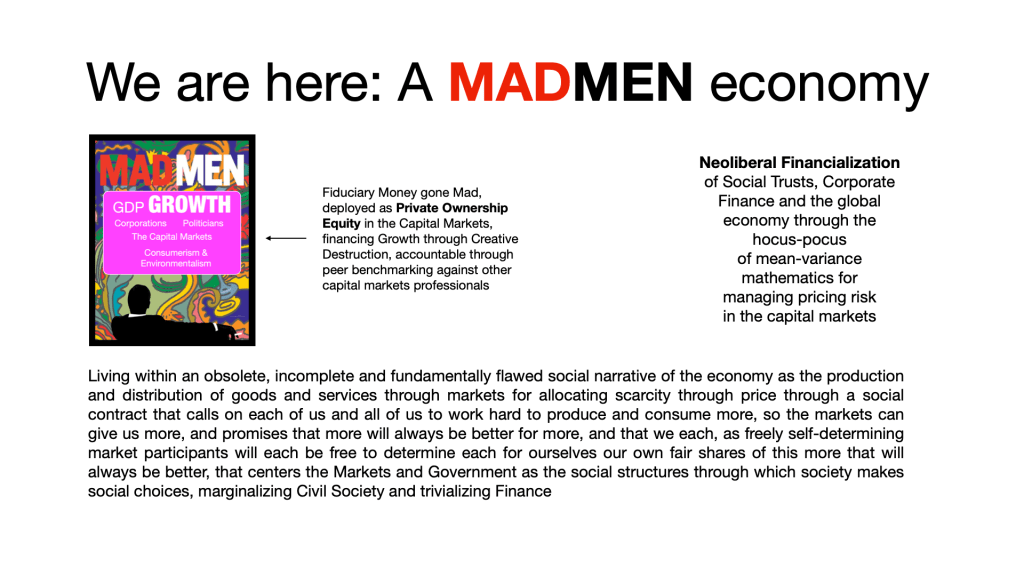

That sense today has us agreeing to see the economy as a market for allocating scarcity through price, in which growth is the antidote to scarcity.

We are all agreeing with each other that if we all produce and consume more, then the markets will give us that will be better for more, and we will each, as freely self-determining individuals, then freely determine for ourselves what our own fair share of that more that is better will be.

This agreement is being breached.

What we are actually creating for ourselves is more that is better for fewer and fewer, and less that is less for the rest of us, through a cascading cavalcade of social failings that include:

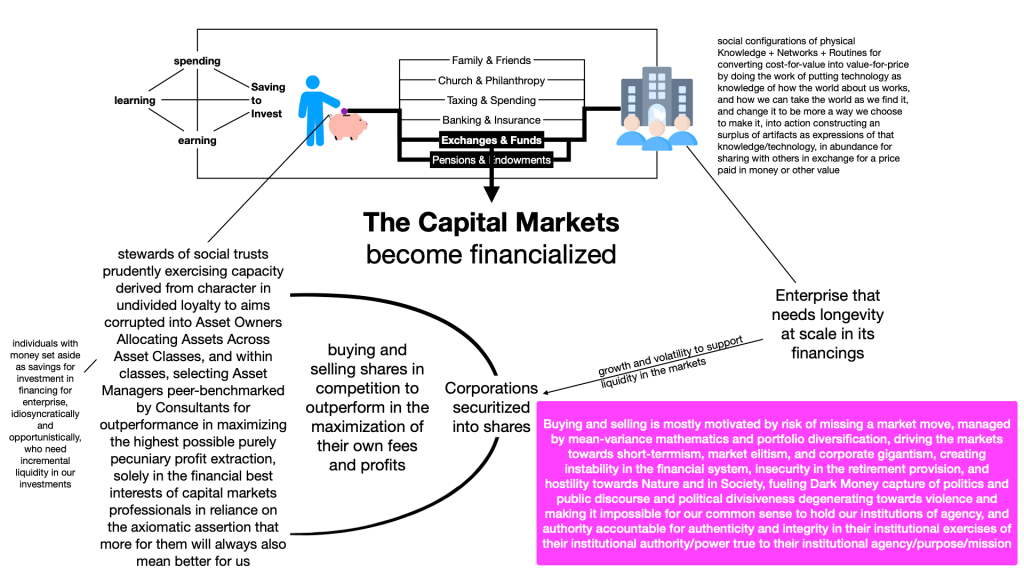

Incomplete and therefor incorrect theories of the social structures for social decision-making that are not fit to our purposes of taking action to evolve and adapt to the changing circumstance of our changing times in the 21st Century, and beyond…

- Short-termism;

- Market elitism;

- Corporate gigantism;

- Financial system instability;

- Social safety net insecurity;

- Cultural and ecological hostility;

- Dark Money capture of politics and public discourse;

- Political divisiveness degenerating towards violence; and

- pervasive and persistent inability of our common sense to hold our institutions of agency and authority accountable for authenticity and integrity in their institutional exercises of institutional authority/power true to their institutional agency/purpose/mission.

This definition of the economy includes an unvoiced expectation that the economy is a kind of human cosmology that operates according to laws that we did not create, but can only discover, and obey.

A better vision will show us that the economy is a human construct that we create from start to finish. It is true, however, that much of the economy is created more by what in the law of contracts is called usage of trade and course of dealing, than by formal declaration. Which tells us that how we agree to define the economy can be a more or less correct depiction of that trade usage and course of dealing.

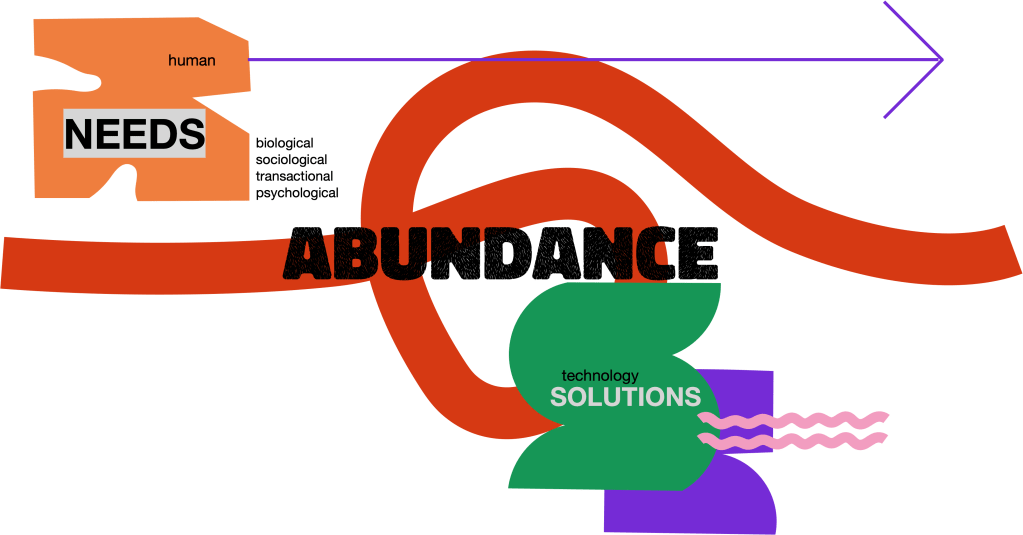

The prevailing definition is less correct. A better definition would show us the economy as:

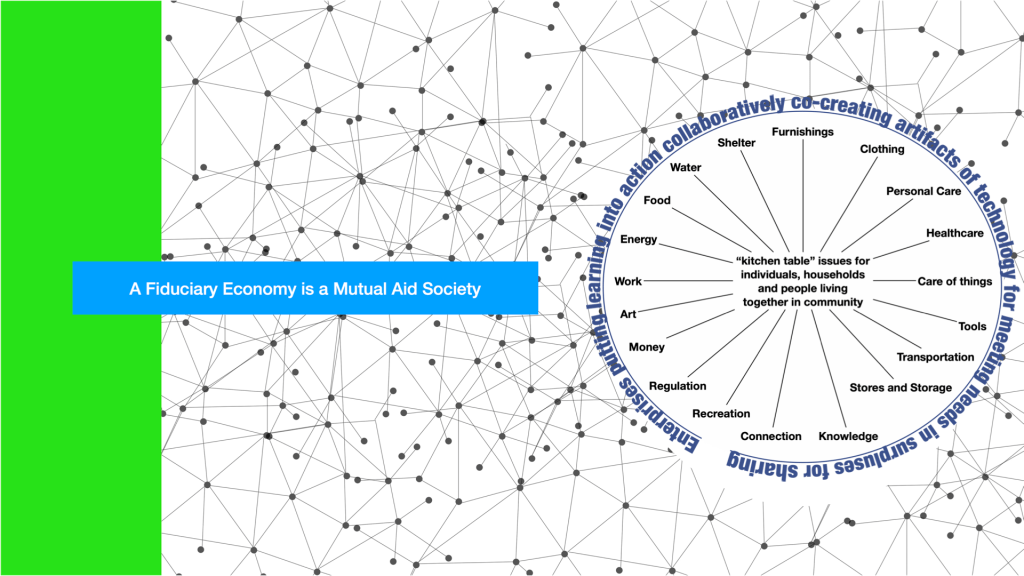

- a mutual aid society for sharing an abundance of technology solutions to the everyday problems of everyday people living our everyday lives through

- networks of connections for enterprise and exchange that form

- an artificial world that we make for ourselves in which to live out of the world of Nature into which we all are born as

- an artificial world that we make for ourselves in which to live out of the world of Nature into which we all are born as

- a safe and dignified house for humanity within

- a built environment of Urban, Rural, Curated and Left-Alone landscapes along the creative edge of

- an interactive Human-Nature partnership that is constantly changing, evolving and adapting, as times change, from time to time, and over time, and humanity evolves prosperous adaptations to life’s constant changes

- choosing new beginnings to fit the circumstances then prevailing through institutions of agency, authority and accountability for making social choices socially through

- Civil Society (inquiry for innovation),

- Finance (money for predistribution),

- Enterprise (markets for distribution) and

- Government (redistribution to enforce respect for socially necessary boundaries).

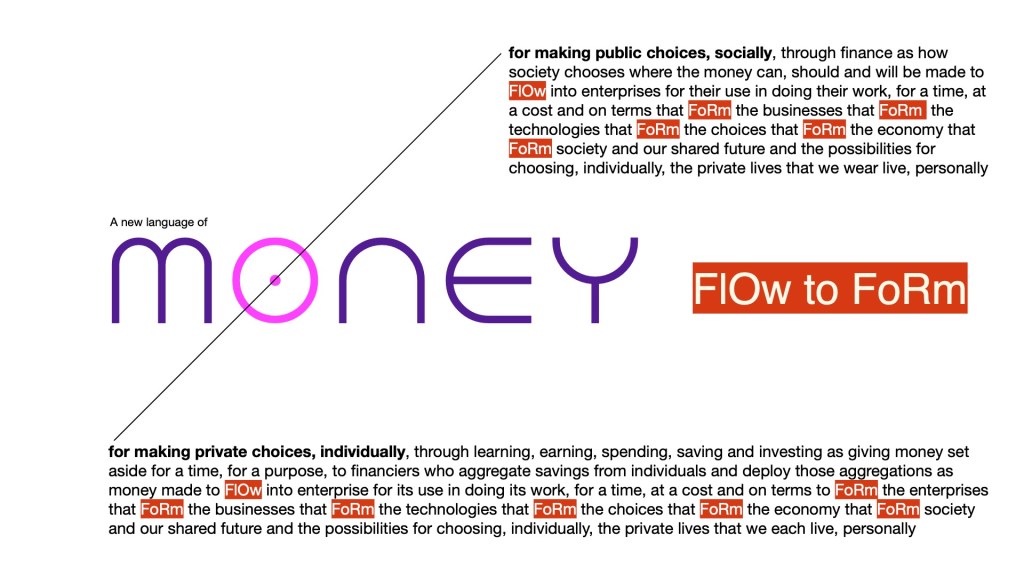

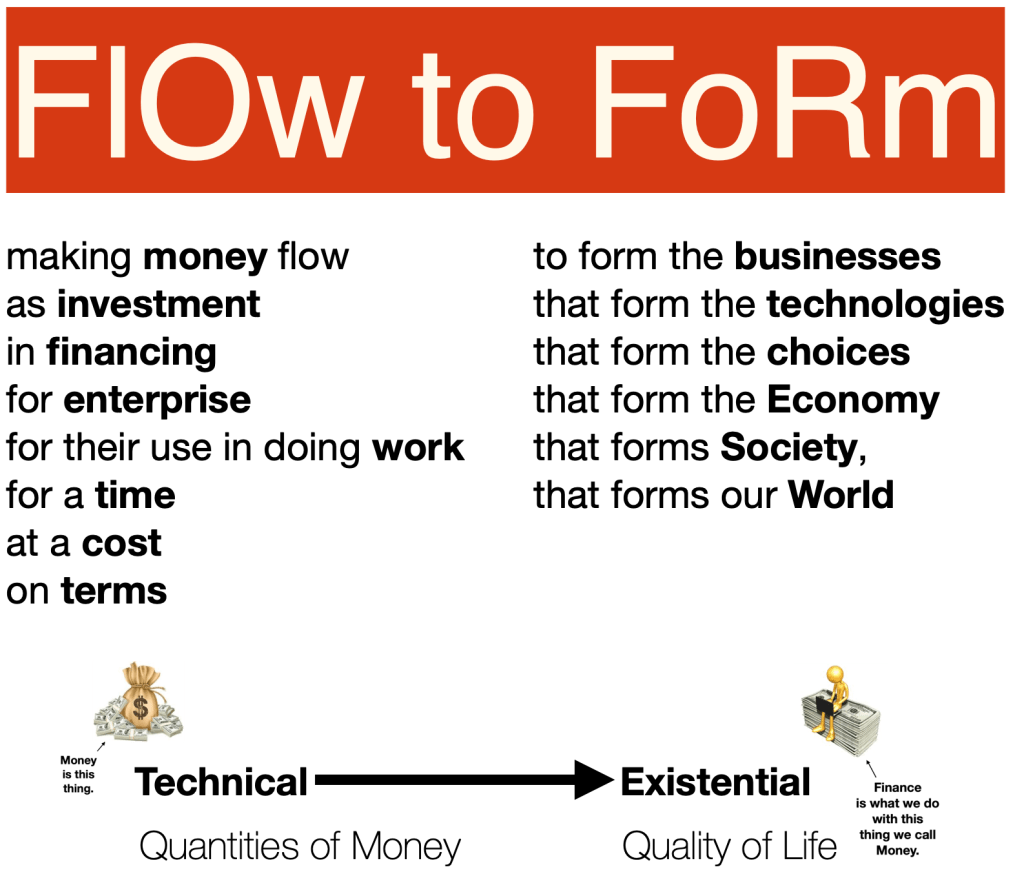

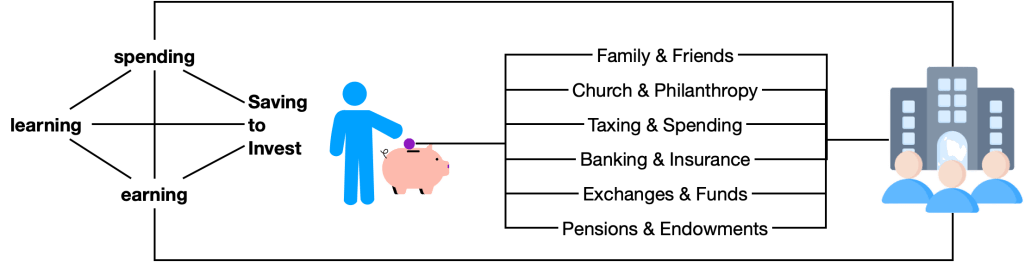

We each participate in the economy through learning, earning, spending, saving and investing, to choose from among the offered choices, those choices we deem best, based on availability and ability to pay, for building our own personal and private worlds in which we live our own best lives, as best we can, under the circumstances then prevailing, personally and privately, out of the public world of technology choices constructed in abundance for sharing through exchange, out of the world of Nature into which we each and all are born.

We each participate in the economy through learning, earning, spending, saving and investing, to choose from among the offered choices, those choices we deem best, based on availability and ability to pay, for building our own personal and private worlds in which we live our own best lives, as best we can, under the circumstances then prevailing, personally and privately, out of the public world of technology choices constructed in abundance for sharing through exchange, out of the world of Nature into which we each and all are born.

By re-defining the economy as a mutual aid society for making connections that give shape to an artificial world that forms a safe house for humanity within built environments along the creative edge of an interactive and constantly evolving Human-Nature partnership, we give ourselves a much richer and more nuanced sense of the choices we must make together, a society, for evolving prosperous adaptations to life’s constant changes, and the social structures that we use for making these choices together.

By re-defining the economy as a mutual aid society for making connections that give shape to an artificial world that forms a safe house for humanity within built environments along the creative edge of an interactive and constantly evolving Human-Nature partnership, we give ourselves a much richer and more nuanced sense of the choices we must make together, a society, for evolving prosperous adaptations to life’s constant changes, and the social structures that we use for making these choices together.

The prevailing social contract tells us there are only two such social structures: Markets for freedom, and Government for fairness (or oppression of freedom in the markets, according to some voices).

Experience shows us there are two others, Civil Society and Finance, but our prevailing social contract marginalizes Civil Society and tells us to disregard Finance entirely, as just a utility through which individuals express their choices in the Markets (good, even when they are objectively bad, because the Markets are the (near) perfect expression of the collective wisdom of freely self-determining individuals [except, not]); or through Government (bad, when in constrains the actions of individuals acting individually or through organizations in the Markets, or creates social safety nets; good when it wages war, creates laws that protect the special interests of vested interests and bails out the Markets when they fail, which they do episodically).

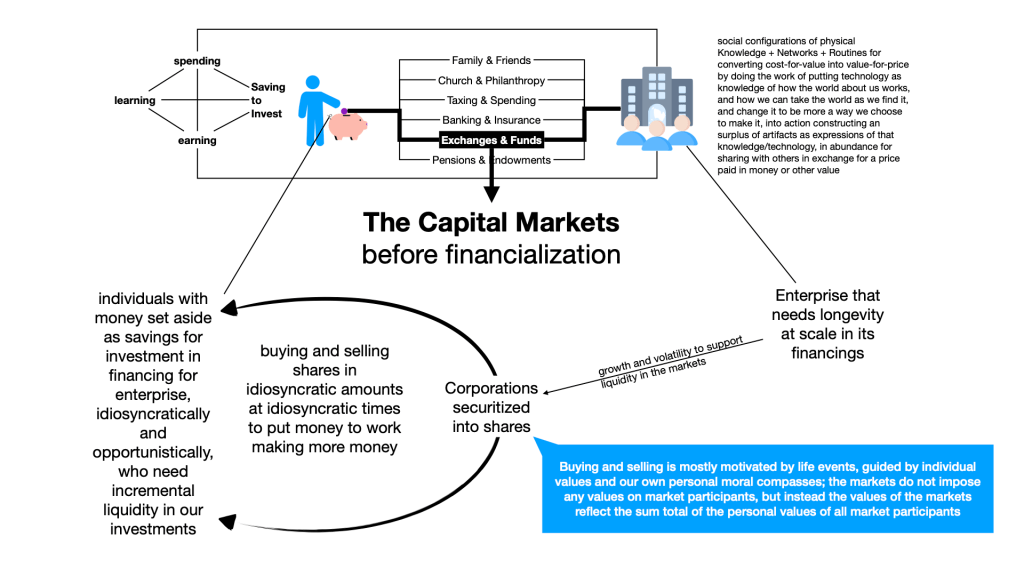

Experience shows us that money is not just a utility, but a source of social power in the markets. We all know from personal experience that people do not make choices in the markets. Money does. Or, rather, people make choices by spending money. And you have to have, before you can spend. It’s pay-to-play, and if you cannot pay, you cannot play. And the more you can pay, the bigger your say in the choices that will be chosen through the markets.

Especially so in Finance, where all the choices are made about what choices will be made available for those with money to choose from, by spending the money they control, in the Markets.

Experience teaches us that Finance shapes Markets, which means our social contract, if it is to be a good and true and truly useful contract, must recognize the role of Finance in shaping the Markets, and instruct us on the functions and modalities of Finance as social structures for deciding socially, and predistributively, what choices will be made available in the markets, from which people can choose, based on availability, price, performance/fitness to purpose, and ability to pay.

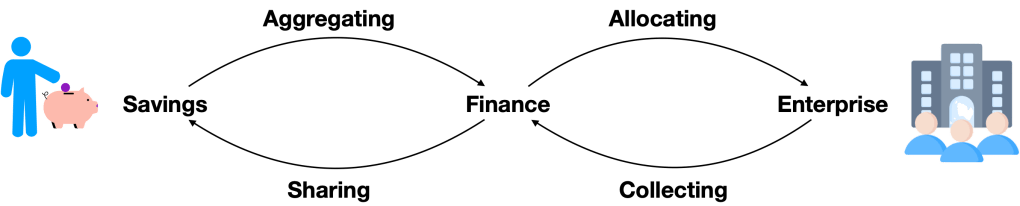

In the right new social contract, we will see that there are four functions performed through our institutions of finance:

- Aggregating money set aside by others

- Allocating those aggregations as financing for enterprise

- Charging enterprise for those deployments

- Sharing charges collected with the original sources of the money

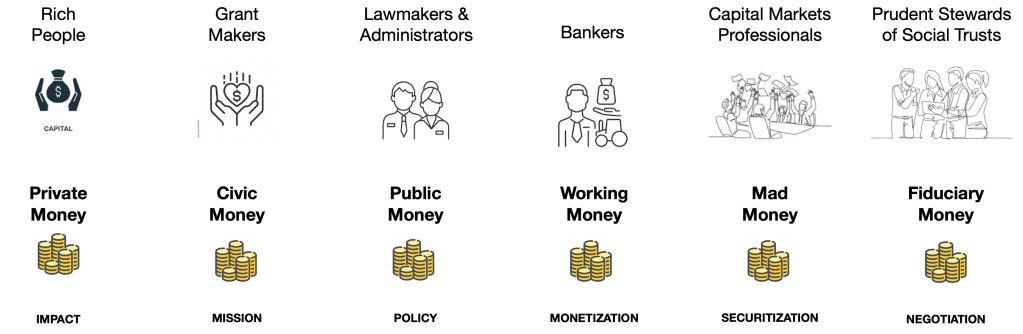

Six Codes for Aggregating, Allocating, Collecting and Sharing

- Private Money set aside to care for our own, aggregated through Family & Friends for deployment as patronage for IMPACT, accountable to peer pressure from the family and its friends, mostly, and, less so, social shaming from society more generally;

- Civic Money set aside to care for others, aggregated through Church & Philanthropy for deployment as grants for MISSION, accountable to foundational doctrines or documents (the instructions);

- Public Money set aside (by force of law) to contribute to public health, public safety and the public welfare (boundaries, for separating, and uniting), aggregated through Taxing & Sending (government) for deployment as subsidies for POLICY, accountable to jurisdictional limitations, Constitutionals processes, bureaucratic practices, electoral politics, the special interests of vested interests (money), and protest in the public swore (but only if those protests affect money and votes);

- Depositors Money set aside for safekeeping and secure transacting, aggregated through Banking & Lending for deployment as the temporary monetization of PROPERTY (loans, debt, credit), accountable to consumer confidence, public trust and the rules of safe and sound banking as enforced through industry and governmental oversight;

- Market Money set aside for putting money to work making more money opportunistically and idiosyncratically, aggregated through Exchanges & Funds for deployment through speculation on future movements in market clearing prices for securitized shares of large scale financing agreements (bonds for debt, stock for equity as ownership, other shares in other securitized portfolios and derivatives) in public, or private alternative, markets for maintaining market clearing prices for such shares to finance PROGRESS that has been stripped of its humanity over the 20th Century, and reduced to simple numerical GROWTH in the volume of transactions measured in prices paid in money, from one period of measurement to the next, accountable to liquidity in the markets and rules of fair trading enforced by industry and governmental oversight; and

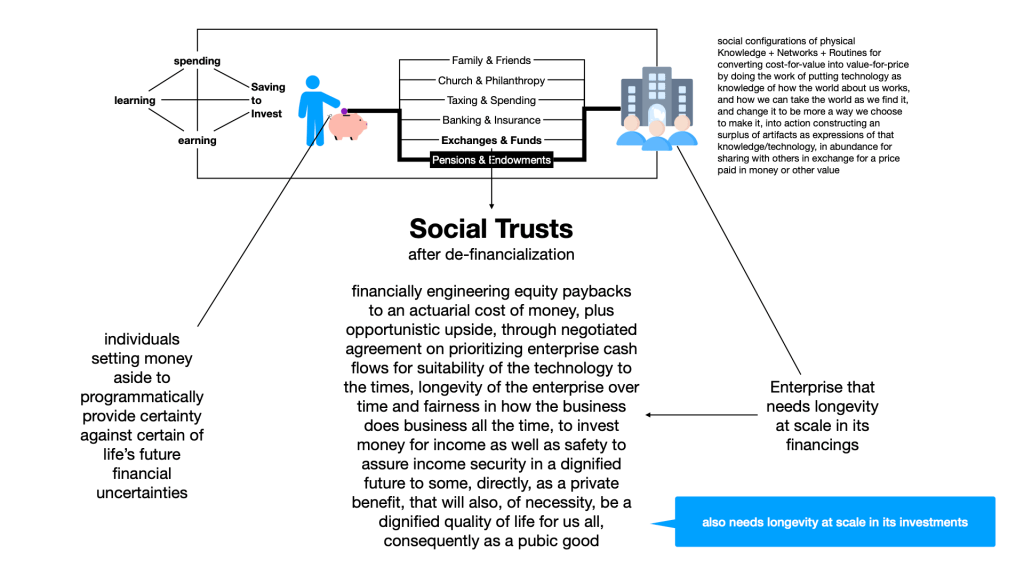

- Fiduciary Money set aside to programmatically provide certainty against certain of life’s future finance, which are also physical, uncertainties, aggregated through Pensions & Endowments (for retirement, and civil society, respectively) for deployment through negotiation for SUFFICIENCY to the longevity of the pension or endowment, accountable to legal fiduciary duties of prudence and loyalty in the discretionary exercise of plenary powers true to purpose, according to the common sense of reasonable people with knowledge of powers and purpose, and experience of prudence and loyalty.

A Corruption of the Code

We – you, me and all of us – have the power to fix this, because the law gives that power to US.

This is the law of fiduciary duty, that imposes constraints of prudence and loyalty on the exercise of otherwise plenary powers of discretionary authority that the law grants to the trustees of a trust.

A trust is a legal form of ownership of, and control over money, or other property, for a purpose specified as a condition to the transfer of ownership through a legal document knows as a deed of trust, trust indenture, or declaration of trust.

The construct of a trust dates back at least to the Crusades (and perhaps earlier, to Roman law), when landed aristocrats would transfer their estates to trusted persons – a younger brother or other family relation – who could be trusted to care for the estates in their absence, and to return them upon their return, as they rode off to conquer the Infidel in the Holy Land.

In the 19th Century, as the ancien regime of primogeniture and the landed aristocracy was losing its relevance, while the economy was increasingly being shaped by private enterprise (i.e. enterprise not controlled by the aristocracy exercising unaccountable control of the fiscal and regulatory powers of Government), the trust form of ownership was adapted for use in what we now know as estate planning: intergenerational transfers to widows and orphans and others who either could not, by law, take title to property in their own, or could not be trusted, in the estimation of their benefactors, with the kind of unconstrained discretionary control that the law recognizes as the law of ownership.

Later in the 19th Century, this practice of using private trusts for private purposes of intergenerational transfers of money or other property, subject to constraints imposed by the transferor (known in the law, variously, as the settlor, or the trustor [both words mean the same thing]) was evolved to the creation of social trusts for endowing foundations for benefiting civil society: arts; culture; science; education, charity, etc.

In the middle of the 20th Century, this late 19th Century social innovation of the social trust for socially purposes was further adapted for use in provisioning the social safety net of the Workforce Pension as a mutual aid society designed according to the laws of actuarial science to average the actual cost of making contractually calculated payments to contractually qualified recipients at contractually specified intervals, calculated to provide income security in a dignified retirement to evergreen populations of current and future retired workers.

;

;

Technology

In Greek mythology, the Titan Prometheus, in defiance of the Olympian Zeus, gave us fire.

In Judeo-Christian mythology, Eve gave Adam an apple from the Tree of Knowledge, in defiance of God.

One truth in this mythology is that we, as humans, are gifted/cursed with the ability, through inquiry, to learn abut how the world about us works, and how we can take the world as we find it, and change it to be more a way we choose to make.

Enterprise

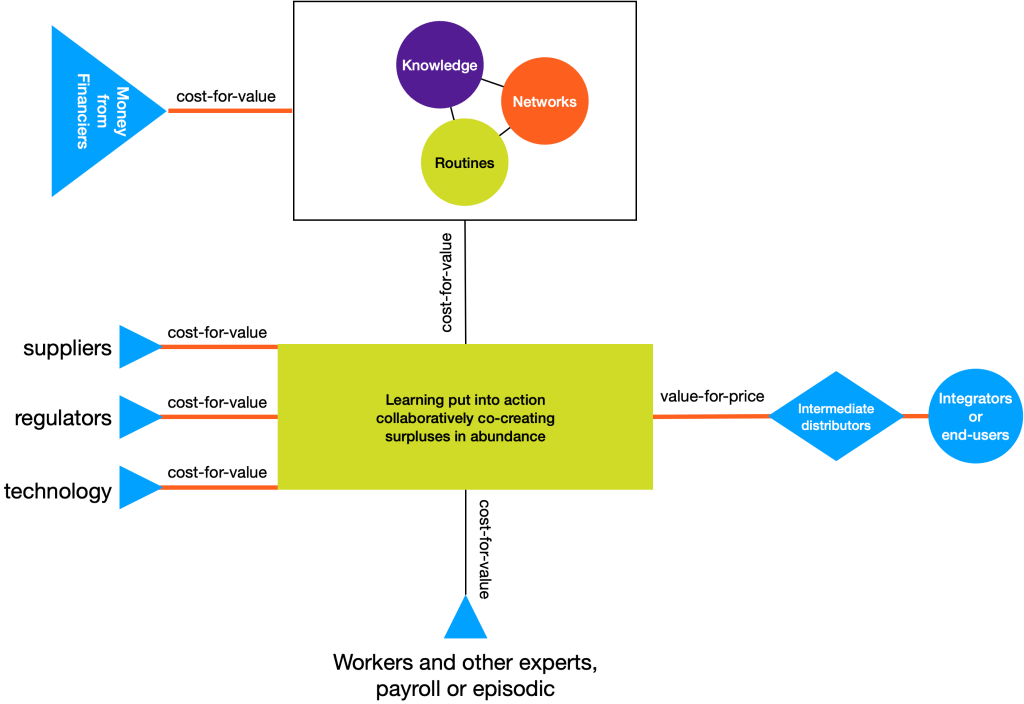

Putting technology as knowledge of how the world works in some specific way, into action changing the way the world works in that specific way, to make it work more a way we choose to make it, is not a singular activity.

The modern myth of the individual defies this deeper truth that to be human is to be together, and apart, in society, doing the work of putting technology into action creating abundances for sharing, through Enteprise as the social configuration of physical Knowledge + Networks + Routines for converting cost-for-value into value-for-price.

Exchange

To be human is to live in a mutual aid society for sharing an abundance of technology solutions to the everyday problems of everyday people living our own best lives, under the circumstances then prevailing, every day, making choices from among the available possibilities, through exchange, using money for:

- learning about technology;

- earning by contributing to the work of putting technology into action

- spending to acquire the benefits of technology for our own use and benefit;

- saving what we do not spend, for a purpose, for a time;

- investing what we save, for a time, for a purpose.

Our values

Our mission is to challenge the status quo, embrace innovation, and create meaningful, lasting impact through everything we do. Driven by a vision to inspire change, push boundaries, we deliver work that truly makes a difference.

Our Moment in History

Our mission is to challenge the status quo, embrace innovation, and create meaningful, lasting impact through everything we do. Driven by a vision to inspire change, push boundaries, we deliver work that truly makes a difference.

Crisis as a call to INQUIRY, for insight and new learning, about our uniquely human invention of money as savings for investment in financing for enterprise to evolve prosperous adaptations to the changing circumstances then prevailing