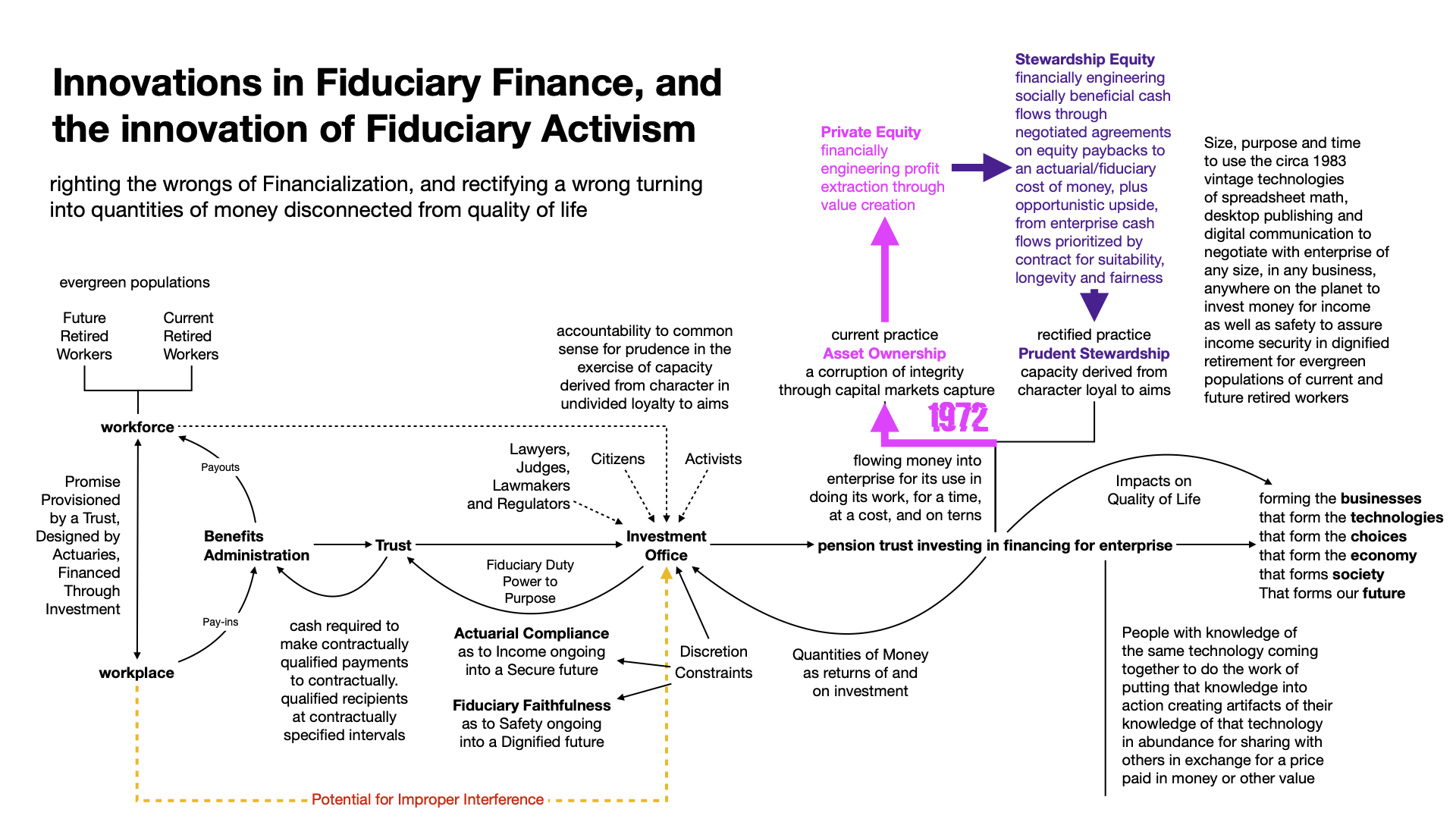

a new math gets invented

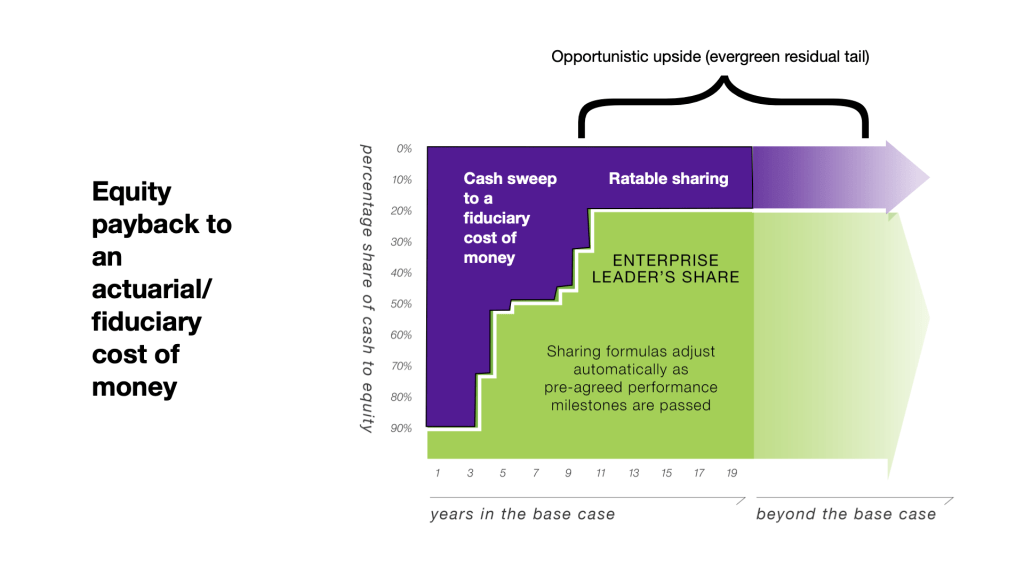

- equity payback to an actuarial/fiduciary cost of money, plus opportunistic upside, for Actuarial Compliance as to INCOME

- from enterprise cash flows prioritized by contract for suitability of the technology to the times, longevity of the enterprise over time, and fairness in how the business does business all the time, for Fiduciary Faithfulness as to SAFETY

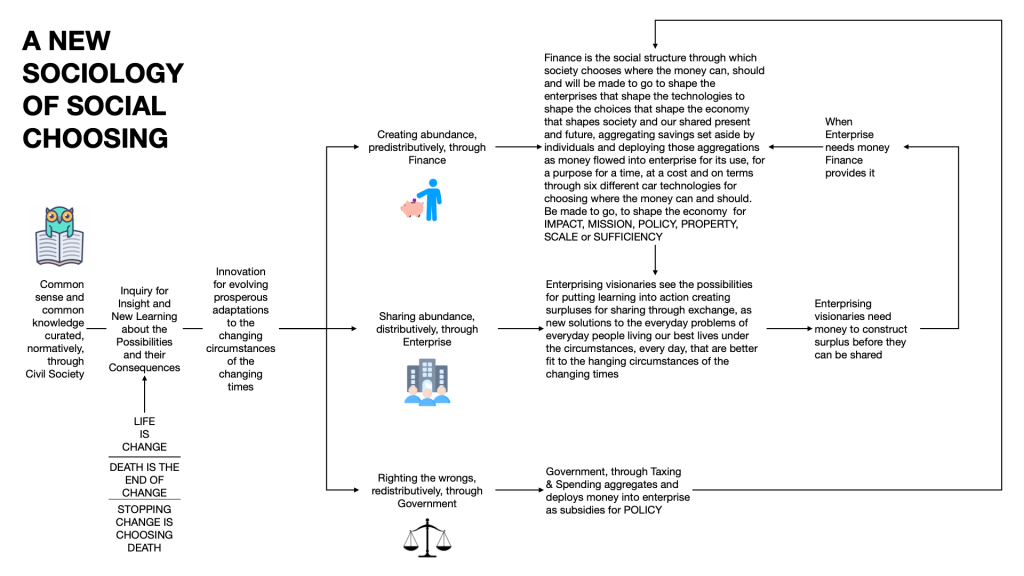

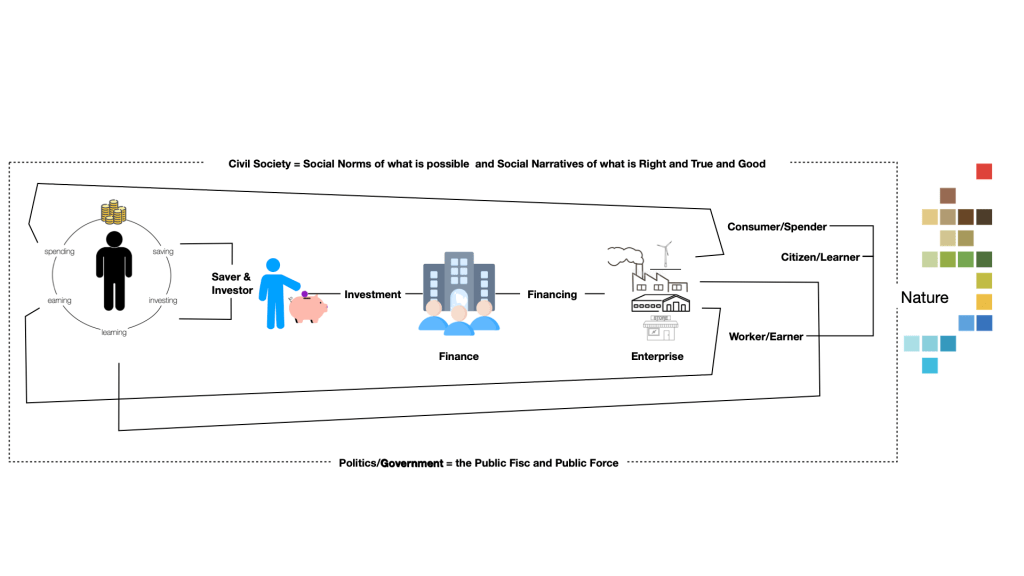

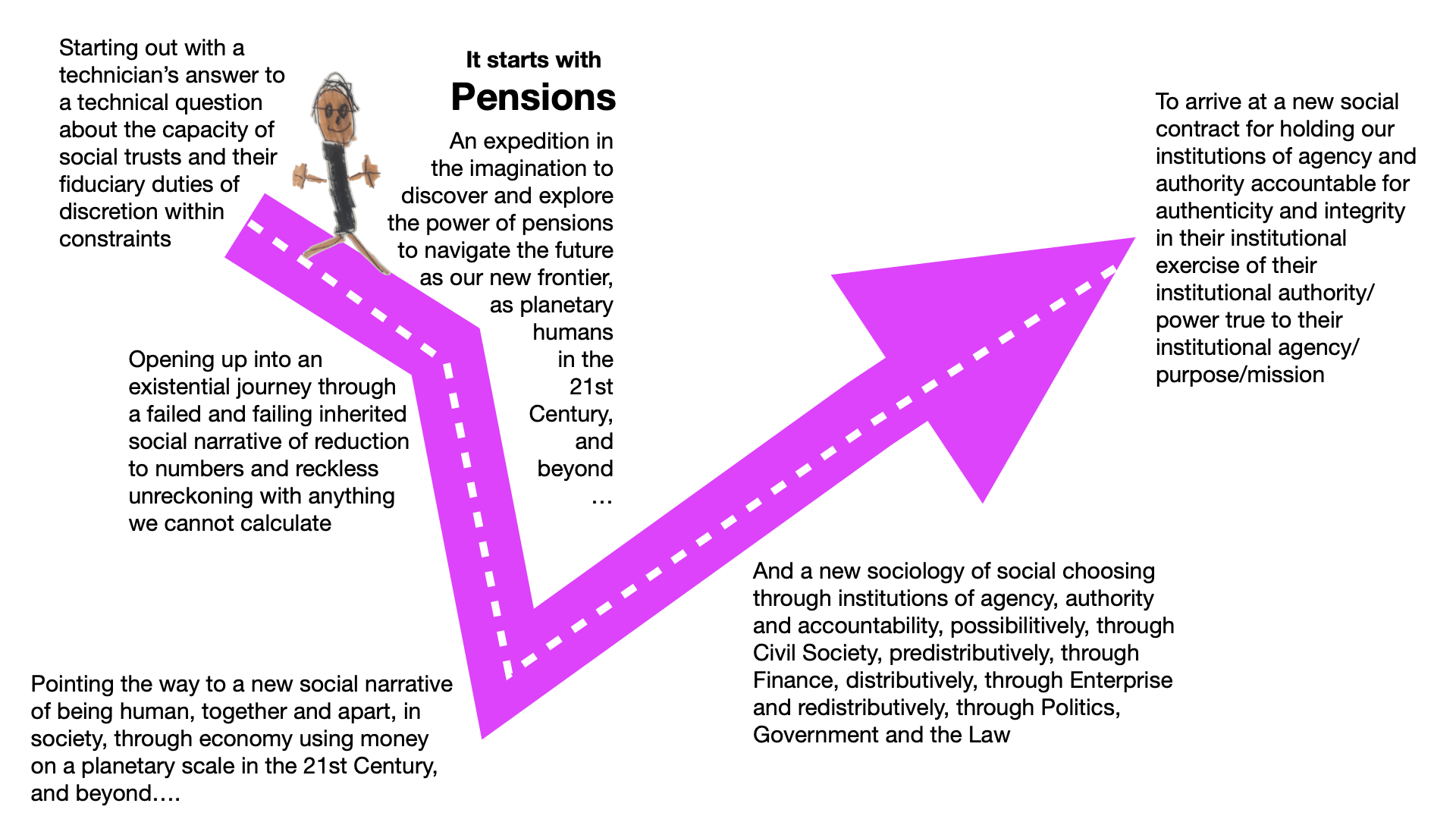

Introduction: The Importance of Money and the Role of Finance

Money is a number. The language of numbers is mathematics.

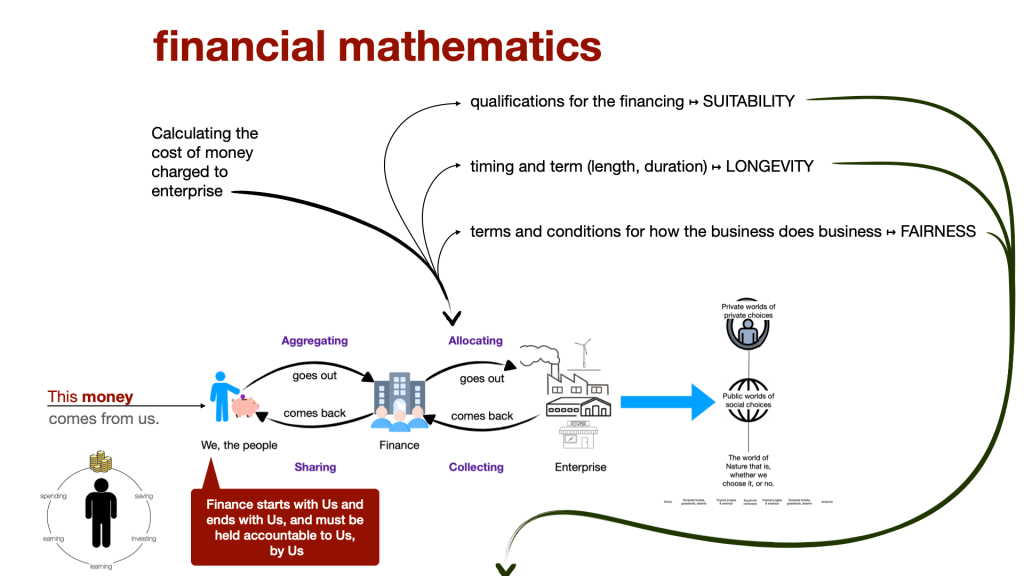

The language of money in finance is the mathematics that a financier uses to calculate the cost charged to enterprise for the use of money aggregated by that financier and allocated to enterprises for their use, for a time, at a cost and on terms.

The cost of money charged to enterprise determines the qualifications of enterprise for that financing, the time and timing of that financing and the terms that must be met for the financing to continue.

Terms terminate a financing if not met.

So the terms of financing affect what business an enterprise does, and how that enterprise does business, making technology choices available to others through exchange for a price paid in money.

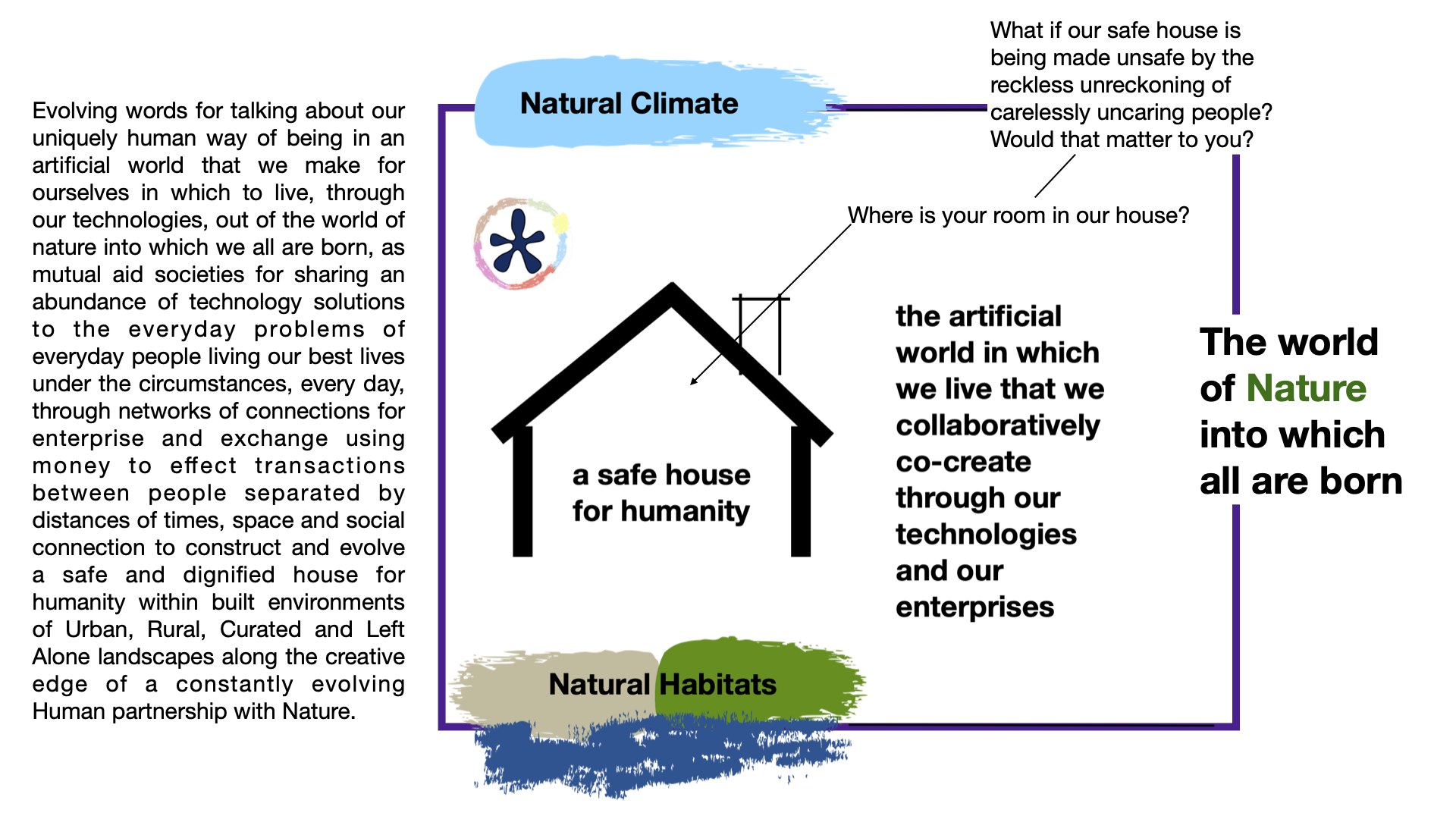

How business does business affects the way money is made to flow through the population of participants in the economy as a mutual aid society for sharing an abundance of technological solutions to the everyday problems of everyday people living our own best lives as best we can under the circumstances then prevailing, every day.

How money is made to flow through a population participating in a shared economy affects the cohesiveness of that population living together in society, ongoing into the future.

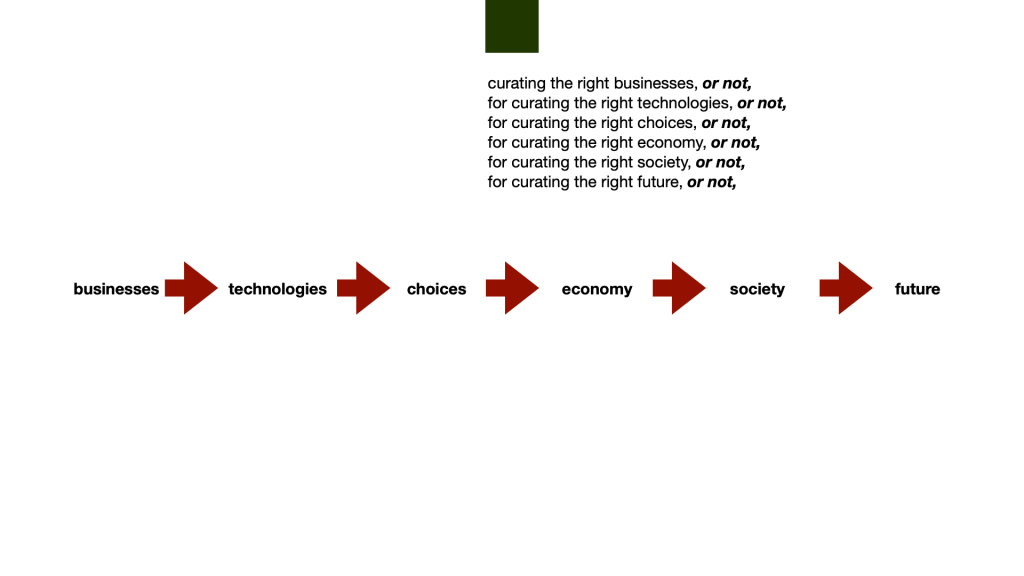

In this way, the mathematics of finance curates the future of society, predistributively, along three metrics of:

1. Suitability of the technology to the circumstances then prevailing, at the time;

2. Longevity of the enterprise, and its social contract with popular choice, over time; and

3. Fairness in how the business does business, all the time.

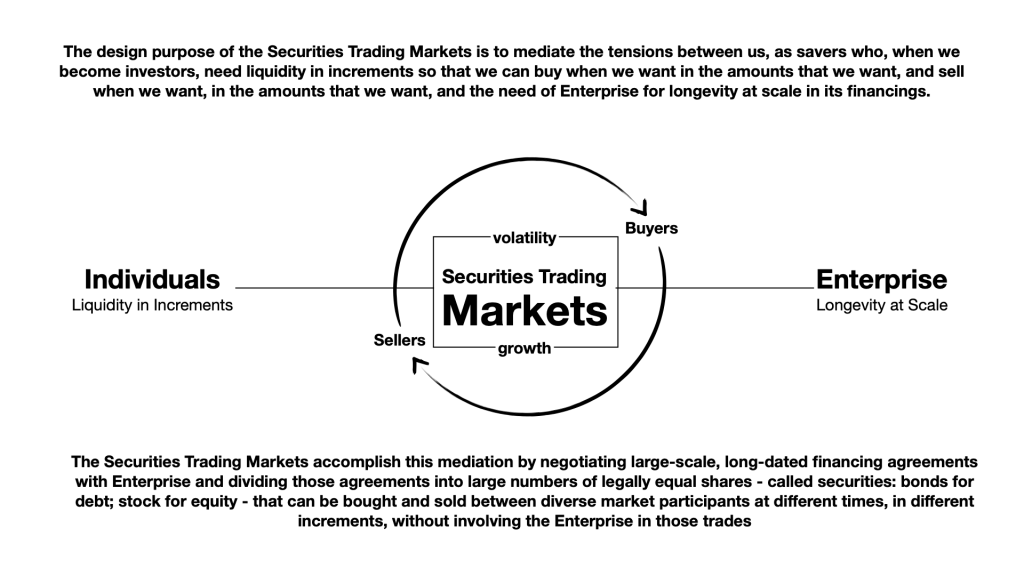

Finance is the institution of social choosing through which society chooses what technologies will be made available for choosing by members of that society, and which members will have what ability to pay the price for choosing those technologies, predistributively.

Civil Society curates the possibilities, through Art, Science, Religion, Culture, Inquiry, History and the Humanities.

Finance curates the practicalities, by aggregating money set aside by others as savings for investment in Enterprise, and allocating those aggregations as money made to flow into enterprises, for their use, for a time, at a cost and on terms that curate the businesses that curate the technologies that curate the choices (and abilities to choose) that curates the economy that curates society that curates the future as our true frontier.

Enterprise does the work of making choices, and the ability to choose, available to others for sharing through exchange.

Politics, Government and the Law exercises the power of the public fisc and public force “in order to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity” (Preamble to the Constitution of the United States of America, 1789).

Our Focus is on Finance

And Within Finance, Fiduciary Money

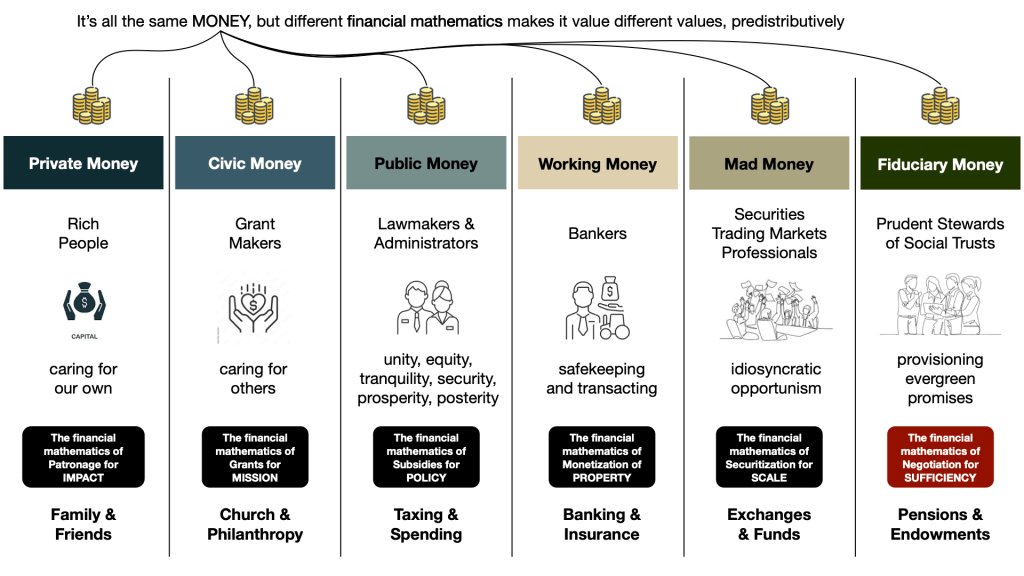

Fiduciary Money is the tens of trillions aggregated, collectively, worldwide, into social trusts for socially provisioning the social safety nets of Workforce Pensions and Civil Society Endowments.

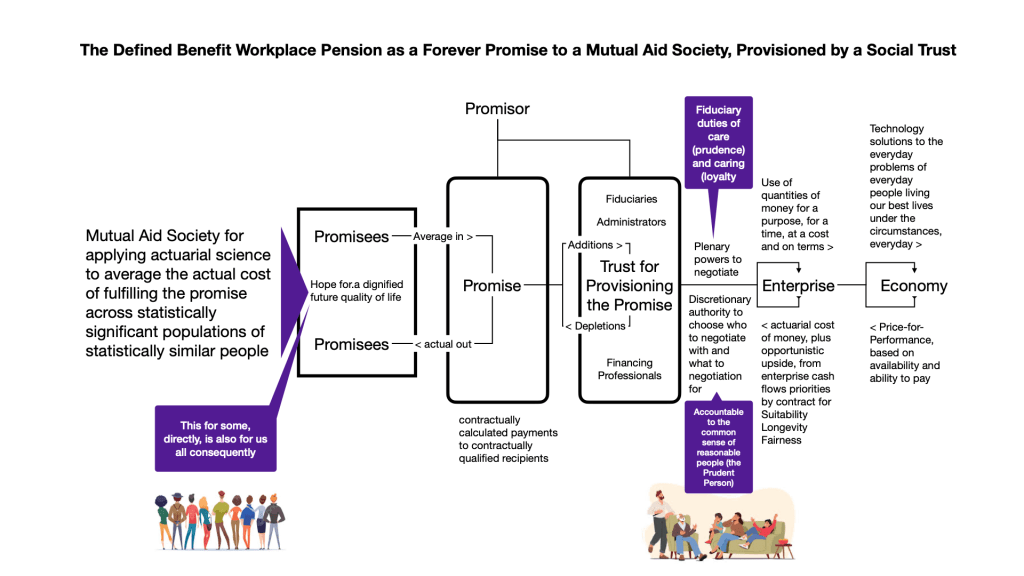

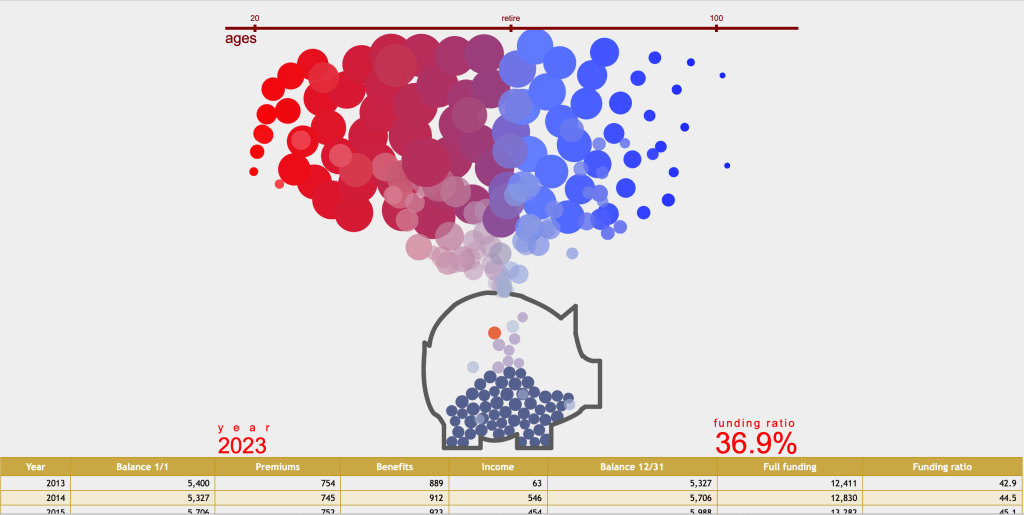

Workforce Pensions are mutual aid societies designed according to the laws of data science, using statistics and the mathematics of probabilities, to average the actual costs of making contractually calculated payments to contractually qualified recipients at contractually specified intervals across a statistically significant evergreen population of statistically similar members of that mutual aid society, as a promise of income security in a dignified retirement to current and future members of that society of workers.

A Pension is sometimes referred to as a Defined Benefit, or DB, retirement income security plan, to distinguish it from a Defined Contribution retirement savings plan.

A Pension is a promise of income security in a dignified retirement that is provisioned through the aggregations of contributions controlled by a trust that is invested with the right and the responsibility to allocate those aggregations as financing for enterprise to earn money sufficient to replenish the depletion of the trust for making contractually calculated payments to contractually qualified recipients at contractually specified intervals, and keep itself ongoing, able to continue making contractually calculated payments to contractually qualified recipients at contractually qualified intervals.

A Defined Contribution Savings Account is a custodial savings account held by a custodian exclusively for the benefit of each individual saver, individually. The custodian is commonly authorized to curate a limited menu of investment options that each individual saver can select from, individually, but no custodian of a DC savings program has authority to make individual investment chocies for individual savers, regarding that individual’s individual account balances.

The amount aggregated in each account is owned the saver whose savings, plus investment earnings (less losses), are held in that account, solely and exclusively for the benefit of that saver, who exercising discretionary control over how those aggregations are invested, within the constraints established by the custodian.

It is important not to confuse a DB Pension plan, which is Fiduciary Money controlled by a social trust for the benefit of so many, directly, as a private benefit, that it is also for all of society, consequently, as a public good, and a DC Savings plan, which is Private Money held in a custodial account, but controlled by the individual account owner, for the exclusive benefit (or detriment) of the account owner.

Donative trusts to endow universities, philanthropic (that is, grant making) foundations and other civil society institutions are also social trusts for a private benefit that is also a public good.

Like pension trusts, trusts for the endowment of civil society control large amounts of money for a legally specified purpose and are self-perpetuating.

These are the characteristics that give both pension trusts and endowment trust the capacity to allocate the aggregations they control as financing for enterprise through the mathematics of equity paybacks from prioritized cash flows, using the personal computing technologies of spreadsheet math, desktop publishing and digital communication.

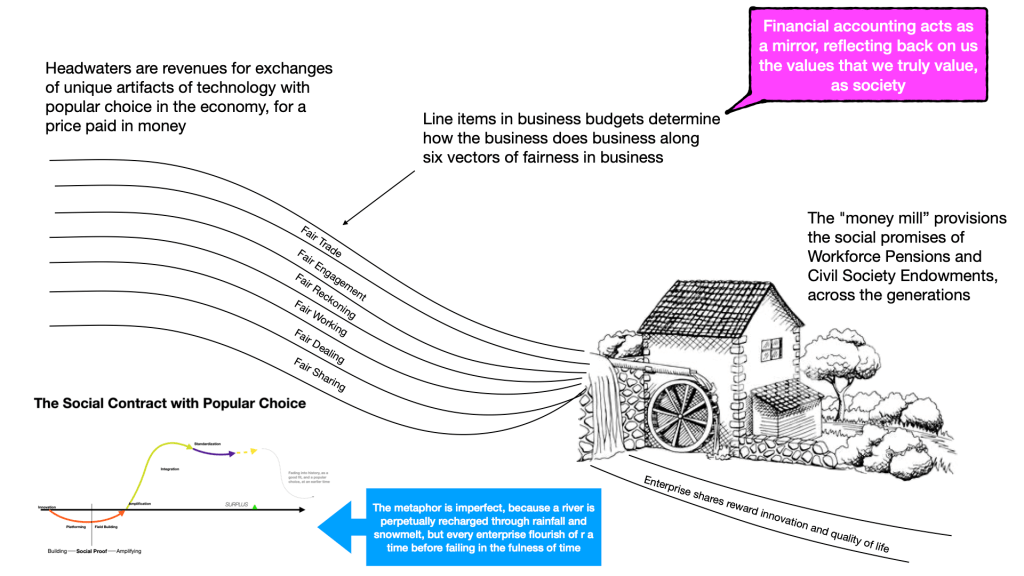

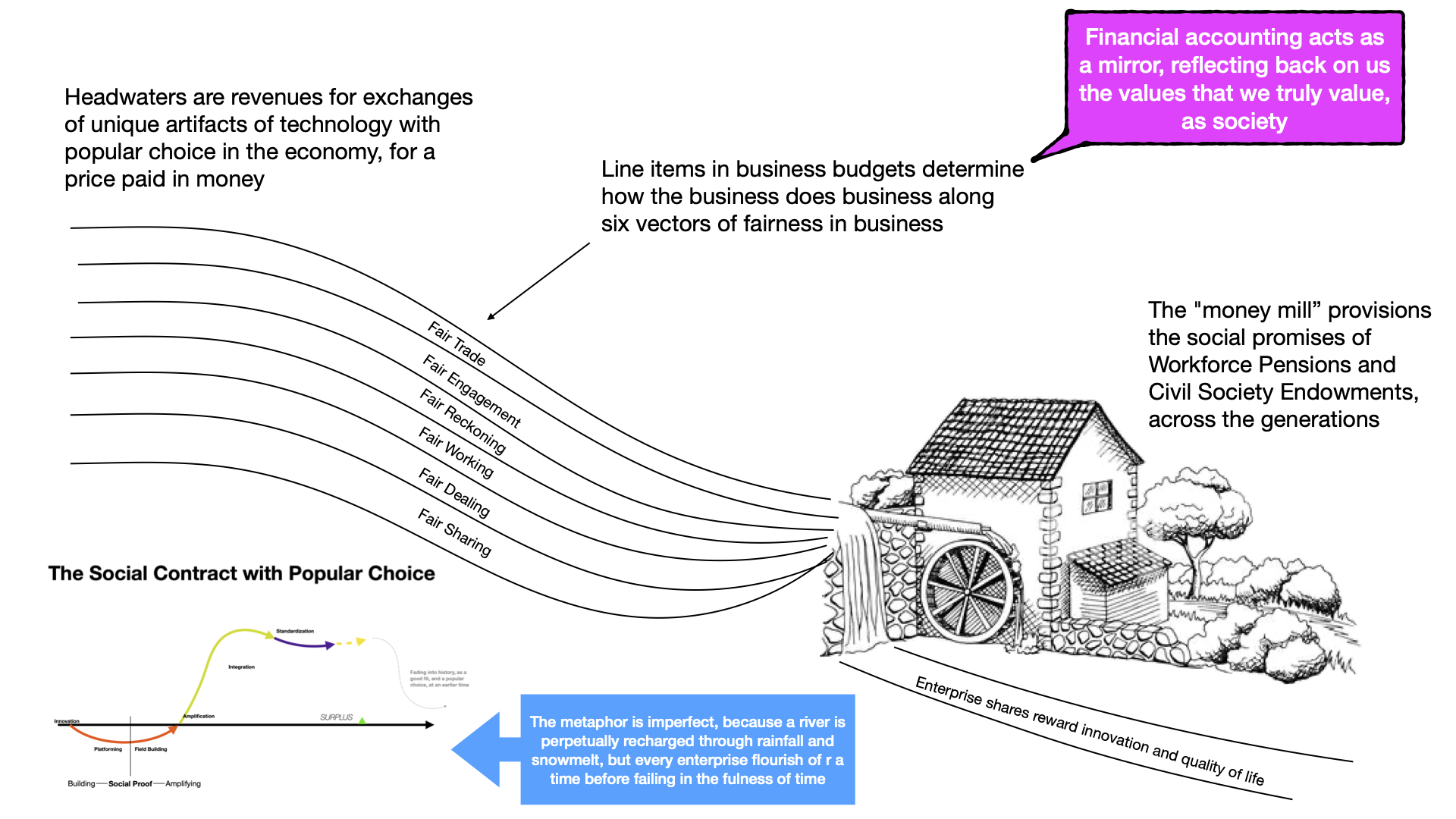

We can visualize this mathematics through the metaphor of a circa 18th Century waterwheel for turning a millstone.

In this metaphor, the water is the cash flowing through the enterprise to be financed.

These cash flows originate in exchanges of the unique artifacts of technological knowledge exchanged with popular choice for a price paid in money, and flow along six vectors of fairness in how the business conducts its business, reducing down to free cash flow after costs and allowances.

Unique Artifacts of Technological Knowledge of how the world about us works, and how we can take the world about us as we find it, and change it to be more a way we choose to make it, out into action constructing surpluses in abundance, for sharing with others in exchange for a price paid in money, or other value that can be converted into money

Some of this free cash flows is sluiced off to turn the wheel that spins the millstone at a steady rate, sufficient to keep the millstone doing the work it is required to do: grinding grain to make flour.

The millstone is a metaphor for the purpose of the trust, to make pension payments to retirees, or grants to civil society, as the case may be.

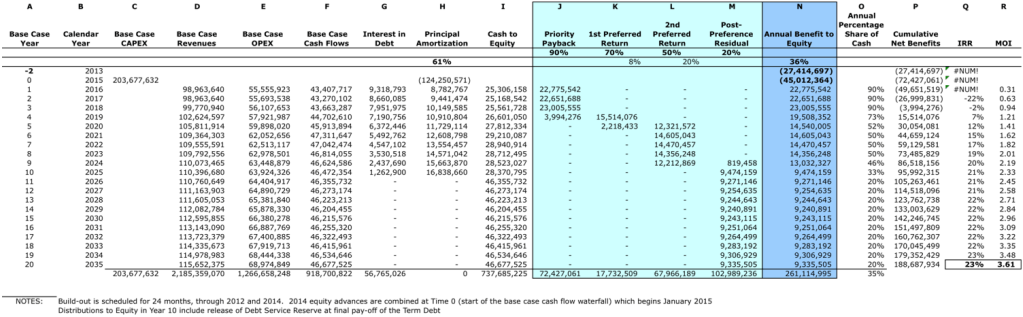

As cost of money thresholds are passed, the amount of free cash flow paid out to the trust as a cost of money is reduced, until the cumulative payments under the financing agreement total the original amount advanced, plus an actuarial or fiduciary increment sufficient to replenish the depletions of the trust for making payments in accordance with the instructions in its documents, in order to keep the trust ongoing, able to continue making payments as instructed.

Thereafter, the sharing resets to a ratable percentage that continues for as long as the enterprise continues (or until the parties agree to settle up for a lump sum, and go their separate ways), as “upside” for the fiduciary financier, over and above its actuarial or fiduciary minimum, as appropriate to the details of each particular financing.

This mathematics of fiduciary financing through equity paybacks allows us to qualify enterprises for financing, and to specify the details of each individual financing along three interrelated parameters of:

Suitability of the technology being made available to popular choice by that enterprise to the circumstances prevailing at the time;

Longevity of the social contract between that enterprise and popular choice over time; and

Fairness in how the business does business along six vectors of fairness in business, all the time.

Suitability

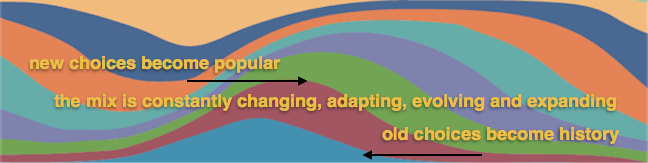

The Suitability parameter invites us to see the economy in essentially human terms, as a mutual aid society for sharing an abundance of technological solutions to the everyday problems of everyday life people living our own best lives, as best we can, under the circumstances then prevailing, everyday.

As circumstances change, the suitability of technology solutions waxes and wanes, with new and better fit to circumstances technologies being innovated from time to time, and over time, to better fit the changing times, through inquiry inspired by disappointment with the then-available choices in search of insight and new learning.

All finance is finance our future choices, and fiduciary finance needs to be prudent in financing choices that are right for their times, (and not caught in the trend-line trap of believing that what is popular now, will always continue to be popular in the future).

This requires a vision of the economy as an adaptively evolving portfolio of technological solutions to the perennial problems of being human in the world.

Longevity

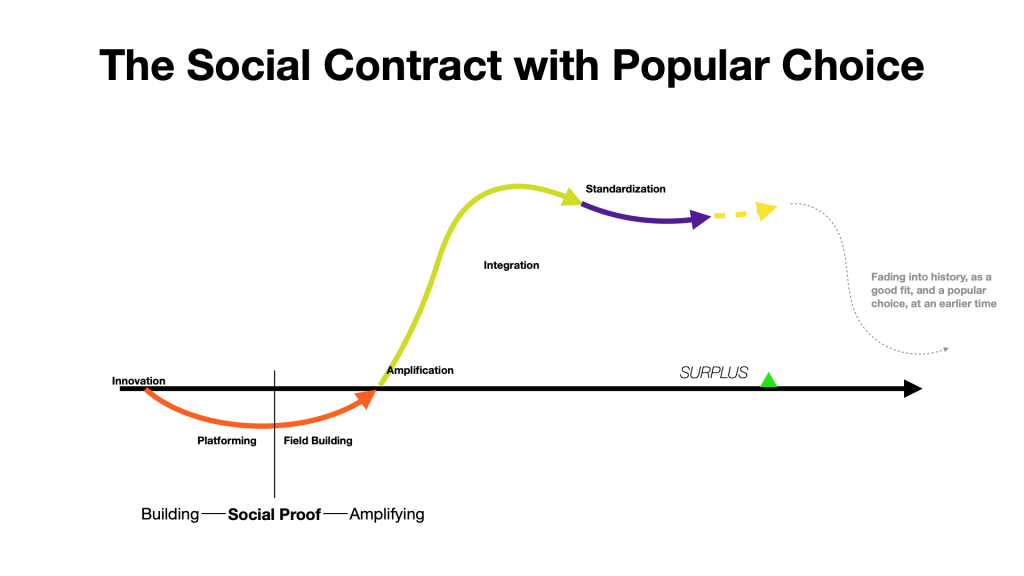

The Longevity parameter invites us to see Enterprise as a social contract with popular choice that flourishes for a time, before fading in the fulness of time, as times change and new choices become more popular, as better fit to the changing circumstances of the changing time, letting previously popular choices fade into history, as a good fit to the circumstances that prevailed at a earlier time.

This flourish and fade follows a recurring patter that:

begins with an Innovation that is at the time invisible to popular choice;

moves through Platform Building to lay the foundations for visibility, and increasing popularity to

Field Development as more people come to see the possibilities

Amplification of visibility of those possibilities to build popularity

Integration of the innovation into popular acceptability

eventually reaching Standardization as the default solute of choices

which continues until times change, new Innovations are made available and the once standard choices falls into Obsolescence, and eventually disappears into history.

The work of designing an equity payback financing includes positioning a qualified enterprise within the flourish and fade of its own social contract with popular choice in order to agree a base case for the equity payback that will be short enough to protect the financing against the fade but long enough to prevent the financing from being a burden on the flourishing.

A topic for further inquiry includes the idea of sequencing the capital stack for enterprise to optimize financing from different sources as best fit to the flourish and fade of its social contract with popular choice.

Fairness

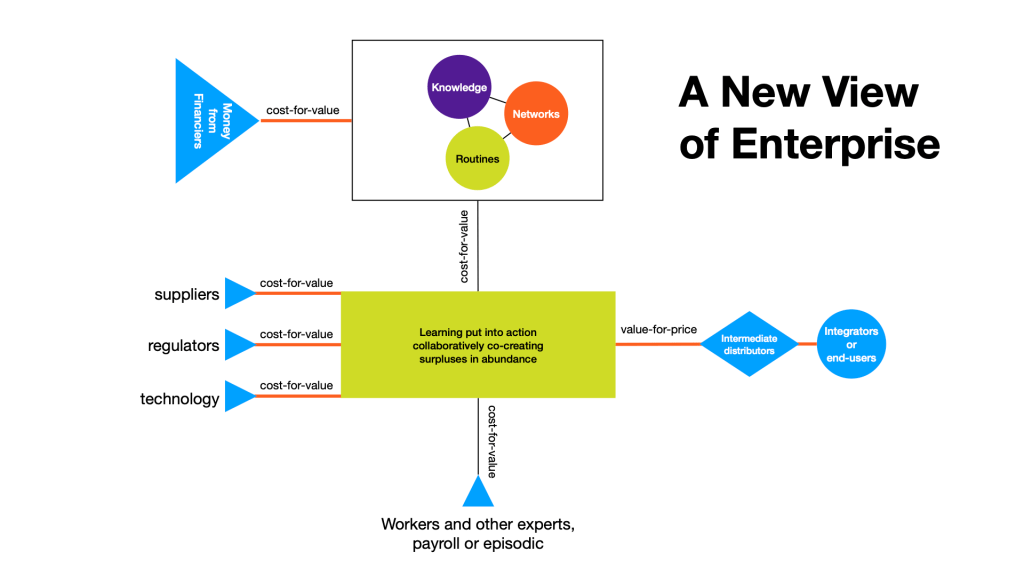

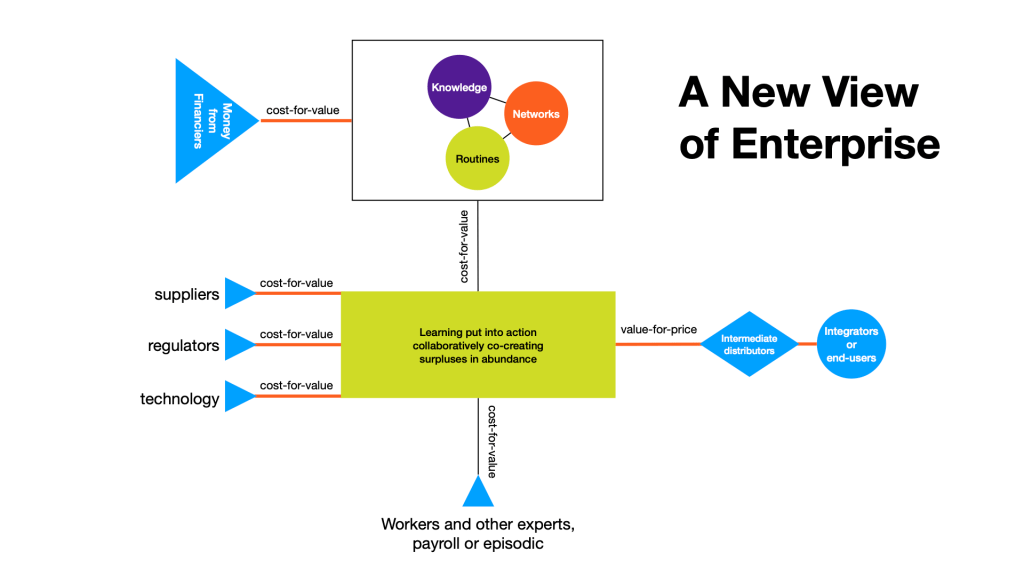

The Fairness parameter invites us to see every enterprise as a social configuration of physical Knowledge • Networks • Routines for paying cost-for-value in order to exchange value-for-price by making a surplus of unique artifacts of technological knowledge in abidance for sharing with others in exchange for a price paid in money, or other value that can be converted into money.

Cost-for-value flows out of the enterprise through six different vectors of fairness in how the business does business.

This include:

– fair trade with suppliers = Fair Trade

– fair engagement with communities, of place and of interest = Fair Engagement

– fair reckoning with the consequences of choice on Society and Nature, now an din the future = Fair Reckoning

– fairness to workers and in the workplace = Fair Working

– fairness to customers and competitors = Fair Dealing

– fairness to the savers whose savings are the original and ultimate source of the money made to flow into enterprise by its financiers, fiduciary and otherwise = Fair Sharing.

Values get infused into the business through budget allowances along each of these vectors for how a business does its business.

The values that a business values are curated by the people who control the allowances in the budgets for these costs.

When these budgets are funded internally, the people who control those budgets are the same people who run the business.

But when these budget are funded in whole or in part through financing supplied by financiers, control over the budgets, and the values that the business values, is shared between the people who run the business and the people who finance those people in running that business.

Equity paybacks give fiduciary financiers the ability to infuse fiduciary values into enterprise by agreeing line item allowances in cash flow budgets that support the business in “making human lives better” (Otti Vogt).

We can leave the details of budgeting and modeling to experts with expert knowledge in budgets and models, but a comfortable fluency with the patterns of how cash flows flow can and should part of the common sense of prudent people familiar with such matters.

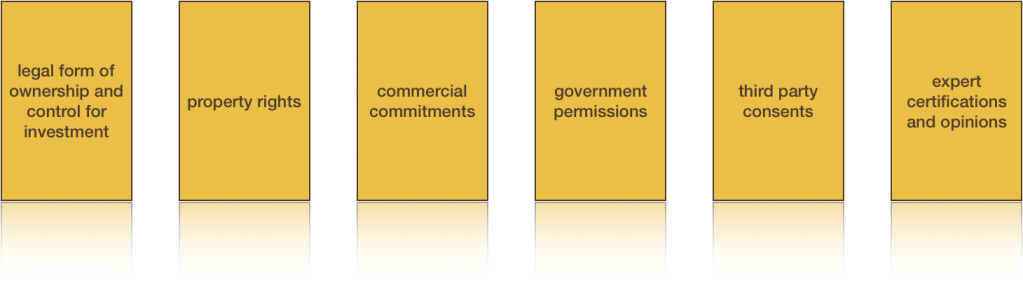

In the same way, we can leave the details of the private laws of negotiated agreement that give legal meaning and consequence to modeled expectations to experts in the law, while developing a fluency with the basic legal structures.