We start with Private Equity as the creative edge of innovation within the prevailing practice of Asset Ownership for profit extraction maximization through cost externalization maximization.

Then we innovate on this innovation, by replacing private ownership equity with social stewardship equity as our main investment thesis.

…the spirit of stewardship is … incompatible with ownership or sovereignty. While owners have rights, stewards bear responsibilities.

Irina Wang

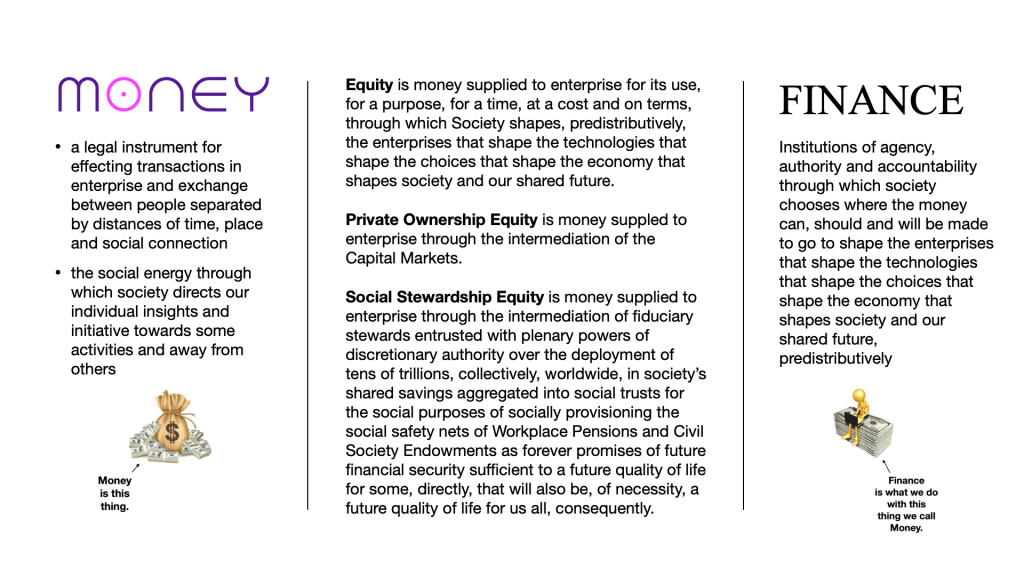

Equity is money made to flow into enterprise for its use in doing its work, for a time, at a cost and on terms that align the rights of the investors with the vagaries of the business. This is in contrast to debt, which is money lent at interest against a promise to repay on demand, or on a schedule that does to vary with the vagaries of the business.

Private Ownership Equity gives the investors in the financing rights to dividends, if and as declared, and gain on sale of their interest in an enterprise reduced to an asset bought for resale on the Exchanges (the public capital markets) or through Funds (the private, alternative capital markets).

Enterprise as a Selling Price

and volatility

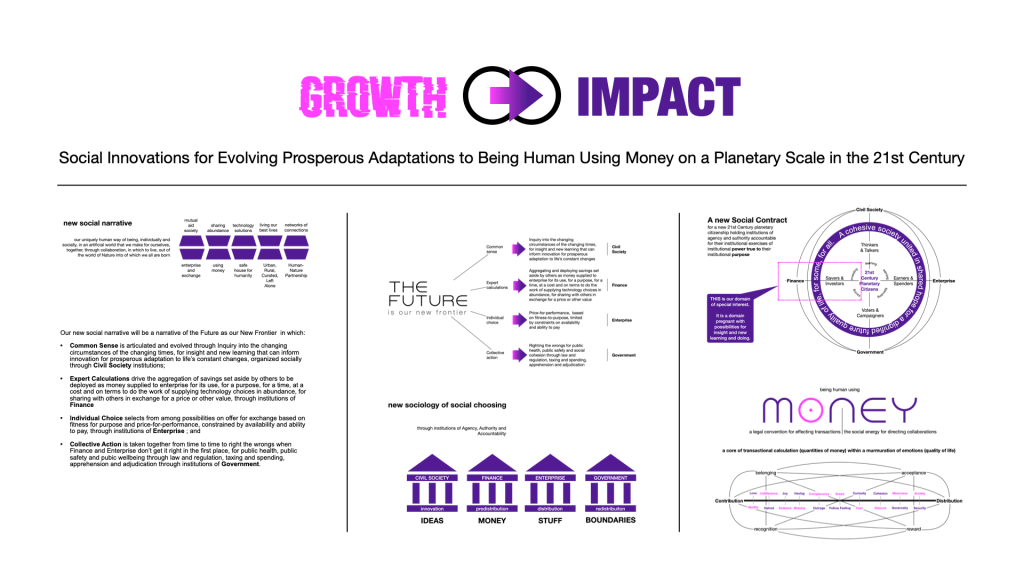

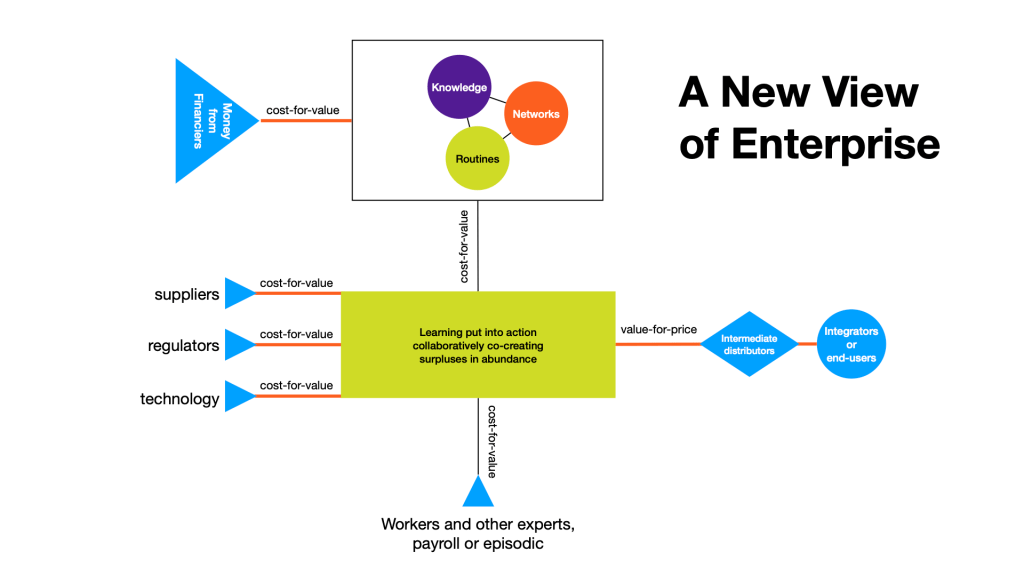

Social Stewardship Equity gives the investors a formula-based share in cash flows generated by the enterprise as a social configuration of physical Knowledge + Networks + Routines for converting cost-for-value into value-for-price by putting learning about how the world about us works in some specific way, and how we can take the world about us as we find it, in that way, and change it, to be more a way we choose to make it, in that specific way – learning that we call “technology” from the ancient Greet techne – practical knowledge + logos – words and language, or language for talking about practical knowledge – into action constructing a surplus of artifacts as an expression of that knowledge in abundance for sharing with others, for their use in taking the world around them as they find it in that specific way, and changing it to be more a way that choose to make it, in that specific way, in exchange for a price paid in money, or other value that can be converted into, or otherwise function as, money.

The enterprise as an asset that can be purchased for resale, in its entirely or in shares, at market clearing prices in the public or private, alternative, capital markets for maintaining market clearing prices on such assets, is imagined as continuing on into the future as the forward projection of an historical trend line of changes in market clearing prices for that asset.

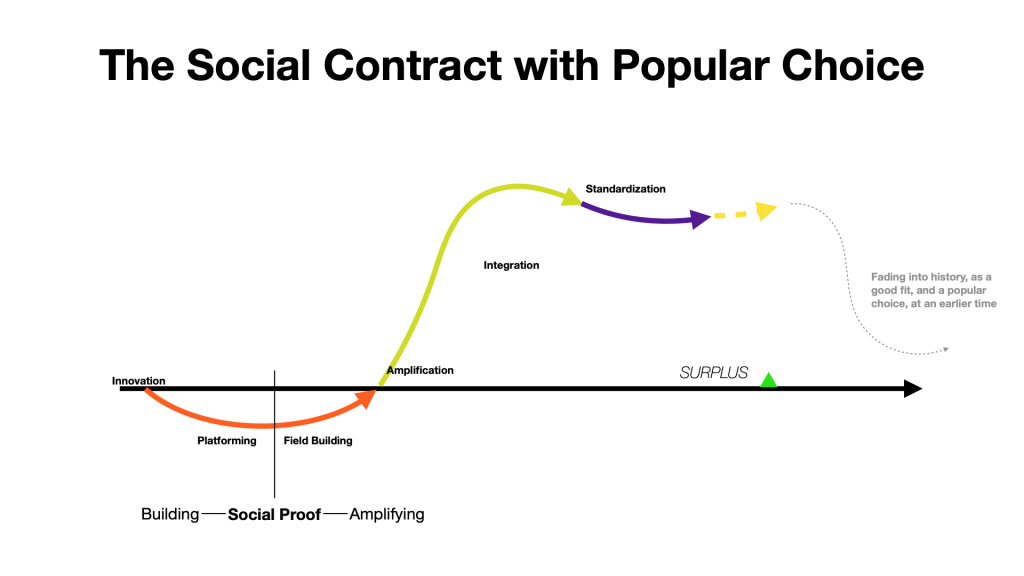

The enterprise as social configuration of people doing work can be seen as continuing on into the future along the flourish and fade of a social contract with popular choice that begins at the beginning, with Innovation and progresses through Platform Building, Field Building and Amplification for Integration to arrive at Standardization as the most popular, default choice within a given population, before fading into Obsolescence as the circumstances then prevailing change and humanity evolves prosperous adaptation to life’s constant changes through inquiry for insight and new learning that can inform innovation, making new choices more popular as better fit to the circumstances then prevailing, while letting previously standard, default choices fade into history, as a good fit under the circumstances prevailing at an earlier time.

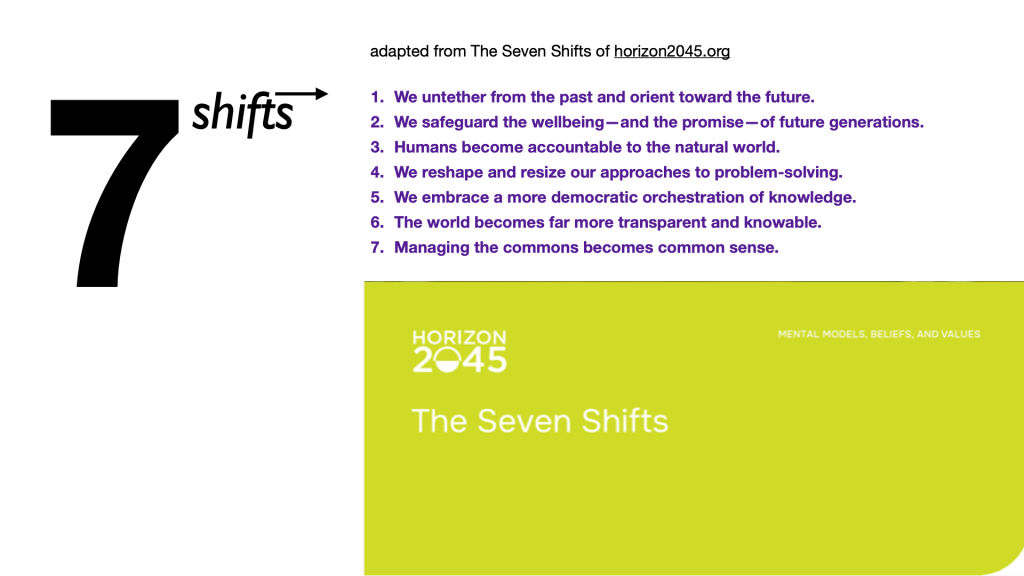

We can make this shift, from enterprise as growth in selling price to enterprise as a social contract with popular choice that flourishes for a time and then fades in the fulness of time, and Equity as Private Ownership for Profit Extraction to Equity as Social Stewardship through Equity Paybacks for INCOME with IMPACT, using the Seven Shifts framing form Horizon2045.

- We untether from the past and orient toward the future.

- Private Ownership Equity reduces history to a trend line and shows us our future as a forward projection of this historical trend line, creating booms that go bust when the trend line fails, giving the lie to the axiomatic assertion of Capital Markets control over Fiduciary Money, that more will always be better.

- Social Stewardship Equity dwells along the creative edge of the future as our new frontier, choosing new beginnings from among evolving possibilities, and their consequences, as times change, to fit the changing times.

- We safeguard the wellbeing—and the promise—of future generations.

- Private Ownership Equity speculates on share price movements in the share price trading markets, timing and riding the booms and busts of trend line-based future forecasting.

- Social Stewardship Equity negotiates equity paybacks to an actuarial/fiduciary cost of money, plus upside, from enterprise cash flows prioritized by contract for suitability of its core technology to the changing times, longevity of its social contract with popular choice, and fairness across all six vectors of enterprise cash flow to shape the right enterprises for shaping the right technologies for shaping the right choices for shaping the right economy for shaping a cohesive society, and keeping it ongoing, united in hope for a dignified future quality of life, for some, and all.

- Humans become accountable to the natural world.

- Private Ownership Equity operates within an experience that Nature is vast, and we are not. We can take, and take and take from Nature without ever reckoning with the consequences of our takings, because those consequences will just disappear into an infinitely receding geobiophysical frontier, reabsorbed back into Nature without consequence. To us.

- Social Stewardship Equity operates with an experience that Nature is vast, and so, now are we. When we take from Nature, we must always reckon with the consequences of our taking. Because there will always be consequences. For us.

- We reshape and resize our approaches to problem-solving.

- Private Ownership Equity operates at the scale of markets, on the assumption that markets can and do always expand, endlessly and exponentially. Because growth in markets is necessary for growth in transaction volumes, and growth in transaction volumes is necessary for growth in share prices, and growth in share prices is necessary for Private Ownership Equity to extract a profit from the markets.

- Social Stewardship Equity operates at planetary scale, to mediate the tensions between here and there, now and later, you and me, along all six vectors of cash flow connections that shape the enterprises that shape the technologies that shape the choices that shape the economy that shapes society and our shared future.

- We embrace a more democratic orchestration of knowledge.

- Private Ownership Equity is elitist and authoritarian, requiring specialized knowledge of financial instruments and trading protocols, and a feel for the mood of the market that excludes all who are not sufficiently expert, and “tapped in”.

- Social Stewardship Equity is inclusive and democratic, referring the details to experts in those details, but engaging with the common sense of reasonable people who care enough to take the time to make the effort to acquire knowledge and experience relevant to the possibilities, and their consequences.

- The world becomes far more transparent and knowable.

- Private Ownership Equity shows us the economy as the production and distribution of goods and services in markets for allocating scarcity through the mysteries of price that are irrationally presented as operating rationally, which is crazy.

- Social Stewardship Equity shows us the economy as a mutual aid society for sharing an abundance of technology solutions to the everyday problems of everyday people living our best lives under the circumstances, every day, through networks of connections for enterprise and exchange to construct and reconstruct a safe and dignified house for humanity along the creative edge of an evergreen, ever-changing adaptively evolving Human-Nature partnership.

- Managing the commons becomes common sense.

- Private Ownership Equity makes money for finance, and the profits that can be made by deploying money for finance, private, personal and individual, making participation in the economy through saving and investing a zero-sum game of winner take all.

- Social Stewardship Equity celebrates society’s shared savings aggregated into social trusts for the social purpose of socially provisioning the social safety nets of Workplace Pensions and Civil Society Endowments as forever promises of a dignified future for some, directly, and for us all, consequently, as a new 21st Century global commons that is accountable to the shared common sense of a new 21st Century planetary citizenship.