few things impact our shared future more than how investments flow

American Sociologist Michael A. McCarthy

There are few words in the English language that so completely express the roiling tumult of conflict and contentiousness that is our human way of being in the world as this one word, “money”.

By design, money is inert. A simple measure that in itself says nothing about the value of what is being measured. A purely factual recording of a quantity.

But what is being measured, what is being quantified by money, is our human relationships with each other; our worth, as a human, to another human. And that is very dangerous territory, this territory of our worth to others. It is a symphony of rationality and and a cacophony emotion, of thinking and feeling, of thoughtfulness and thoughtlessness, every single note of which is sounded in some way through money.

Money does not exist in Nature. It is completely made up, a purely human invention. A thing that is no thing. Nothing.

And yet it is the most powerful thing in the whole of human experience. The root of all evil. And the best revenge.

We all use money. Some of us want it.

Some wish we did not have it. We all need it. Few really understand it. Because our stories about money are as confused and conflicted as the relationships that we energize through money.

To have money is to have power over others. To be without money is to be without power, forced to become indentured to others, or driven to rely on our wiles in an effort to beguile.

To be sure, there is an empirical residue of human emotion that manifests without money: the care and caring of mother for child, of family and friends; the animosities of rivals and hatred of enemies.

But mostly, people live together using money.

Given the importance of money to our human way of being together in society, it seems we should have a universally accepted and clinically precise language and vocabulary for talking about money, much the way we have a language for talking about language. We know what words are and how they are used. When they are being used correctly, and when they are being corrupted.

But we don’t know so much about money.

Why not?

In the prevailing popular narrative, money is pushed out of the frame, which centers on, and is monopolized by the Markets v Government Regulation debate (George Layoff and Gil Duran, FrameLab).

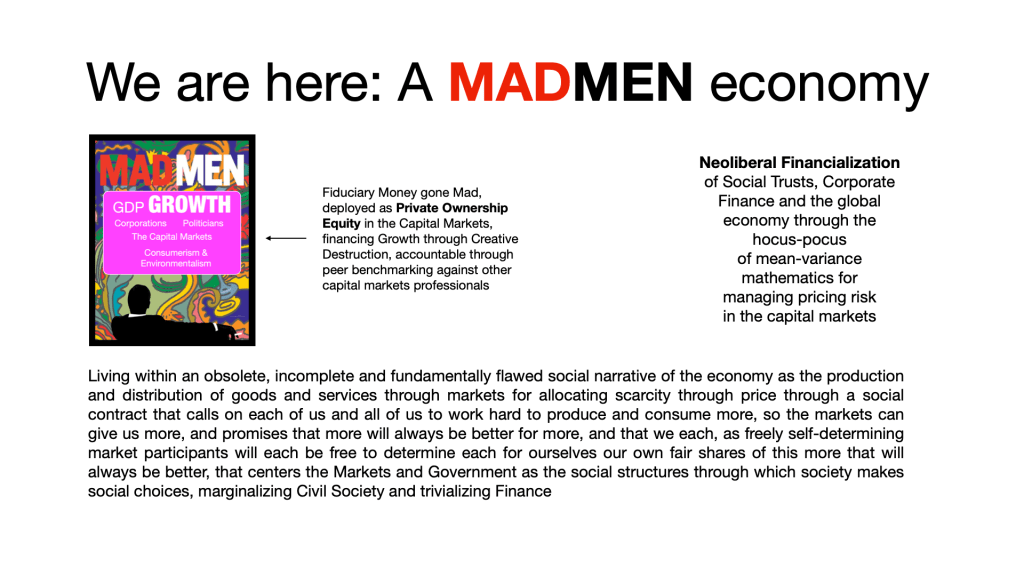

We are sold a story of the economy as the production and distribution of goods and services through markets for allocating scarcity using price, in which all choices are made by individuals each guided by our own personal moral compass, as participants in the markets, or by the force of law as wielded by government.

This social narrative and sociology of social choosing supports a social contract that calls on each of us and all of us to work hard to produce and consume more, so that the markets can give us more, on the promise that

- more will always be better; and

- that as freely self-determining market participants we will each always be free to freely determine, each for ourself, our own fair share of this more that is better.

This social contract is failing, because it is obsolete, incomplete and fundamentally flawed in at least three foundational premises.

- More is not always better. It depends. More of what? Better for whom? How? When? Where? What are the costs? What are the consequences? Who pays those costs? Who carries those consequences?

- People do not make choices in the markets. Money does. Or, rather, people make choices in the markets by spending money. And you have to have before you can spend. The more money you have, the more money you can make in the markets. The less money you have, the fewer choices you can make.

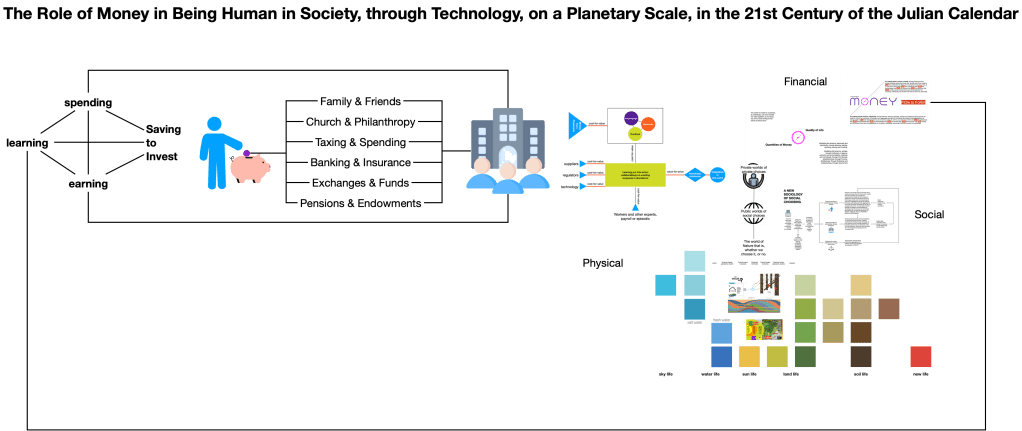

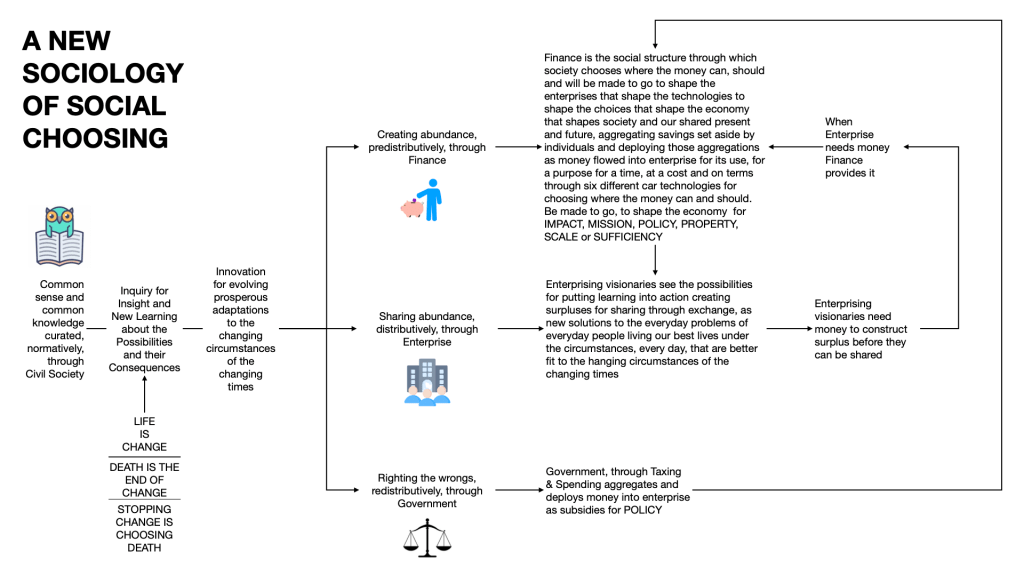

- Money matters. And Finance matters, as the institutions of agency, authority and accountability through which society chooses where the money can, should and will be made to flow into enterprise, for its use, for a purpose, for a time, at a cost and on terms, to form the enterprises that form the technologies that form the choices that form the economy the forms society that forms the possibilities for each of us and all of us to each live our own best lives, under the circumstances, as circumstances change, adapting and evolving to fit the changing times, as times change from time to time, and over time.

What this flawed and failing social contract is actually delivering is more that is more for fewer and fewer (Wealth and Power Concentration), leaving less that is less for the rest (Wealth dissipation and Power dissolution) in a cascading cavalcade of social discord that manifests as:

- Short-termism;

- Market elitism;

- Corporate gigantism;

- Financial system instability;

- Retirement security insecurity;

- Cultural and ecological unsustainability;

- Dark Money capture of politics and public discourse;

- Political divisiveness degenerating towards violence; and

- The inability of our shared common sense to hold our institutions of agency and authority accountable for authenticity and integrity in their institutional exercises of institutional powers true to their institutional purposes.

This flawed and failing social contract is supported by an obsolete social narrative of Growth that is derived from a 19th Century narrative of Progress through technological innovation and economies of scale into an infinitely receding geobiophysical frontier for endless exponential market expansion within a lived experience that Nature is vast, and we are not, so that we can take and take and take from Nature without ever reckoning with the consequences of our taking because those consequences would always disappear into the Frontier, reabsorbed back into Nature without consequence, to us.

By the opening decades of the 20th Century, the Frontier had stopped receding, and the narrative of Progress fell into a crisis that was resolved over the course of the 20th Century by reducing Progress to Growth as the simple numerical increase in undifferentiated transaction volumes, measured in prices paid in money, from one period of measurement to the next.

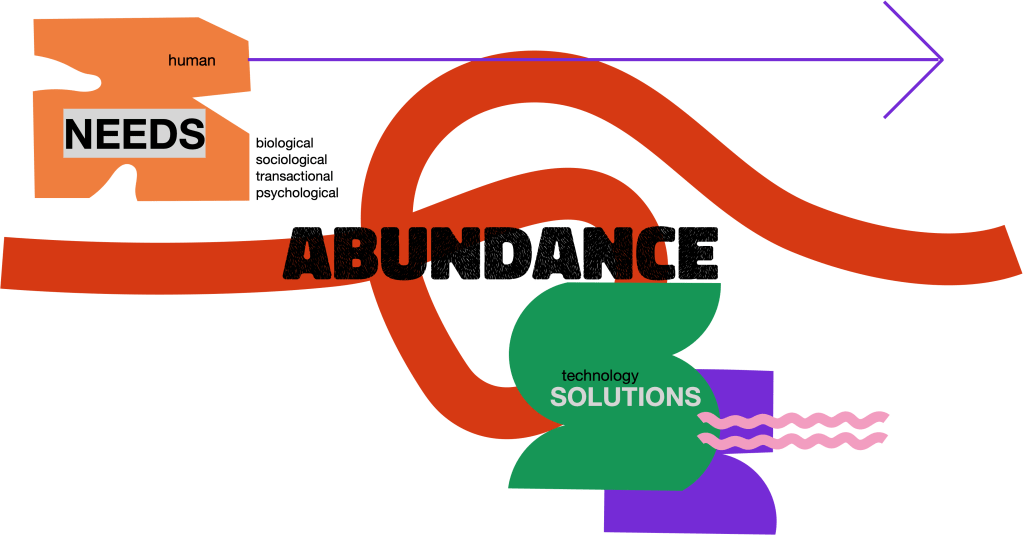

In the opening decades of the 21st Century, this narrative of Growth is now in crisis. Lived experience is showing us that while Nature is still vast, so, too, now, are we. We can no longer take from Nature without reckoning with the consequences of our taking, because there will be consequences, and those consequences will not just disappear. We can no longer continue to replace careful and caring consideration of the connections between quantities of money and quality of life with an axiomatic assertion that more money (for some) will alway mean a better life (for all).

We need a new social narrative of being human on a planetary scale, in the 21st Century.

And the right new social narrative has to articulate for us the connections between quantities of money and quality of life in a new sociology of social choosing for being human using money on a planetary scale, in the 21st Century, and beyond…

Let’s start with you.

…and your own personal and private world that you make for yourself in which to live your own best life.

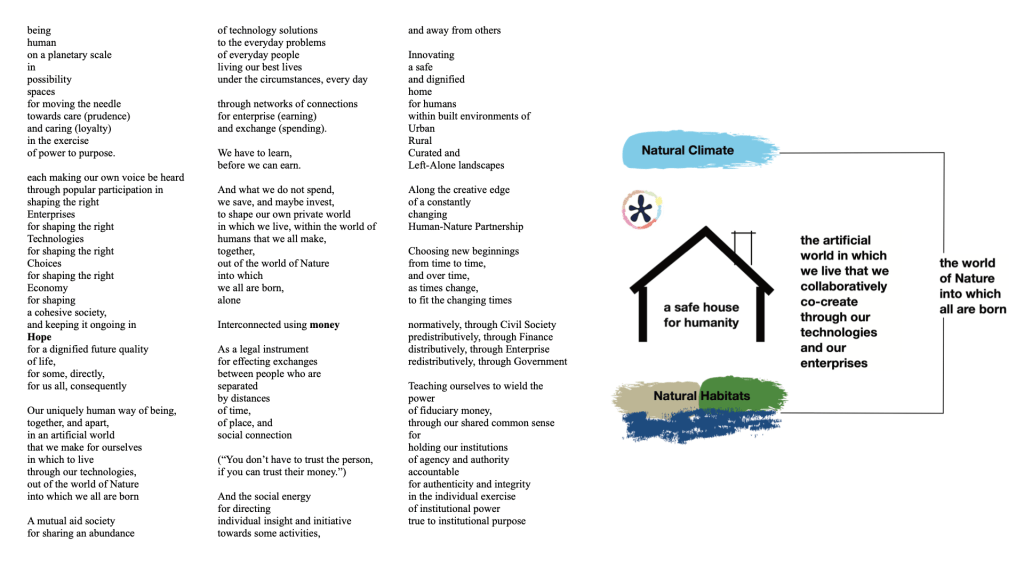

You make this private world out of the shared public world that we all make together for living our best lives in society, through economy, using money.

We make this money-made shared world out of the world of Nature into which we all are born, and on which we each depend for our own presence, and ongoingness.

You make your place in our shared world using money.

We all do.

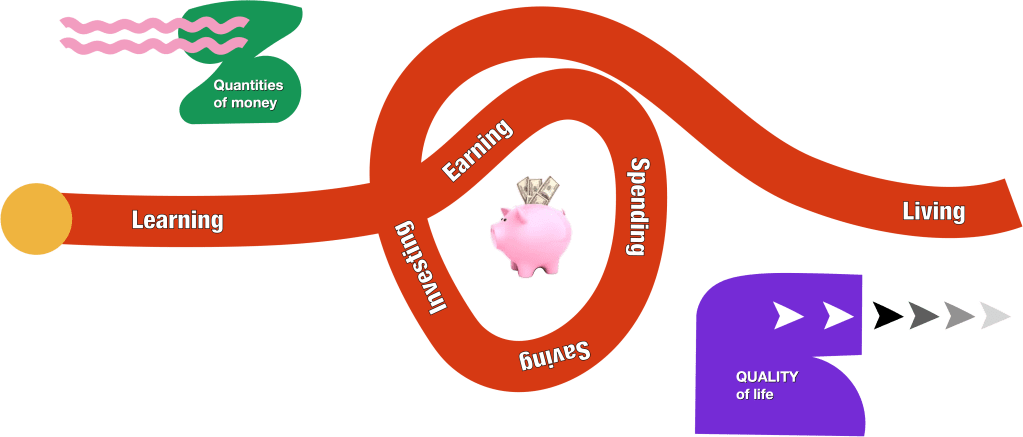

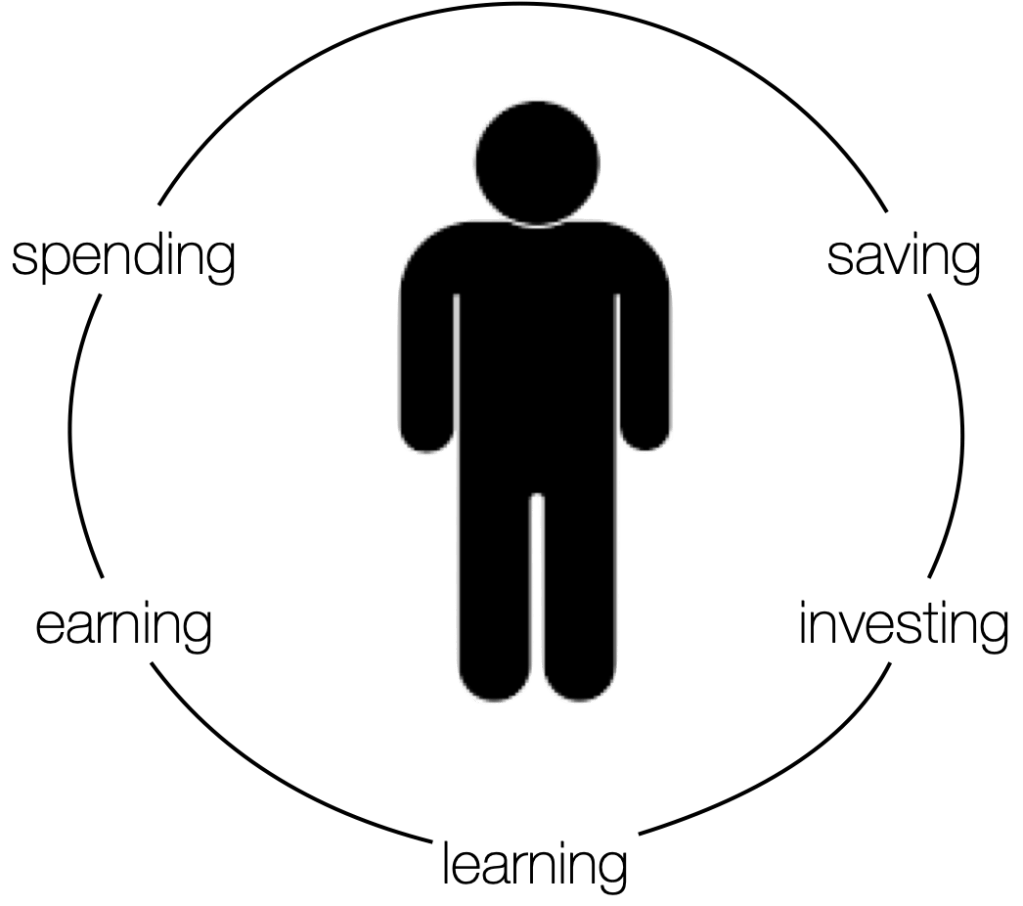

We learn so we can earn. We earn so we can spend. What we don’t spend, we save. What we save, we invest.

What we invest in is new learning that can empower new earning that can empower new spending and new saving and more new learning, in a recurring cycle

- that forms our own personal and private worlds in which we live our own best lives,

- out of the social world in which we all live,

- that we form together,

- through the work of putting technology, as knowledge of how the world about us works, in some specific way, and how we can take the world about us as we find it an change it to be more a way we choose to make it, in that way, into action

- constructing an abundance of technology solutions for taking the world about us as we find it and changing it to be more a way we choose to make it

- to supply ourselves with choices of solutions to the everyday problems of everyday people living our best lives under the circumstances, as circumstances change from time to time, and over time, everyday,

- through inquiry for insight and new learning that can inform innovation for evolving prosperous adaptations to life’s constant changes

- through networks of connections for enterprise and exchange

- using money as a legal instrument for effecting transactions between people separated by distances of time, place and social connection, that is also the social energy through which society directs our individual insight and initiative towards some activities, and away from others,

- to construct and episodically reconstruct a safe and dignified house for humanity

- within built environments of Urban, Rural, Curated and Left-Alone landscapes

- along the creative edge of a constantly changing and adaptively evolving human partnership with each other, and with Nature,

- choosing new beginnings from time to time and over time to fit the changing times,

- through institutions of agency, authority and accountability,

- creatively, through Ciivl Society,

- predistributively, through Finance,

- distributively, through Enterprise and

- redistributively, through Government

As we expand our sociology of social choosing to bring Finance into the frame, we return to the problem of money, to see that the problem with money is a problem of language, and logic, of words and their meaning, and of the limitations of the cultural framework through which we take in the possibilities, and their consequences, for how we can choose to shape our private worlds in which we live, as individuals, out of the public world that we choose to shape together out of the world of Nature into which we all are born, and on which we all depend for our own ongoingness.

As we have seen, the cultural framework for seeing how the flow of money forms the possibilities for living a quality of life that we inherited from the closing decades of the 20th Century is obsolete, incomplete, and fundamentally flawed.

We need a new framework, through which we can evolve a new vocabulary and a new language for expressing the logic of money through which we shape the world of humans in which we live, socially and individually, our to the world of Nature into which we each and all are born.