Anti-shareholder activists [are using] government power to…[rewrite] financial market rules …to accomplish political objectives of … the fossil fuel industry and (others)

Rick Alexander

Shareholder Commons

Climate action today is trapped in a virtue-less loop of promises made and promises broken, within a confused and confusing diagnosis of the problem that drain off energy for social innovation into carefully orchestrated campaigns of “snake oil salemanship”, none of which are actually capable “curing the patient”.

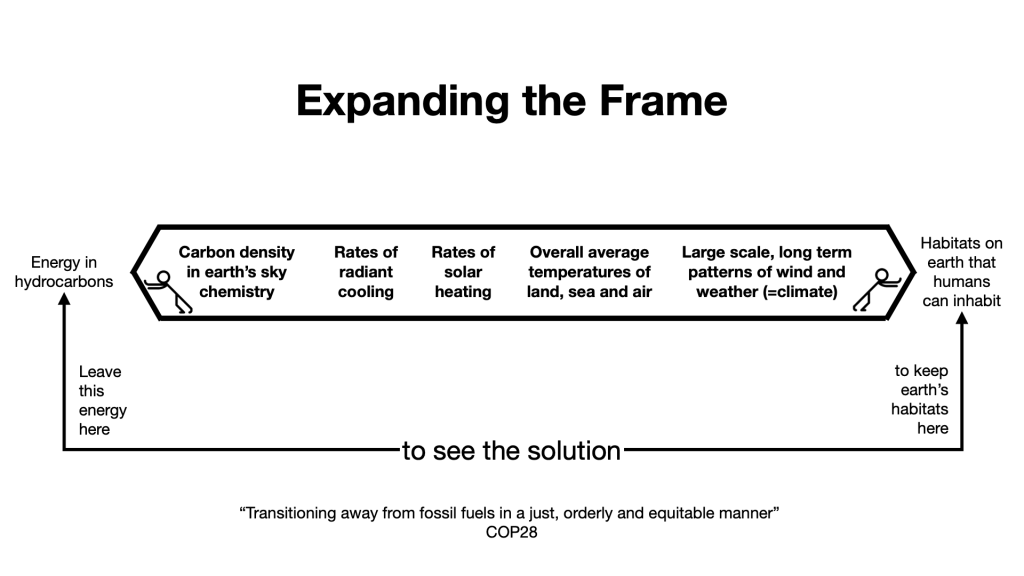

The way out of this doom loop is to get radical, in the Latin sense of “going to the root”, expanding the frame so we can see the problem more completely, and therefor more correctly, and direct individual insight and initiative into actions that will actually be effective.

The prevailing popular framing shows us the climate problem as a carbon emissions problem, with adverse weather consequences.

This framing points us to proven emissions control solutions: variations on theme of making politicians make laws that punish bad actors for their bad actions, and make corporations pay to clean up their mess.

This leads us to a portfolio of campaigns for climate action that include:

- reducing our climate footprint by reducing the energy intensity of our personal style of living – an application to social activism of the Neoliberal philosophy that all decisions made by the markets are the sum total of our own individual choices, and we are each ultimately responsible personally, for the shape of the economy – no government regulation needed

- corporate purchasing of carbon offsets – reminiscent of the practice of the Catholic Church selling indulgences at the time of the Reformation, a not inapposite reference, because the Reformation was in large part a response to the innovation of what we know now as merchant banking, dominated by the Fuggers in what is now Germany, and the Medici in what is now Italy – as a strategy for transition to something called Net Zero,

- divesting from fossil fuels investments, as a way of pressuring hydrocarbon companies to change their business models, form being hydrocarbons companies, to begin anew energy companies; and

- activist shareholder engagement to influence corporate policy on impacts on Nature

None of the above are strategies for “transitioning away from fossil fuels in a just, orderly and equitable manner, as COP28 correctly concluded that we must.

We need to be hospicing energy extraction from hydrocarbons companies to neutralize their opposition to their own replacement in our global energy supply technology network, and redirect their profits into financing the transitioning away for hydrocarbons through a new planetary-scale enterprise for rapidly redesigning and remonstration that global energy supply technology network to be purpose-rebuilt for energy suitability complete with habitat longevity and social equity on a planetary scale in the 21st Century, and beyond…

The problem is in two parts.

Technical/Scientific

the cause-and-consequence connections between energy in hydrocarbons and habitats on earth that humans can inhabit

Human/Social

the agency and authority for “putting money towards those solutions that actually support a healthy for all”

First, the science.

Because carbon atoms released when energy is extracted from hydrocarbons through combustion cannot be offset in real time through photosynthesis.

Hydrocarbons are formed when carbohydrates formed through photosynthetic use of energy from the sun to chemically bind carbon atoms to oxygen and hydrogen to form starches, sugars and lignites that are the fuels that powers life through digestion and respiration, are compressed under pressure over long period of time.

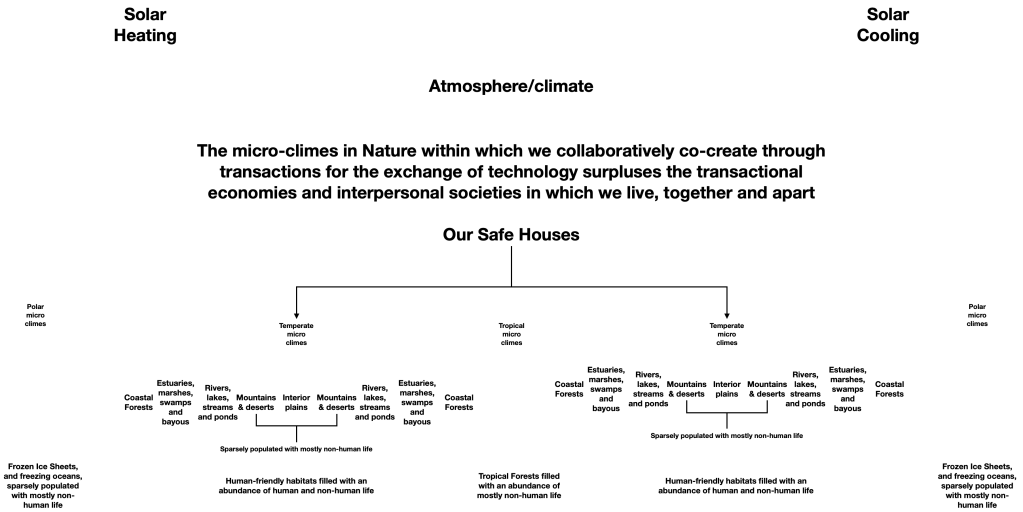

Carbon atoms released into earth’s sky chemistry through digestion and respiration are taken up again through photosynthesis, using new energy flowing over the earth from the sun all the time, in a virtuous cycle that keeps carbon density within earth’s sky chemistry within ranges that set rates of radiant fooling of the earth at levels that balance against rates of solar insolation to keep overall average temperatures of air, land and oceans within limits that support large scale, long term patterns of wind and weather, and ocean currents, that support habitats on earth that we humans can inhabit.

This geothermal dynamic balancing requires that vast quantities of carbon that would otherwise populate the atmosphere remain permanently sequestered in durable hydrocarbon chemical bonds.

Otherwise, rates of radiant cooling will be inhibited by carbon density in earth’s sky chemistry, altering the geothermodynamic balance with solar radiation, raises average air, lane and sea temperatures driving changes in climate as long term patterns of wind, weather and ocean currents, reducing, and possibly even eliminating habitats on earth that we humans can inhabit.

We cannot carbon footprint our way out of this catastrophe.

We cannot carbon offset our way to Net Zero.

The only way we can conserve and preserve the longevity of habitats on earth that we humans can inhabit through constancy in the carbon density of earth’s sky chemistry is to stop extracting energy from hydrocarbons, leaving that carbon chemically bound (using ancient solar energy) and durably sequestered in vast formations of coal, oil and natural gas, mostly buried in the earth’s mantle.

This requires that we find a way to hospice hydrocarbons extraction companies, redirecting their profits into financing the “transitioning away from fossil fuels in a just, orderly and equitable manner”, as COP28 correctly concluded that we must.

How are we going to do that?

Then, the social.

The problem is money. The solution is money.

The problem is our prevailing social narratives about money are fundamentally flawed, and flat-out wrong.

The solution is evolving a new social narrative of money that is more right than wrong.

One way we can do that is to explore the language used by shared by Emil Moldovan and his co-authors in their article published in the Nature Portfolio Journal on Climate action:

The evolving climate change investing strategies of asset owners

https://www.nature.com/articles/s44168-024-00168-4

This article focuses our attention where it needs to be, on the choosers who are choosing for us where the money can, should and will be made to go to shape earth’s future climate, and in particular, so-called Asset Owners, who are more correctly identified as trustees of social trusts for social benefit who are entrusted with discretion in the exercise of capacity derived from character true to aims, within the fiduciary constraints of prudence and loyalty according to prudent people familiar with such matters, under the circumstances then prevailing.

By identifying these choosers as Asset Owners, we are replacing the prudence of people familiar with the capacity they actually derive from their character, and the aims they are actually constituted to pursue through the laws of their creation, with the expert of experts whose expertise is not the expertise we need for “transitioning away from fossil fuels in a just, orderly and equitable manner” as COP28 correctly concluded that we must.

This is a human problem, that requires a human solution.

We can look for that solution by asking this question, raised by the title of the cited article:

What is “climate change investing”?

What is “climate change investing”?

a call to question

a vast, new place of inquiry in search of insight and new learning about our uniquely human way of being in the world

resolution of ambiguity in our use of words for talking about money and savings and investment and financing and enterprise and technology and the economy and society and our shared future