Building a Platform

for

Popular Participation

in

Citizens Assemblies

for

Deliberative Accountability

in

Fiduciary Finance

“So in everything: power lies with those who control finance…”

― Bertrand Russell, Freedom in Society, Sceptical Essays

It is true that there is power in politics: the power of the public fisc; and the power of public force.

But without fisc, there is no force.

Which is why money-in-politics is such a problem for constitutional representative democracy: if the money does not come from the voters, the voters are no longer in control, but are, instead, under the control of politicians who are no longer accountable to us.

If we care about democracy, we have to pay attention to the money.

Citizens Assemblies are an increasingly popular innovation in representative self-government, as a way of countering the corrupting influence of money in politics.

Citizens’ assemblies (sometimes called civic assemblies or policy juries) are like jury duty, but for deciding public policy rather than individual court cases. They bring together a broadly representative sample of the population to learn about a challenging public issue and identify policy solutions. The term “citizen” is used in the broadest sense of the word, not in the restrictive legal sense — so legal residents can be eligible too.

…

Typically, 40 to 100 people participate in a given assembly… The assembly meets several times … learning from experts, deliberating, and developing policy proposals. These proposals are then often put to a legislative body or public vote.Boston Globe, IDEAS https://www.bostonglobe.com/2025/04/22/opinion/time-for-fourth-branch-government/

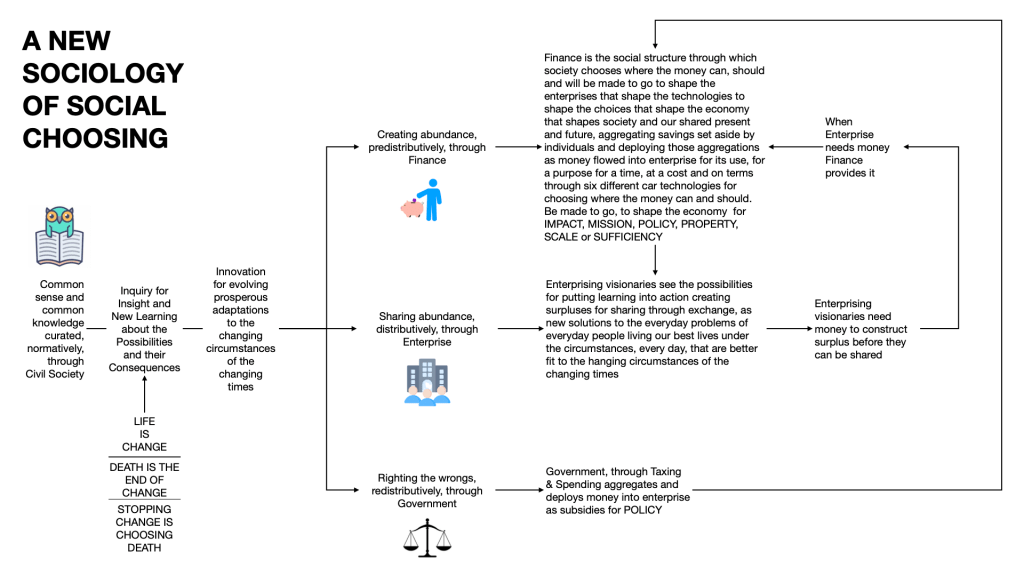

What if we adapted this political innovation of the Citizens Assembly, to hold accountable “those who control finance”?

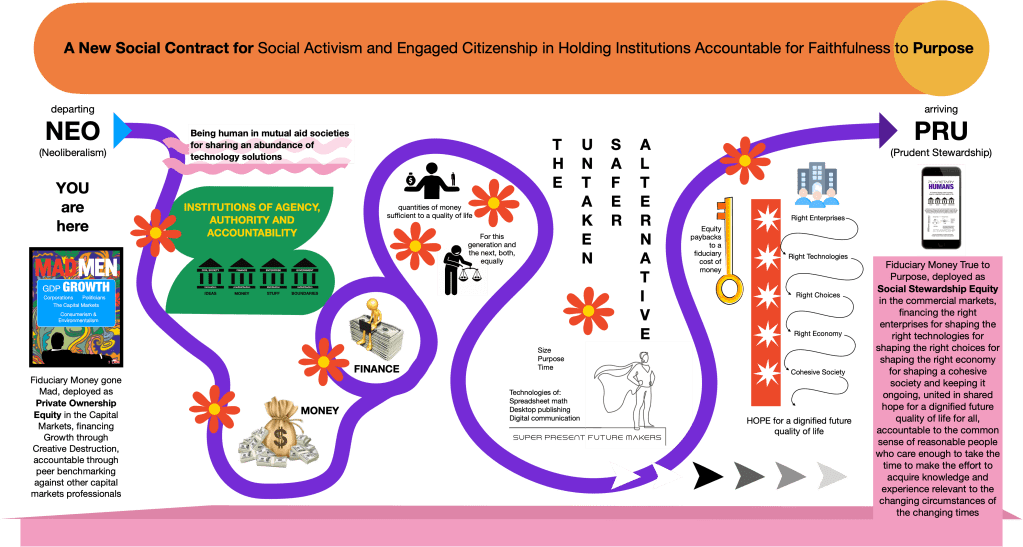

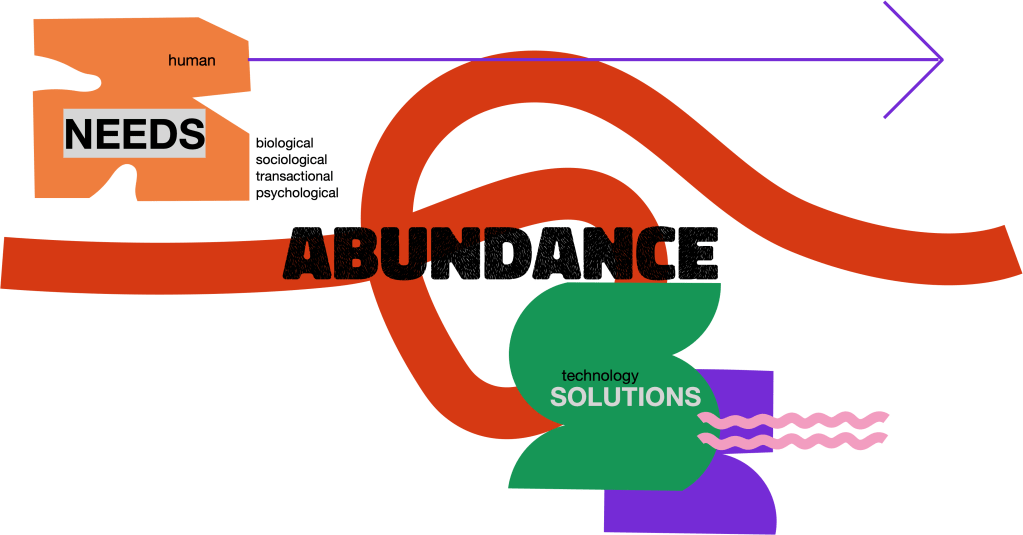

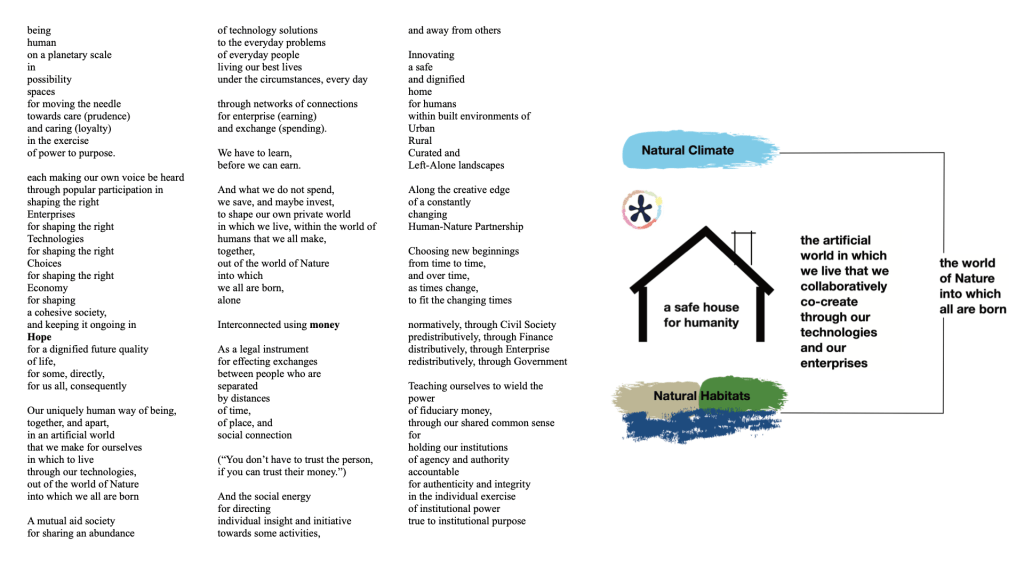

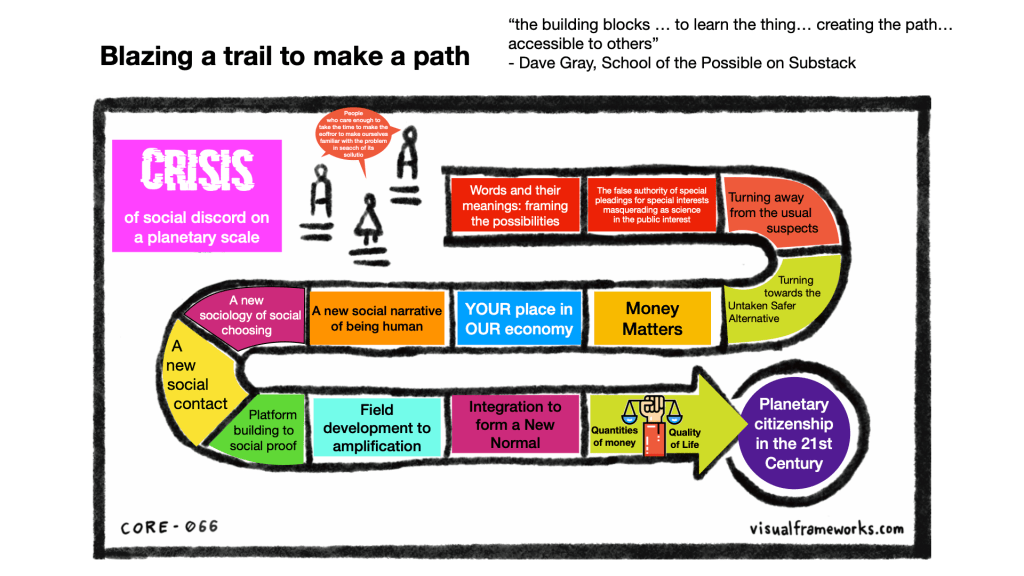

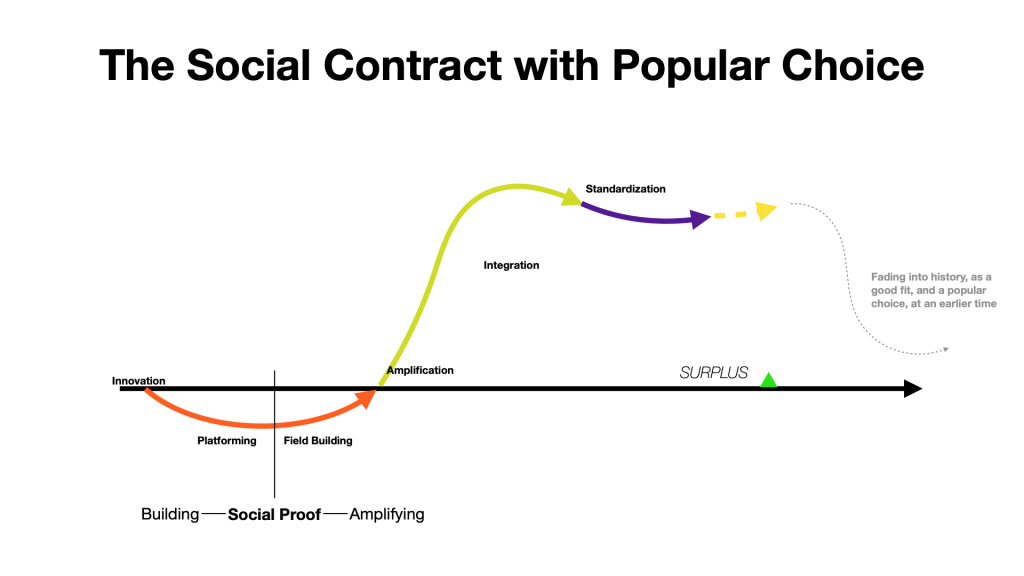

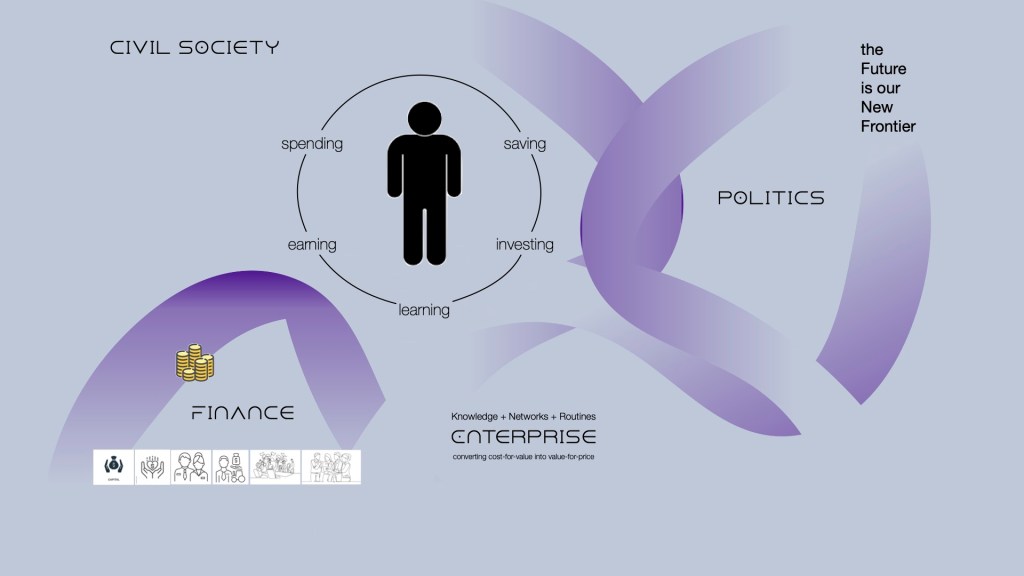

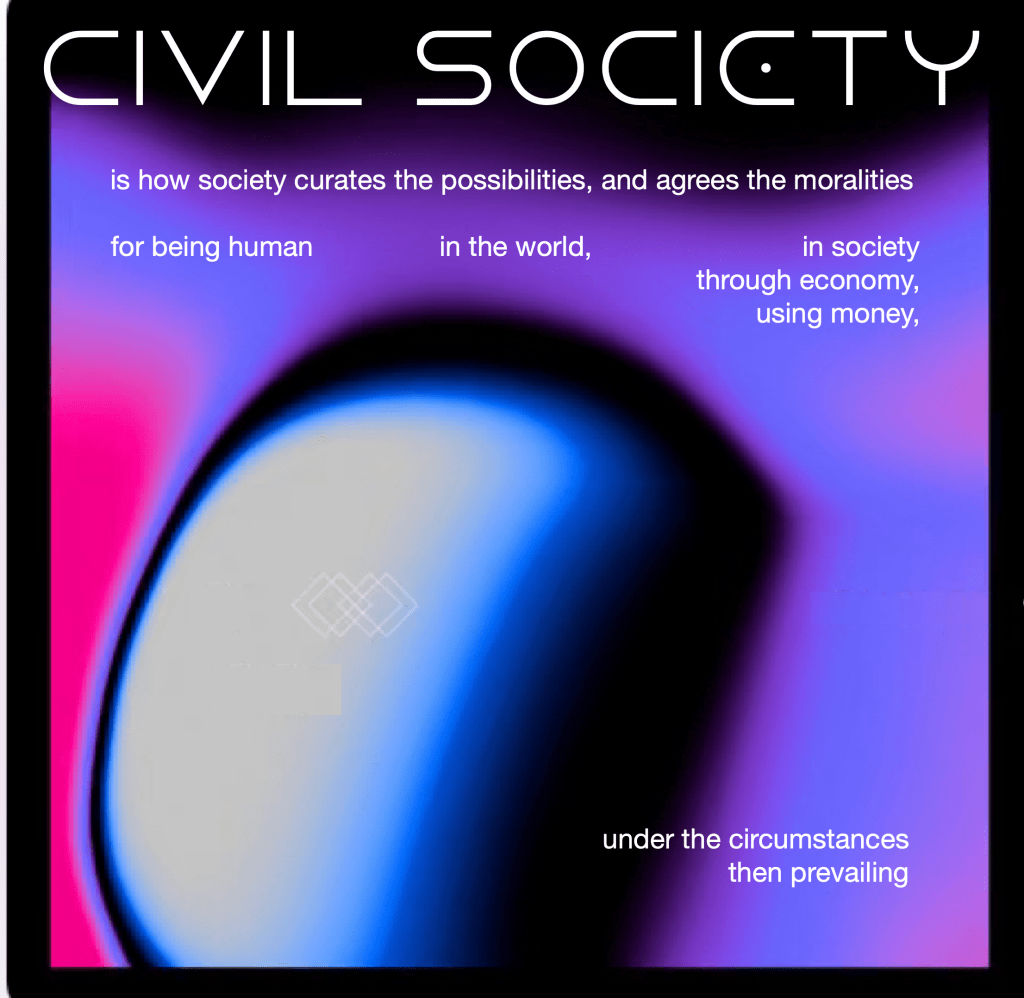

- A new social contract

- A new sociology of social choosing

- A new social narrative of being human in society, through economy, using money on a planetary scale in the 21st Century, and beyond…

notions

of value

Prudent Stewardship

world

view

Sharing Abundance

financial mathematics

Equity

Paybacks

responsibility for social outcomes

Dignified

Futures

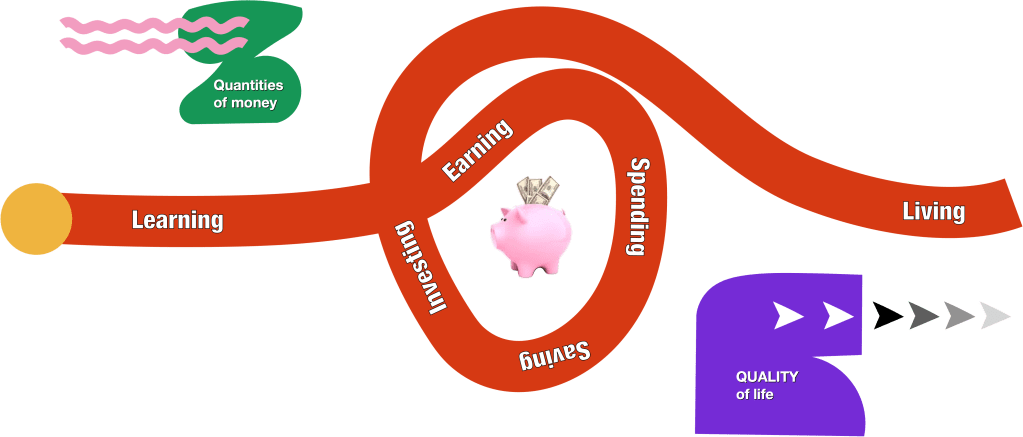

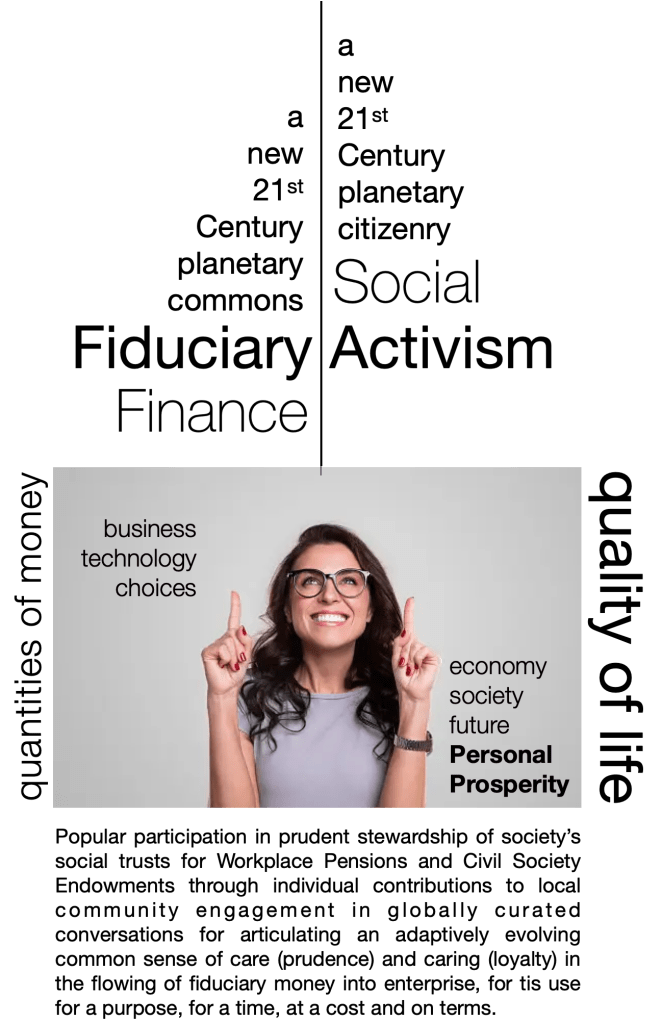

Quantities of Money = Quality of Life

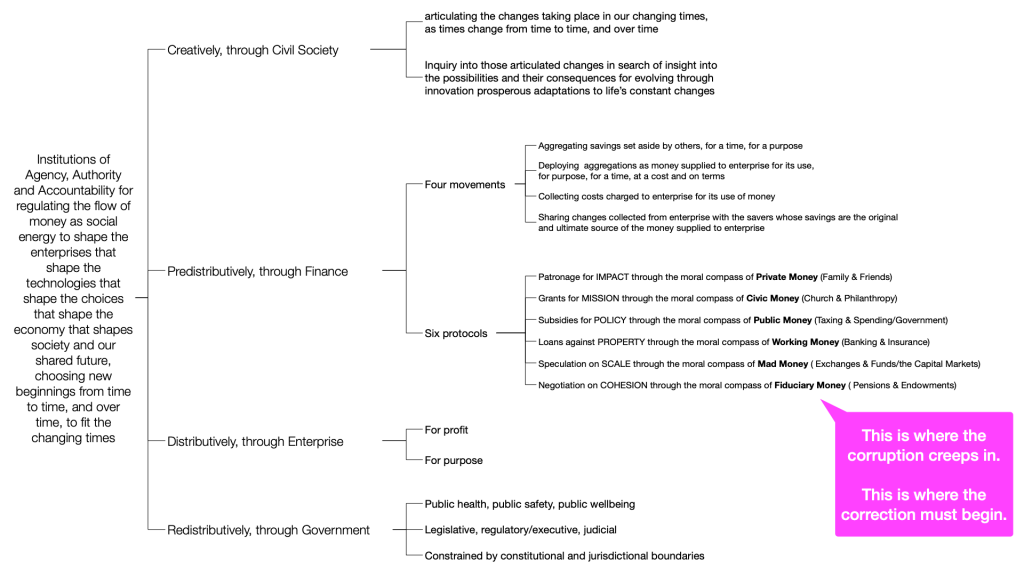

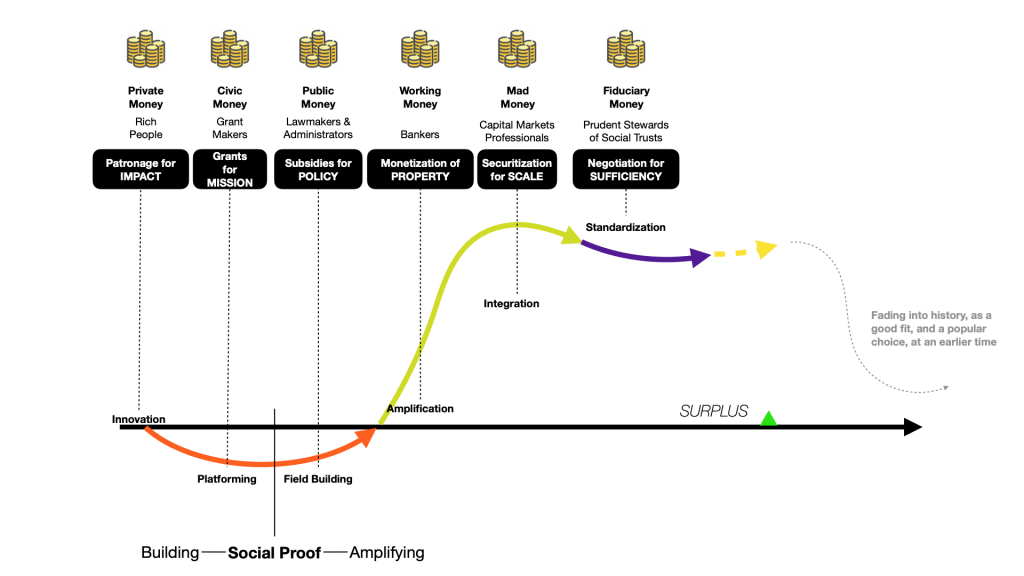

Ambition: to hold those who control fiduciary finance accountable for authenticity and integrity in their notions of value, world-views, financial mathematics and responsibility over social outcomes as stewards of the connections between quantities of money and quality of life, for so many, directly, as a private benefit, that it is also for us all, consequently, as a new 21st Century planetary commons

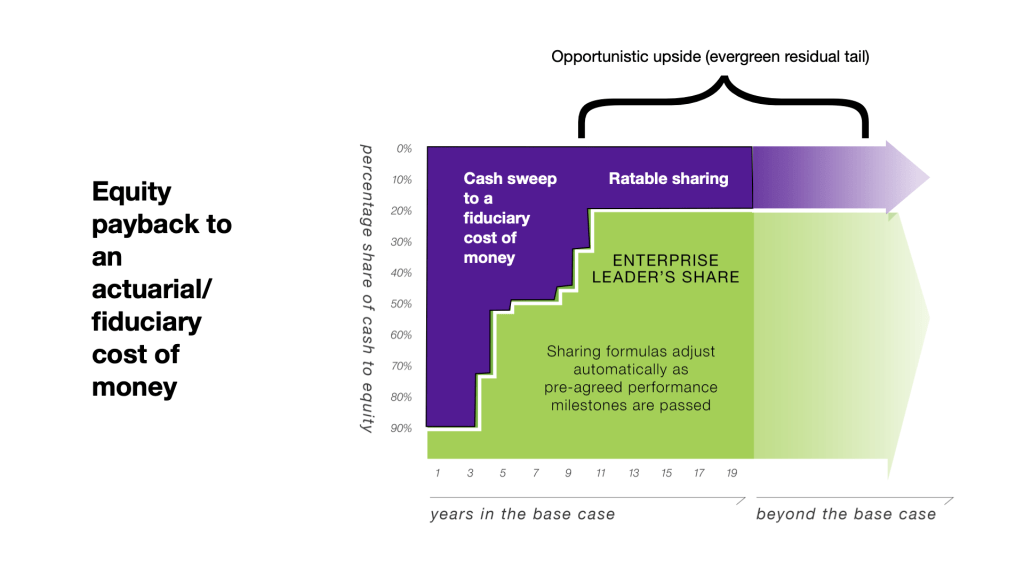

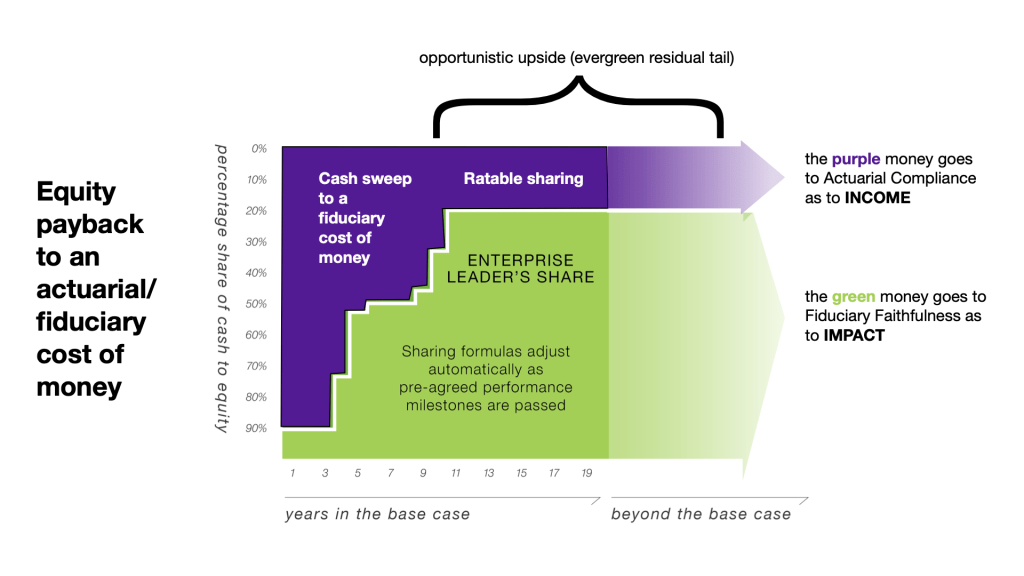

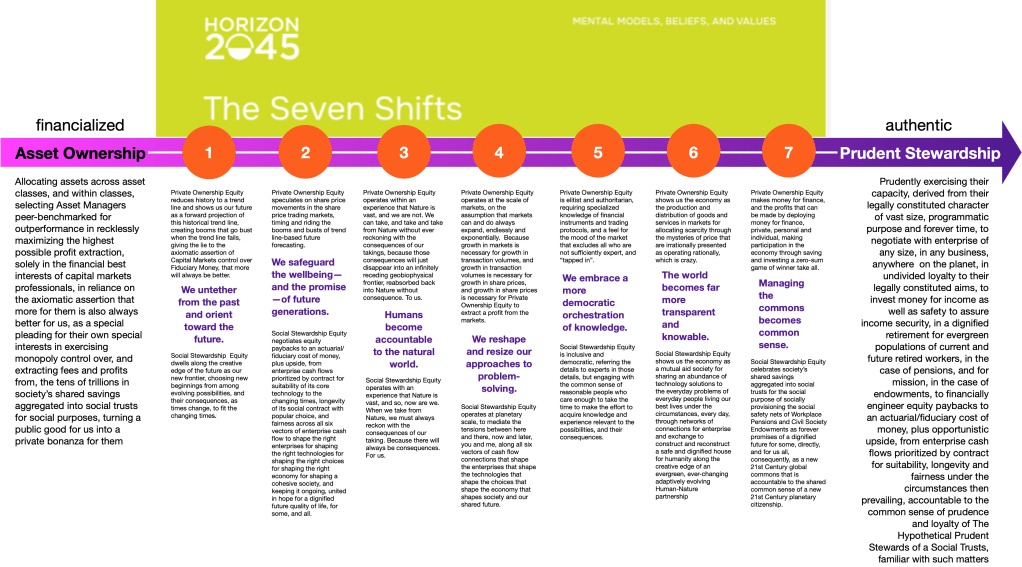

Strategy: Shift Pensions & Endowments out of securities trading and into equity paybacks

Tactics: adapt proven practices in Citizens Assemblies for deliberative democracy in politics and policy to an innovative new deliberative accountability in fiduciary finance

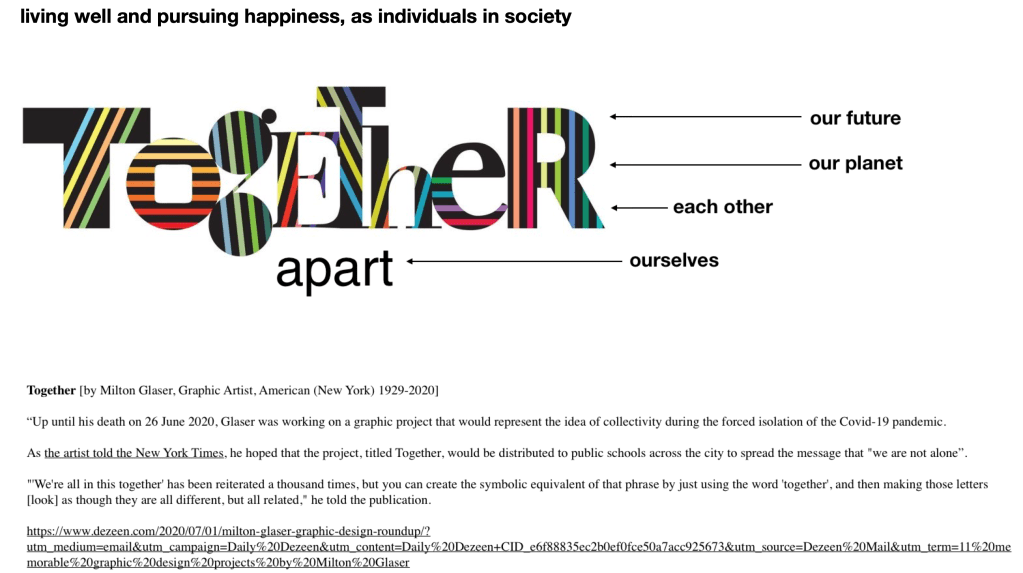

changing the way the world looks and feels using

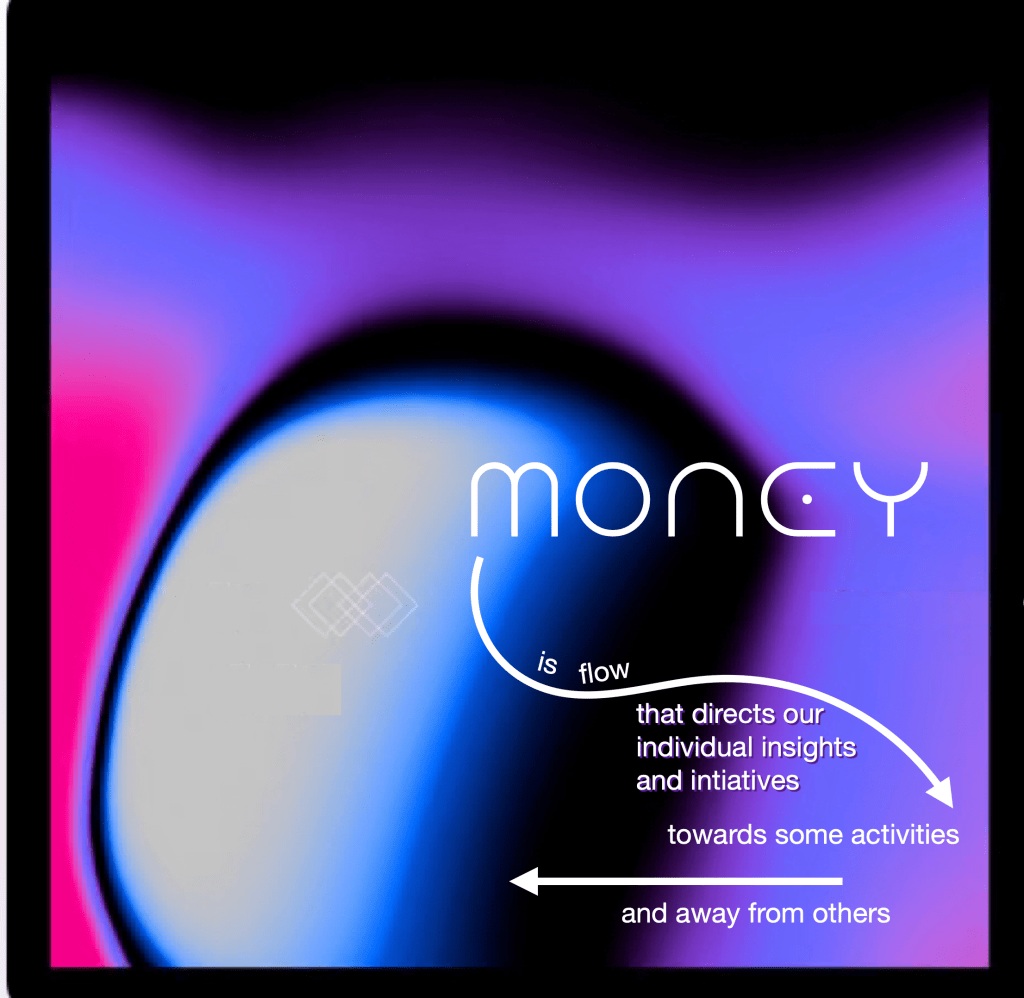

MONEY

as the social energy that directs our individual insights and initiative towards some activities (where we can make money) and away from others (where there is no money to be made)

by coalescing diverse communities of interest around a shared interest in changing who it is that controls the flow

“[if] we are really serious about changing the way the world looks and feels and supporting a healthy planet for all, then… we have to be putting money towards those solutions that actually support that healthy plant for all”

Pedro Henriques Da Silva, Director of the Shifting Trillions Program, The Sierra Club

HOW

do we put money toward solutions?

“the tools, language, mindset, strategies and ambitions … for what is needed”

– Hege Sæbjørnsen, Global Circular Strategy Leader @ Ingka Group, IKEA

Tools

Language

Mindset

Strategies

Ambitions

“the building blocks … to learn the thing… creating the path… accessible to others”

– Dave Gray, School of the Possible on Substack

Catalysts for making the shift

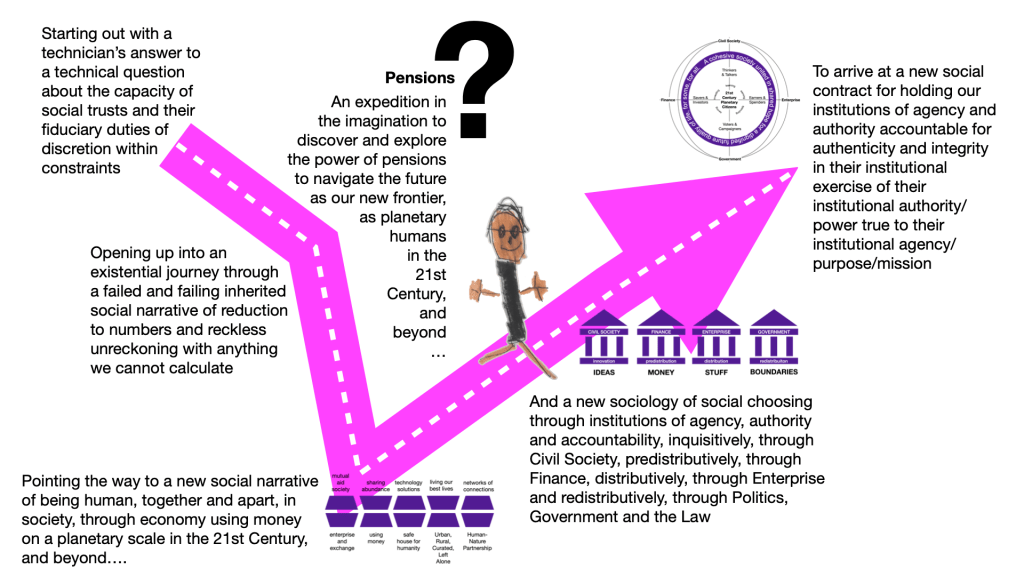

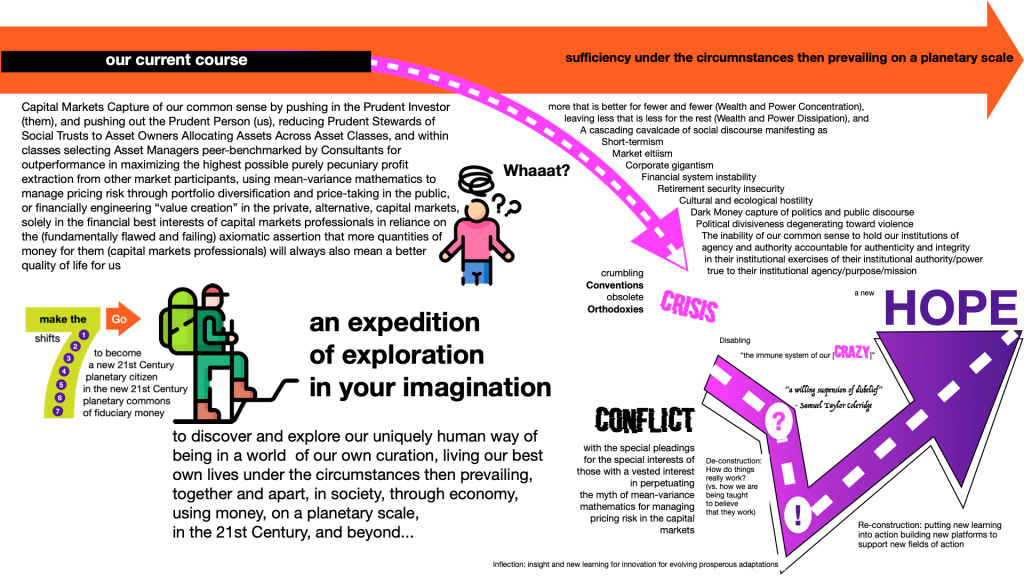

An expedition of inquiry in the imagination to discover and explore insights and new learning about our uniquely human way of being in the world that can inform innovation for evolving prosperous adaptations to the changing circumstances of our changing times

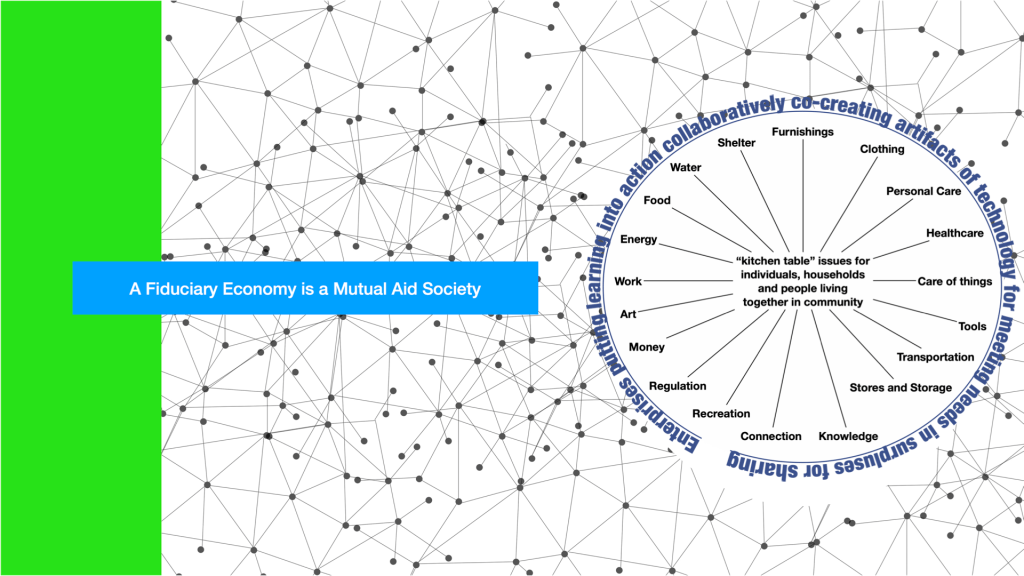

A new conversation about

Money

Savings

Investment

Finance

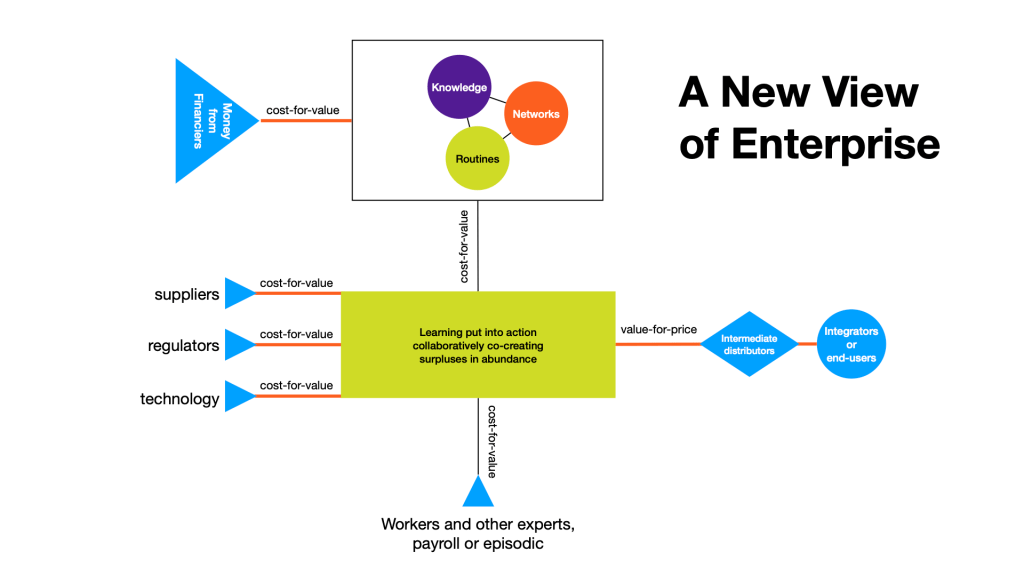

Enterprise

Technology

the Right Economy

for a Cohesive Society

and a Dignified Future

through innovations in fiduciary finance,

and the innovation of fiduciary activism

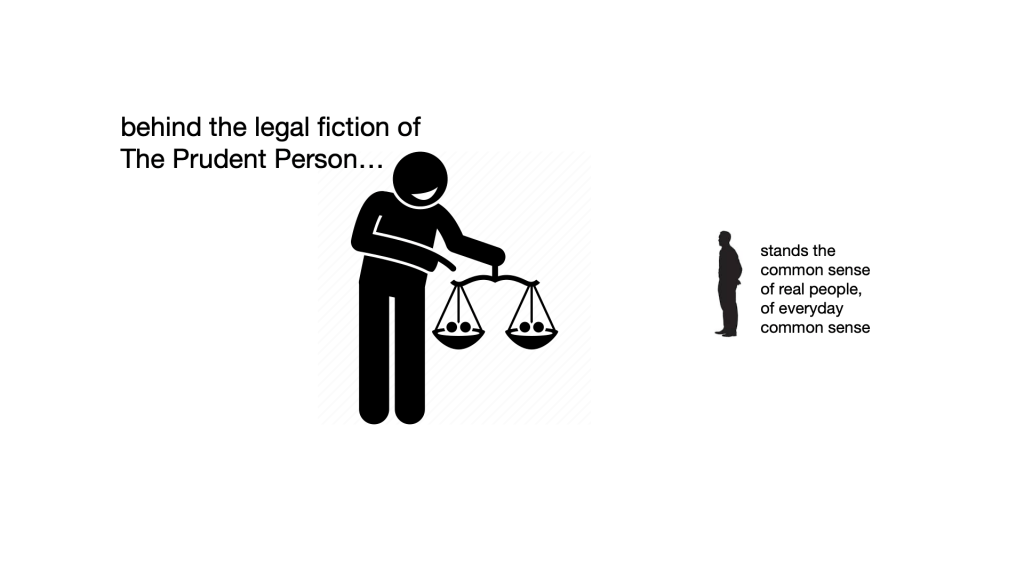

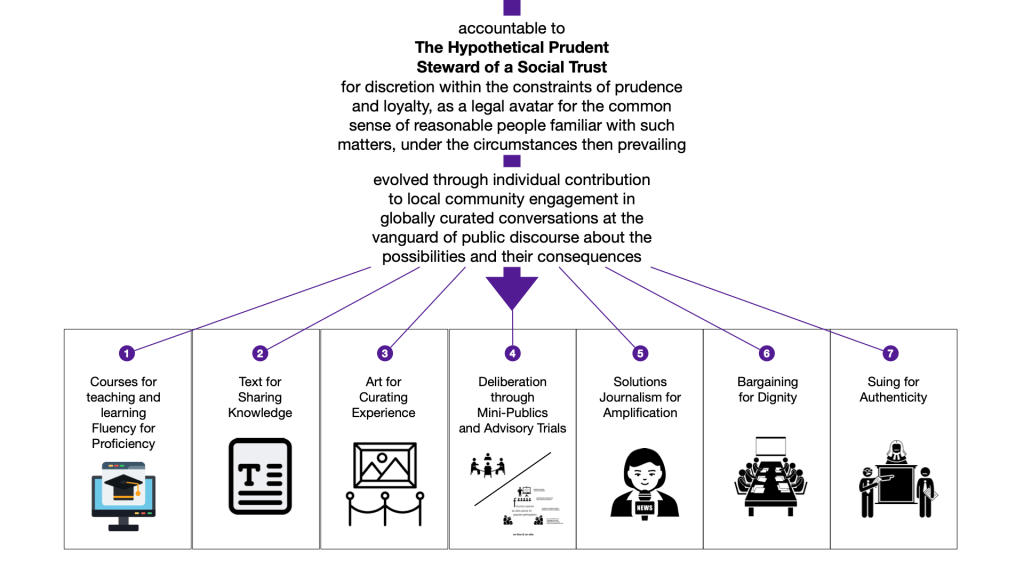

for popular participation in prudent stewardship through the legal avatar of The Hypothetical Prudent Steward of a Social Trust

It’s not simple.

Because people are complex.

We are a whirling swirling maelstrom of conflict and cooperation, constantly moving through choice to consequence,

episodically evolving prosperous adaptations to life’s constant changes, each living our own best lives, as best we can, under the circumstances then prevailing, using technology, together, through enterprise and exchange.

Points of Entry into the Conversation

The Real Story of Our Human History

inquiry for insight and new learning that can inform innovation for evolving prosperous adaptions to life’s constant changes

“a willing suspension of disbelief”

- Samuel Taylor Coleridge

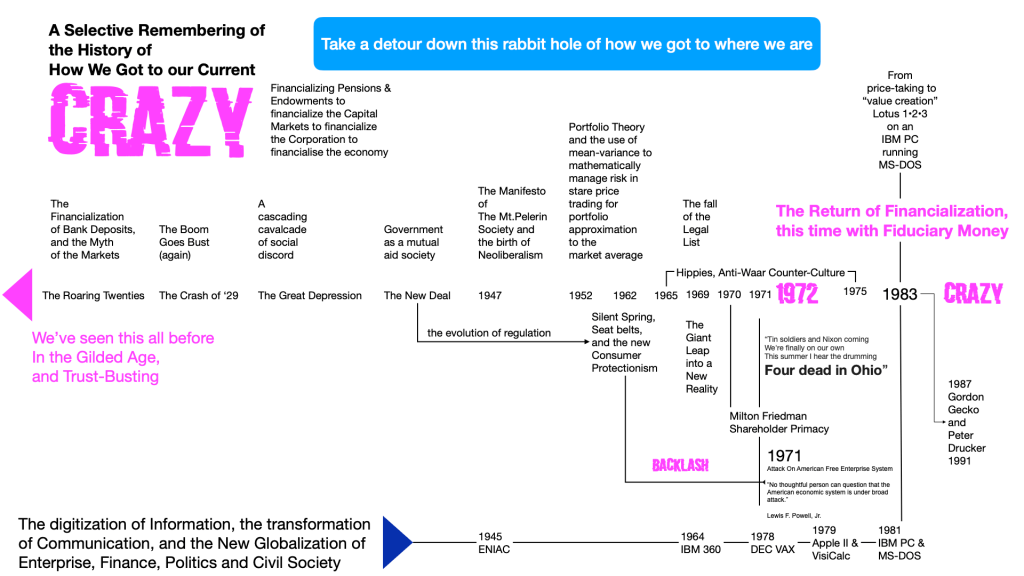

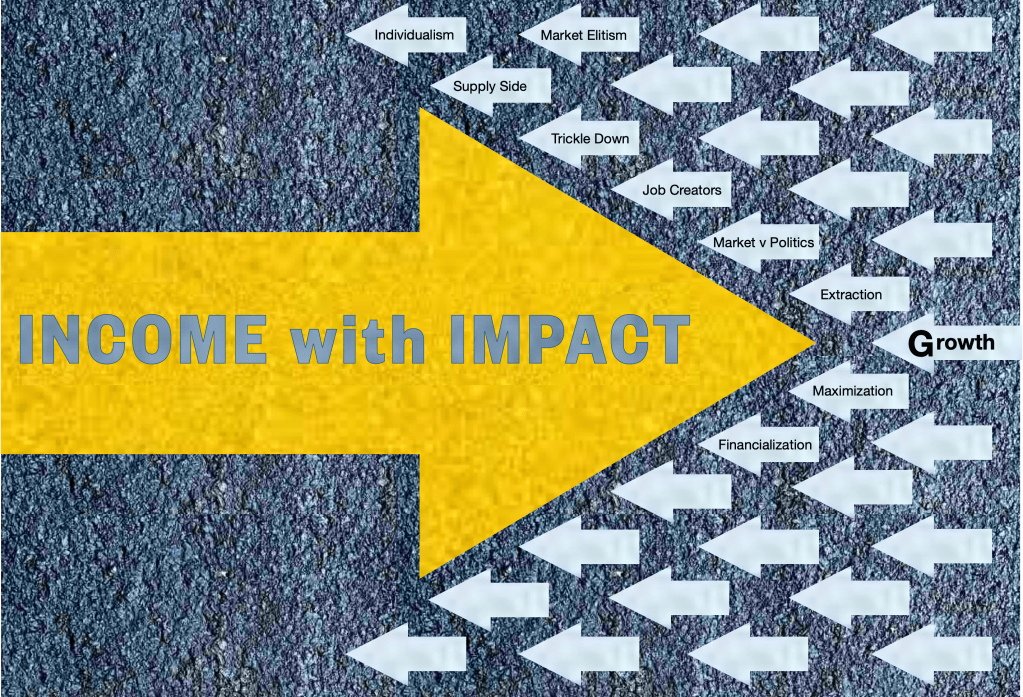

Retiring the Friedman Doctrine

Expanding the frame to upgrade the purpose

YOUR Place in OUR Economy

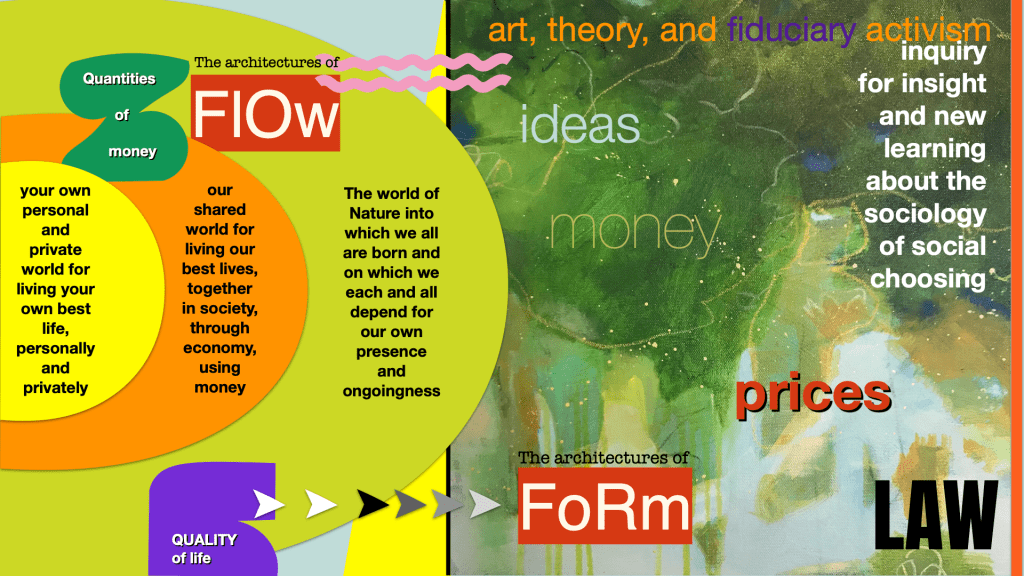

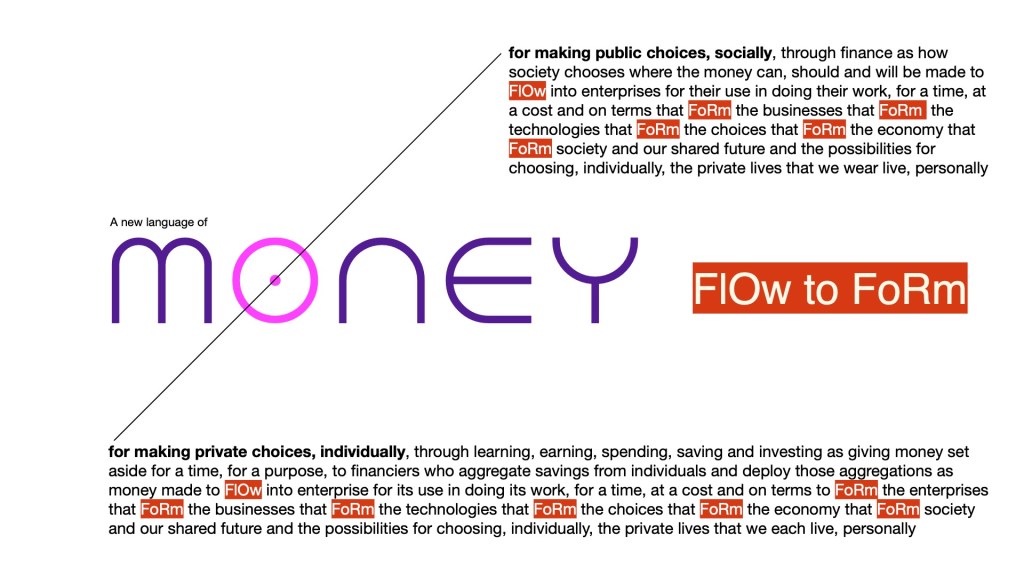

Money as the social energy that forms our public and our private worlds

What’s in the box?

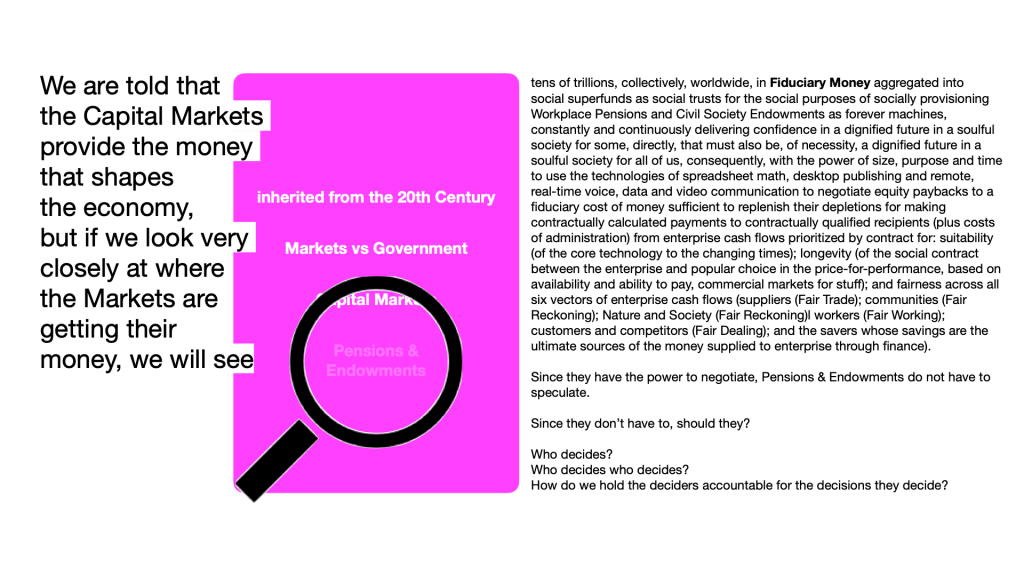

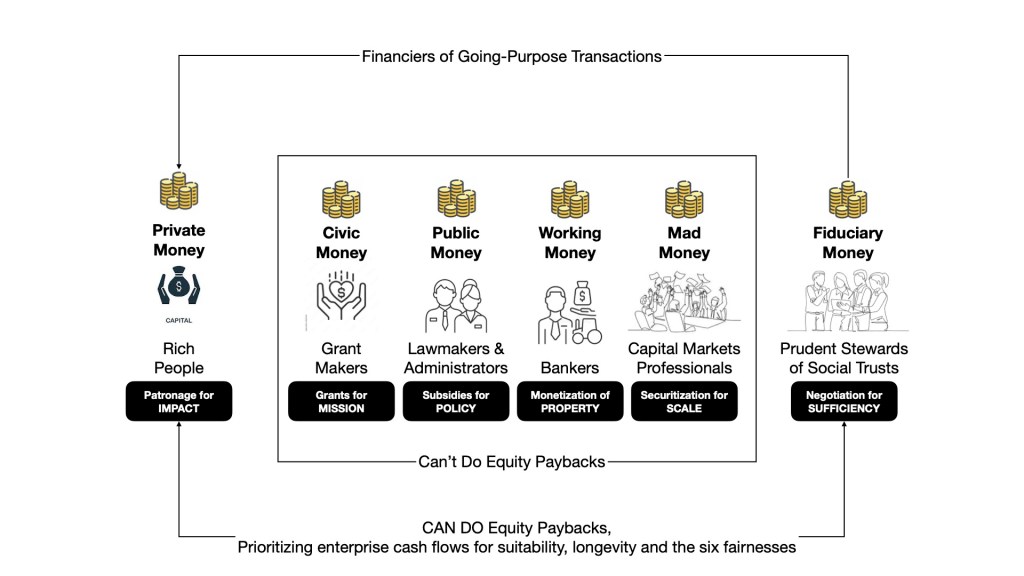

Looking Inside the Black Box of Finance, to see how we, as savers for investment, shape enterprise, predistributively

Do We Have the Right Economy?

The Language and Logic of Money

The Untaken Safer Alternative of Equity Paybacks for INCOME with IMPACT

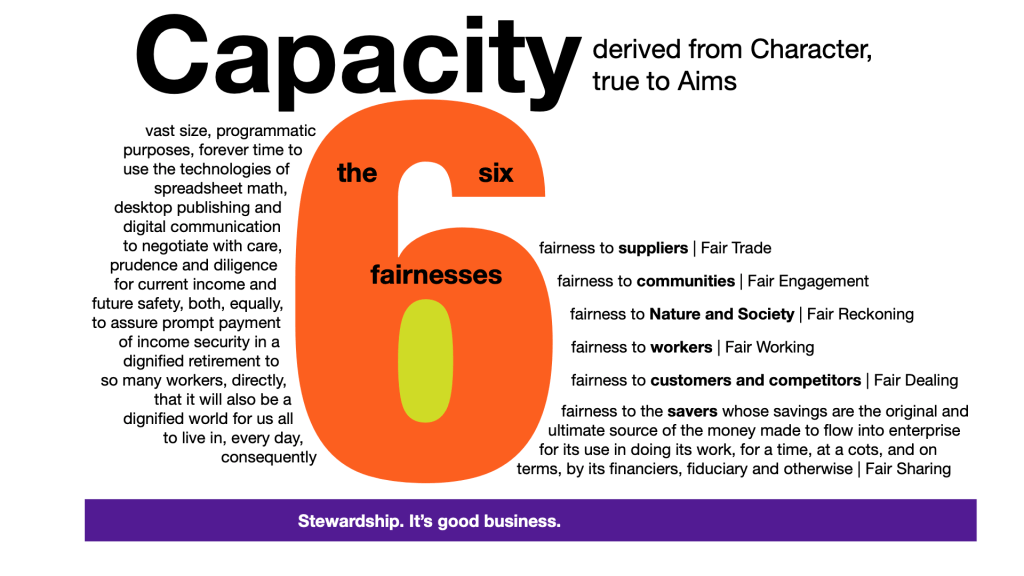

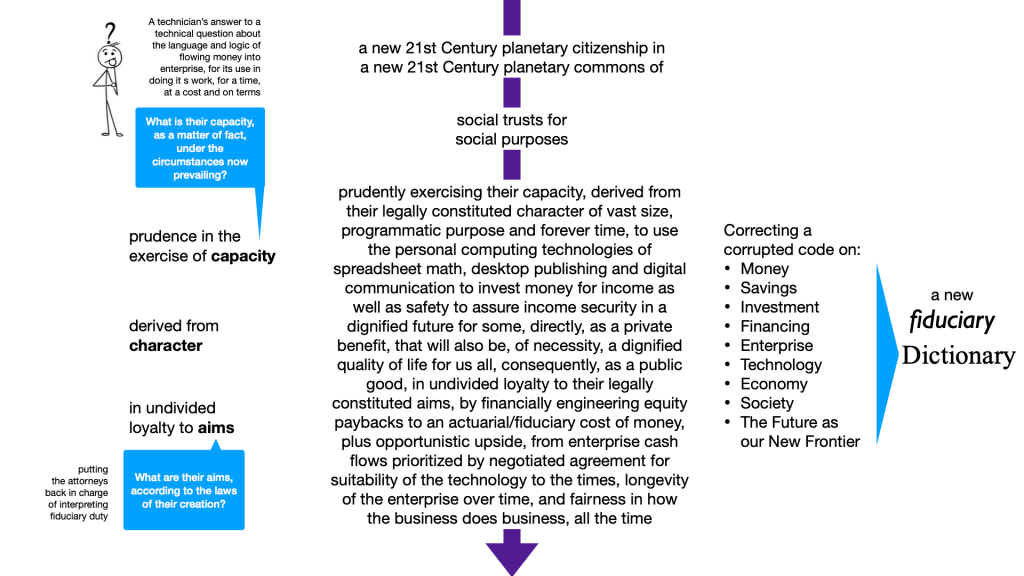

Re-evaluating Capacity Derived from Character Under the Circumstances Now Prevailing

What Does a Fiduciary Look Like?

The law of trusts and the institutional accountability of trustees for their exercise of discretion within the constraints of prudence and loyalty

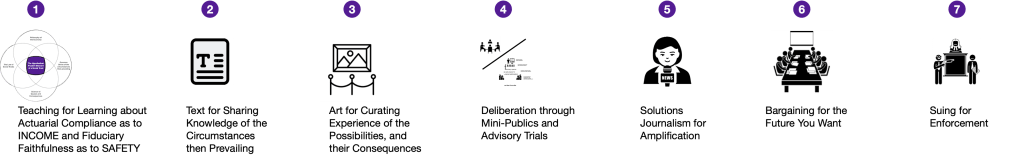

Citizens Assemblies for Public Participation in Prudent Stewardship

- Courses for Fluency and Proficiency

- Text for Knowledge Sharing

- Art for Curating Experience

- Mini-publics and Advisory Trials

- Solutions Journalism

- Engagement

- Enforcement

Fixing Climate

“transitioning away from fossil fuels in a just, orderly and equitable manner”, COP28

Conserving Nature

Regenerating soils, water, biodiversity and social cohesion

Human Rights in Business

Pathways to

a Dignified Future

Retiring the Friedman Doctrine

Beyond GDP

Post-Growth

Wellbeing

Considering the Consequences

trustees interested in being empowered to make choices in the interest of long-term sustainability and wellbeing of the community (what we call a dignified quality of life)

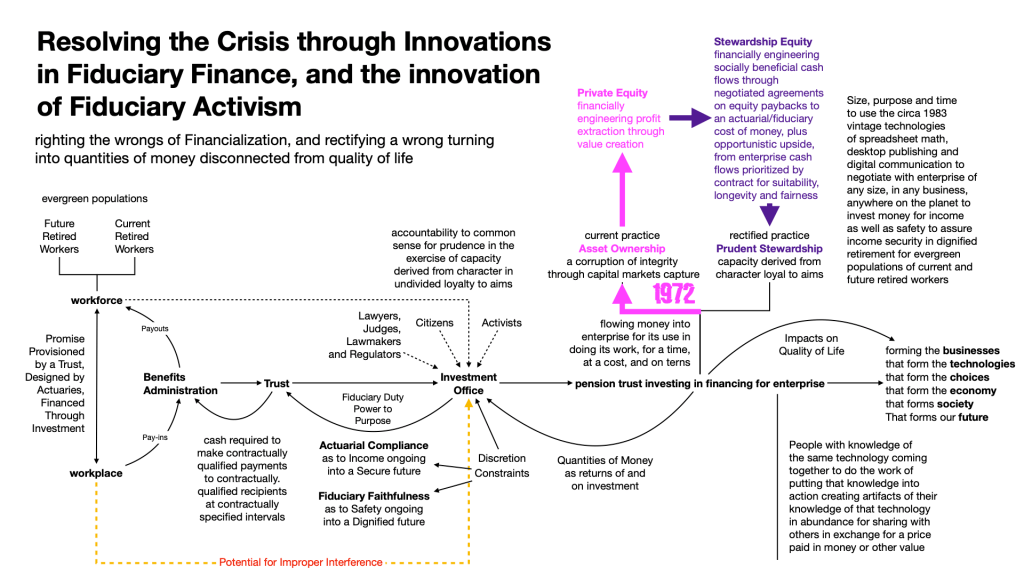

The Story Behind the Stories

Innovations in fiduciary finance, and

the innovation of Fiduciary Activism

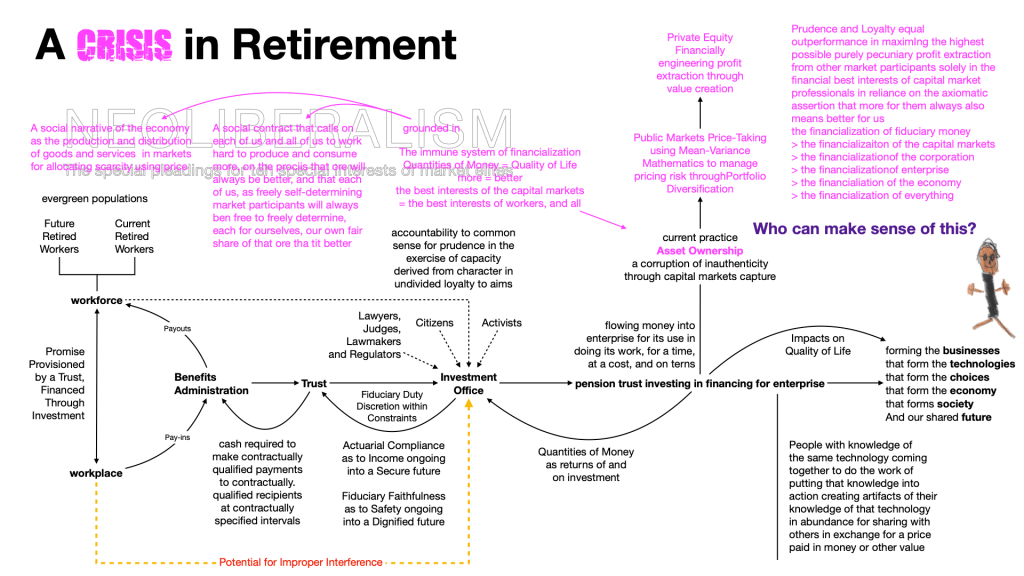

for popular participation in prudent stewardship of society’s social trusts for socially provisioning the social safety nets of Workforce Pensions and Civil Society Endowments

controlling the flow of tens of trillions, collectively, worldwide

through financially engineering equity paybacks to an actuarial/fiduciary cost of money, plus opportunistic upside (for Actuarial Compliance as to income ongoing into a secure future), from enterprise cash flows prioritized by contract for suitability, longevity and fairness across all six vectors of fairness in how business does business (for Fiduciary Faithfulness as to safety ongoing into a dignified future)

accountable under the laws of fiduciary duty as they apply to social trusts for social purposes, for prudence in the exercise of capacity derived from character in undivided loyalty to their legally constituted aims, according to the common sense of prudent people familiar with such matters, under the circumstances then prevailing

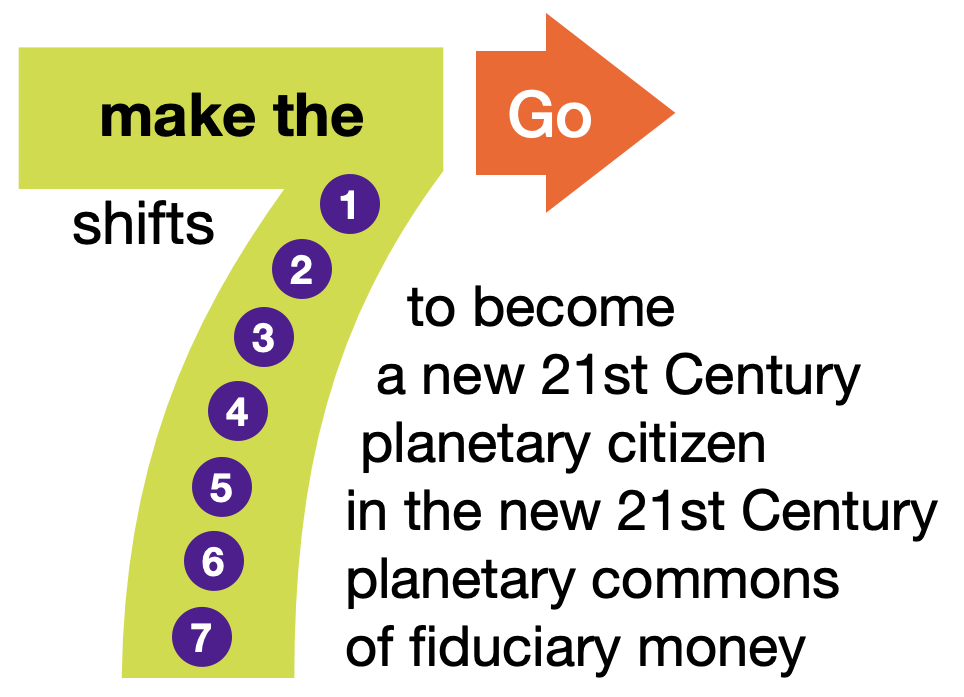

as new 21st Century planetary citizens in the new 21st Century planetary commons of Fiduciary Money

INCOME with IMPACT

The New Wealth of Nations: Pension Superpowers

– Nicholas Firzli, World Pensions Council

Technically, they can. Legally, they should.

an inquiry for insight and new learning that can inform innovations for evolving prosperous adaptations to the changing circumstances of our changing times in how society chooses how investments can, should and will be made to flow

- the capacity that pensions derive from their legally constituted character

- their legally constituted aims, of INCOME with IMPACT, and

- their accountability to The Hypothetical Prudent Steward of a Social Trust, as the legal avatar for our own shared common sense of what makes sense, as prudent people familiar with such matters, under the circumstances then prevailing

few things impact our shared future more than how investments flow

– Sociologist Michael A. McCarthy

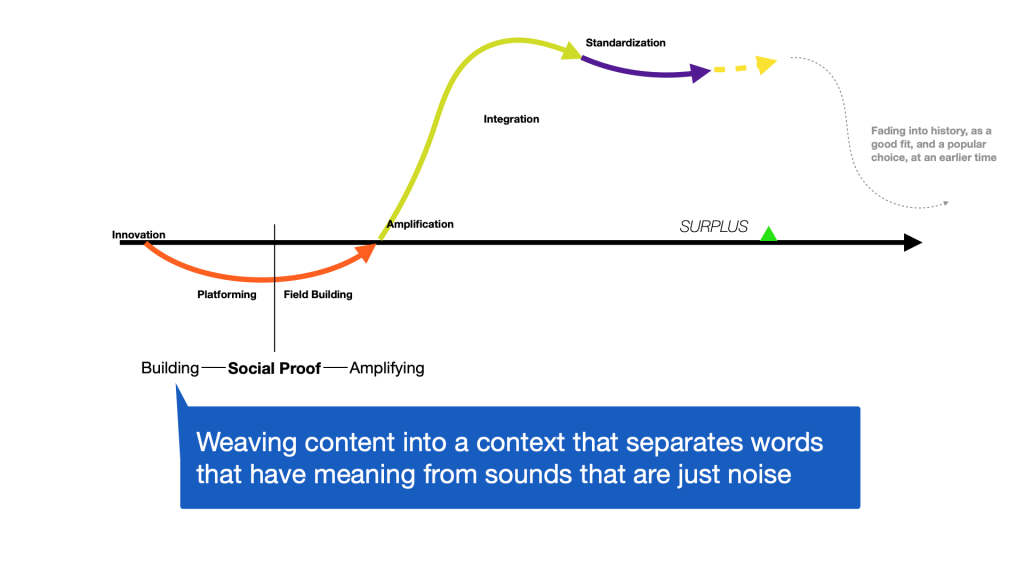

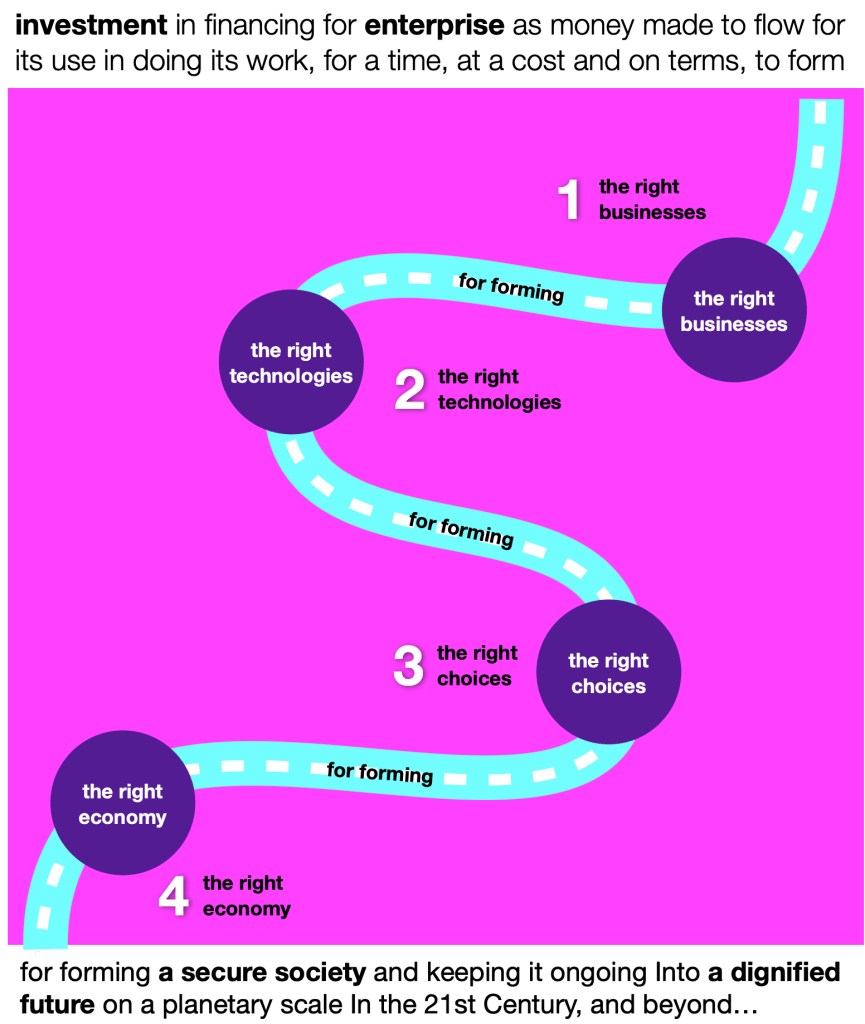

a new conversation at the vanguard of public discourse to adaptively evolve a new language and logic for talking about money as savings for investment in financing for enterprise

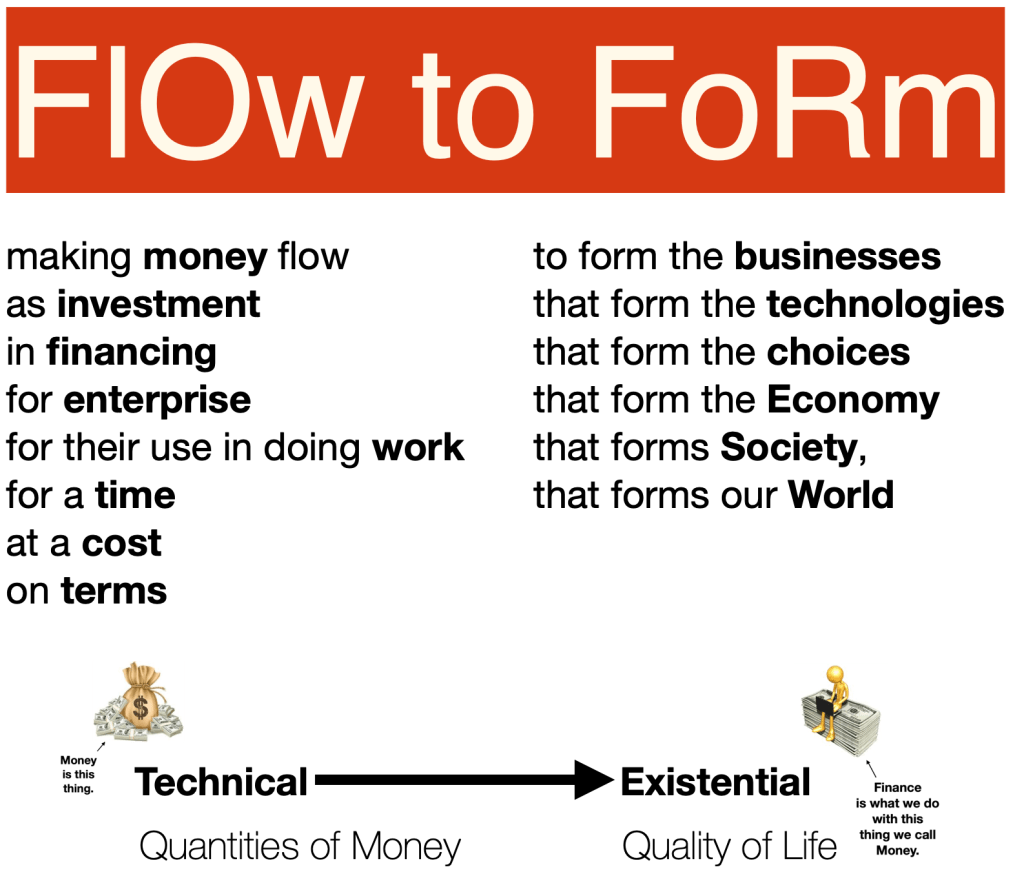

flowing money

set aside by others,

for a purpose,

for a time,

as savings

for investment

in financing

for enterprise,

for its use in doing it work

for a time

at a cost

on terms

that inform the businesses

that inform the technologies

that inform the choices

that inform the economy

that inform society

and our shared future

and present quality of life

How do you want business to be doing business?

re-injecting our own personal moral compasses back into the design of the shared, public world that we all build together, out of the world of Nature into which we each and all are born, that gives us each and all the choices from which we can each choose our own personal and private choices for how we live our own best lives, as best we can, under the circumstances then prevailing, personally and privately

A new social contract

for holding our institutions of agency and authority accountable for authenticity and integrity in their use of language and logic in their institutional exercises of their institutional authority/power true to their institutional agency/purpose/mission

beginning with the institutions of fiduciary finance

and the mid-century modern social innovation of the social trust for socially provisioning the social safety net of Workforce Pensions, as an evolutionary adaptation of the late 19th Century social innovation of the social trust for socially provisioning the social safety nets of Civil Society Endowments, as an evolutionary adaptation of the early 19th Century social innovation of the private trusts for private purposes of intergenerational wealth transfer

It’s a BIG story,

so let’s begin with a few key words

“The old world is dying and the new struggles to be born. Now is the time of monsters.”

- Antonio Gramsci

The old world is always dying.

The new always struggles to be born.

THERE ARE ALWAYS MONSTERS.

The question is,

What are the monsters of our time?

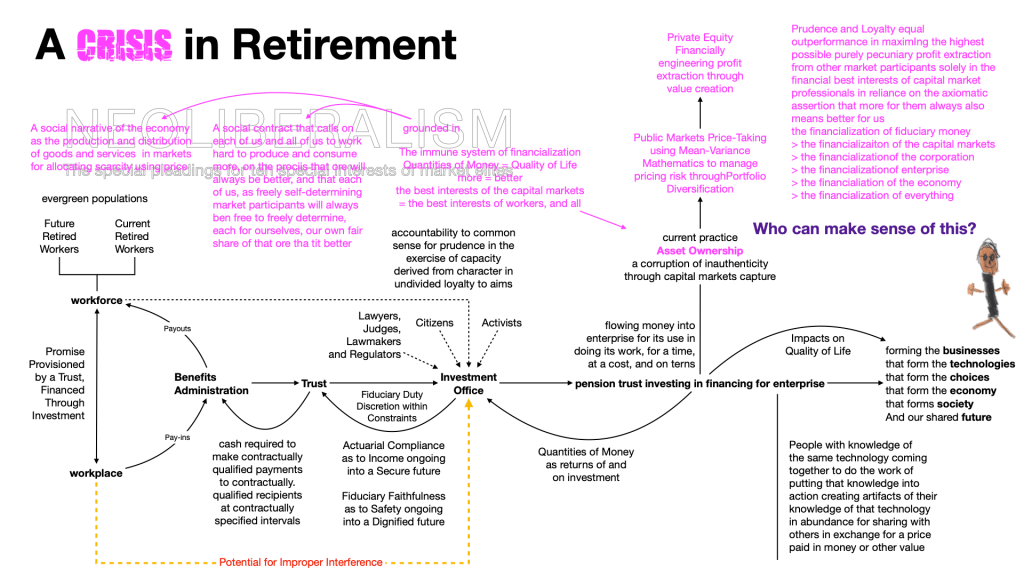

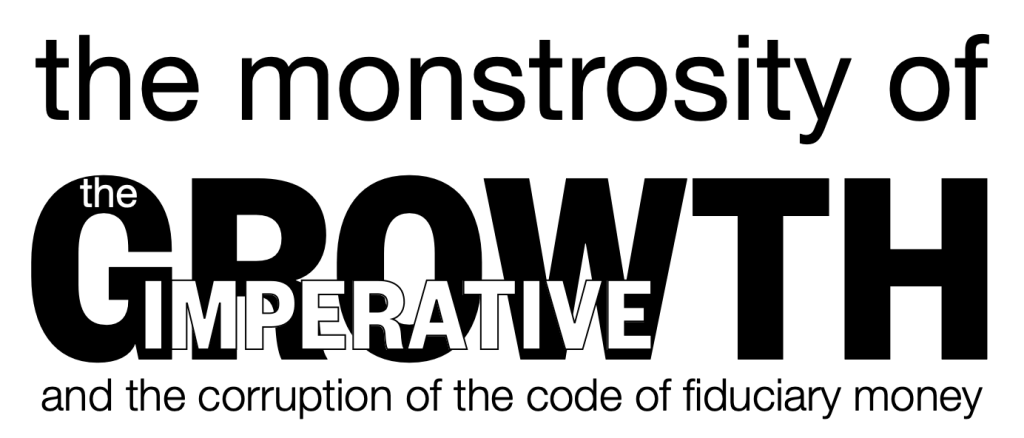

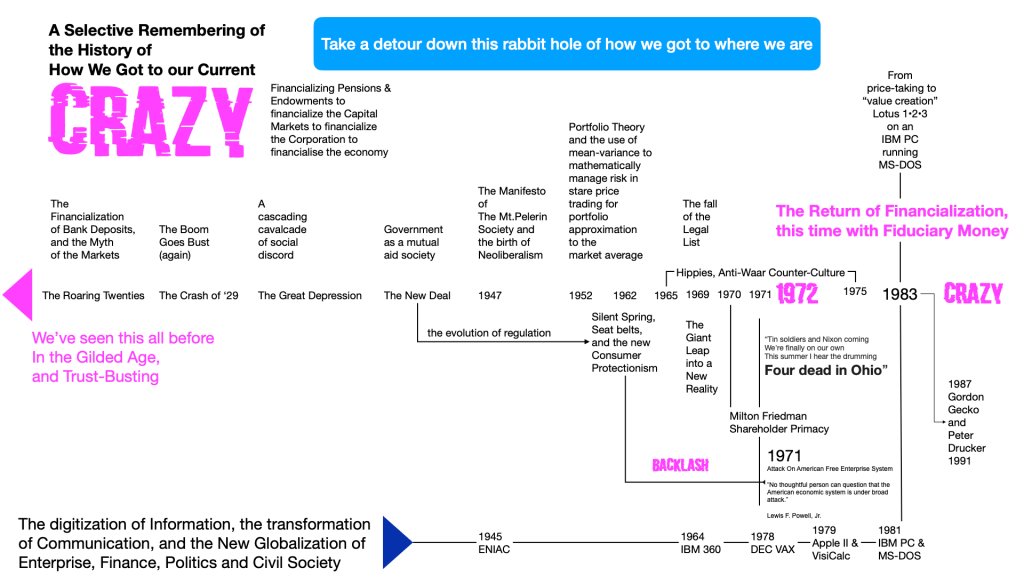

THE PATH OF OUR DESCENT INTO THE MONSTROSITY OF THE GROWTH IMPERATIVE

The Neoliberal Financialization of the Retirement Provision by Capital Markets Professionals

pushing the Prudent Investor (them) in, and the Prudence Person (us) out of interpreting the fiduciary duties of Pension & Endowments trust fiduciaries

replacing our common sense of what is right (for us)

with their expert knowledge of what is profitable (for them)

monopolizing control over the tens of trillions aggregated, collectively, worldwide, into social trusts

for socially providing the social safety nets of Workforce Pensions and Civil Society Endowments,

exercising that monopoly control to re-brand fiduciary stewards allocating aggregations of society’s shared savings in society’s shared interest as Asset Owners Allocating Assets Across Asset Classes,

and within classes selecting Asset Managers peer-benchmarked for outperformance in maximizing the highest possible purely pecuniary profit extraction from other market participants, using mean-variance mathematics for portfolio diversification to manage the risk of price-taking in the public, or financially engineering “value creation” in the private, alternative, capital markets, solely in the financial best interest of capital markets professionals, in reliance on the axiomatic assertion that more quantities of money for them will always also deliver a better quality of life to us, shutting down any consideration of the capacity of social trusts and cutting off all consideration of the future consequences of present choices

Join us in the field