Crisis of social discord on a planetary scale

- Inaction on climate, and biodiversity.

- Inequity in the economy, within and across jurisdictional boundaries of politics and culture

- Financial system fragility

- Purposeless business

- Political divisiveness

- The problem of pensions, and civil society

Many voices speak of a polycrisis. A web of interconnected and interrelated social failings on a planetary scale, across the generations, that defies incremental and local interventions by politicians and corporations.

Science tells us that we are altering through our technologies planetary patterns climate and biodiversity that will change the habitats on earth catastrophic to our continued human habitation of this planet.

And nobody is really doing anything about any of it.

Politicians talk.

Corporations disclose.

Finance dissembles.

Civil Society cries out in protest, against the inaction, and now, increasingly, against calls for action.

Nothing really changes.

Because we are in crisis. We don’t really know what has gone wrong. So we can’t figure out how to take action.

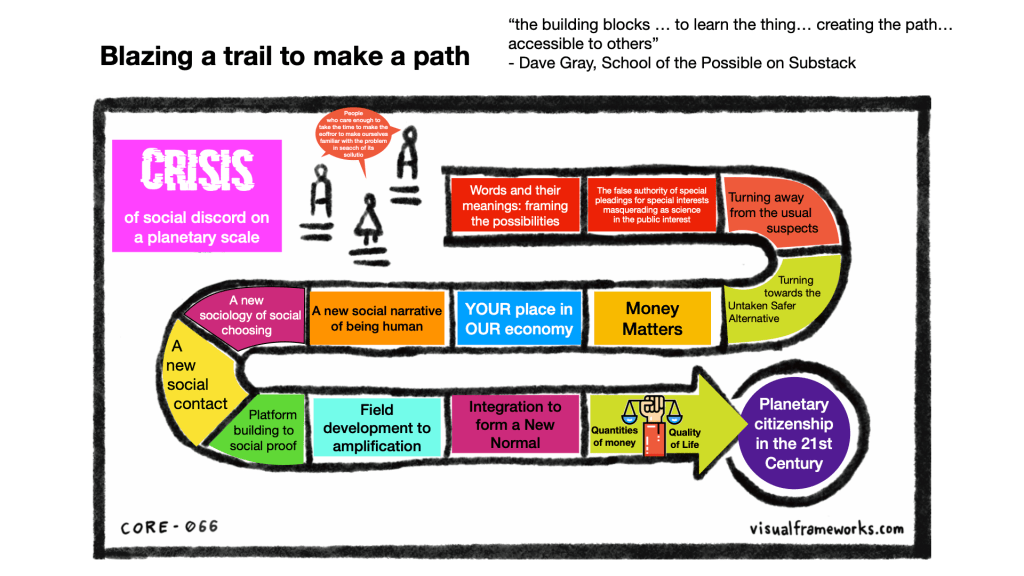

We need to get radical, in the Latin sense of “going to the root”, to rethink how we got to where we are now, and blaze a new trail, for getting to where we want to be, now.

Trail blazing is the work of Trail Blazers, people who are able and willing to create and hold space for open-ended inquiry unconstrained by the conventions of custom and practice, “with a willing suspension of disbelief”, after Samuel Taylor Coleridge, in search of insight and new learning that can inform the innovations we actually need to evolve prosperous adaptations to the circumstances now prevailing

People who care enough to take the time to make the effort to make ourselves familiar with such matters under the circumstances then prevailing

Our subject is us. Humans living together, in society, through economy, on a planetary scale in the 21st Century of the Julian calendar. What do we need to know to live together, well, at this scale, and in this time?

This is the trail that we must blaze, and to blaze this trail we need to come together as people who care enough about living well at planetary scale in the 21st Century to be motivated to take the time to make the effort to make ourselves familiar with our capacity, as humans, that we derive from our character as social users of technology, with the aim of taking the world about us as we find it, and changing it to be more a way we choose to make, adaptively evolving new beginnings to fit the changing circumstances then prevailing, from time to time, and over time, in place and time.

Words and their meanings: framing the possibilities

Our medium is words. Language and vocabulary through which we frame a shared perception of the possibilities for the choices we can choose, and a common set of expectations for the consequences that will flow from those possible choices.

Choice, and consequence. That is the subject of our conversation, to expand our frame, to see new possibilities, and make new choices, guided by new expectations for what the consequences of those choices will be, for ourselves and our posterity.

The false authority of special pleadings for special interests masquerading as science

in the public interest

We can see, once we teach ourselves the power of framing, that all framing is the special pleading of the special interests of people with a vested interest in defining the public interest in line with their own private gain.

It can be difficult to see the special interests that are being served by the popular framing prevailing in the given moment.

It helps to look at previous framings that were popular in prior times, where it is easier to see how those framings advanced the special interests of some vested interest.

It is easy to see, for instance, how the Divine Right of Kings, or Royal Absolutism, made popular in 16th Century Europe, advanced the interests of the Royal Household against accountability to the Lesser Nobility, the Church or the People.

Similarly, Mercantilism in Britain in the 17th Century can be seen as advancing the special interests of the British East India Company.

Today, our currently popular framing of the Great Markets vs. Government Regulation Debate (credit: George Lakoff and Gil Duran, via FrameLabs on Substack), which some call Neoliberalism, or Market Absolutism, or the Friedman Doctrine, is the special pleading for the special interests of capital markets professionals in centering the capital markets as the dominant and domineering institution of agency and authority (without accountability – a common feature of all absolutist philosophies) for making choices for society about technology and enterprise and wealth and power, rhetorically in the name of freedom for all, but substantively in support of freedom of the few to lord it over the many.

Turning away from the usual suspects

Climate is a crisis that reveals the truth about the limitations of Corporations and Politicians as agents of institutions for making social choices through Price and Policy to choose the right new beginnings for humanity to evolve prosperous adaptations to the changing circumstances of being planetary in the 21st Century, and beyond.

To discover that truth, however, we first have to expand the prevailing popular framing through which we see climate as a crisis. That current framing shows us a problem with carbon emissions. That framing shows us a carbon pollution problem.

That calls for carbon pollution control solutions: popular protest to demand that our politicians make laws that make corporations stop polluting, and clean up their mess.

If we expand the framing of the climate situation, we can see that, yes, carbon density in earth’s sky chemistry is a link in a chain of choice and consequence, that begins with our choice to supply energy to our economy by extracting what might be poetically described as “fossilized sunlight” used to chemically bind carbon atoms to other atoms in hydrocarbon molecules formed by applying pressure over time to carbohydrates formed through photosynthesis, which can be released as heat and light, for direct use, or transformed into steam for process heat and as a motive force that can be used directly or to generate electricity for onward use as a motive force or a source of heat or light.

Extracting energy from hydrocarbons, through combustion, releases carbon atoms back into earth’s sky chemistry, increasing carbon density which reduces rates of radiant cooling of the earth, altering the balance of solar radiation increasing overall average temperatures of air, land and water on earth, driving changes in the large scale, long term patterns of wind, weather and ocean currents that we call climate, diminishing over time the habitats on earth that we humans can inhabit, with catastrophic consequences to our own longevity, as people living on earth.

We cannot interrupt that chain through increased photosynthesis/carbon offsets because the additional rates of photosynthesis that would be required to take up that much additional carbon in a virtuous cycle of photoshynthetic uptake and respiratory release would require the very changes in earth’s habitat that we are trying to interdict.

And we cannot interrupt that chain through mechanical sequestration of carbon atoms, in part because of the sheer scale of the problem and in part because of the fundamentally fugitive nature of carbon gases, that always find their way back into earth’s atmosphere if they are not durably bound into hydrocarbon molecules, bonds that took millennia to form, initially, and would take additional millennia to re-form.

Which is why COP28 was correct when it concluded that we must be “transitioning away from fossil fuels (energy extraction from hydrocarbons), in a just, orderly and equitable manner”. Since COP28, however, focus has sifted away from the movement, and towards the manner, as Climate Finance has become the hot new topic in climate action, focusing on moving money into efforts to mitigate damage and otherwise adapt to changing climate.

This is a distraction, not a solution. Just as managing our personal and individual carbon footprint is a distraction, and carbon offsetting and campaigns of Net-Zero, and of divestment, and of shareholder engagement/activism are all distractions.

None of these are solutions for “transitioning away from fissile fuels in just, orderly and equitable manner”.

The only solution is a strategy for hospicing hydrocarbons companies while we rapidly redesign and reconstruct our global energy technology supply network to be purpose-rebuilt for energy suitability complete with habitat longevity and social equity on a planetary scale in the 21st Century and beyond.

Politicians cannot execute that hospicing, or engineer that reconstruction. They do not have the scale. They are constrained by jurisdictional boundaries, and by competing and conflicting national priorities as expressed through the vagaries of election cycles and electoral politics.

Corporations cannot execute that hospicing, or engineer that reconstruction. That is not their mission.

The corporation is a financing agreement between enterprise and the capital markets, a primary tenet of which is that the corporation must grow it share price through creative destruction to support volatility and growth in market clearing prices for it shares, that the markets must deliver to market participants so that buyers will buy so that sellers can sell, so that market professionals can extract fees and profits from transactions between buyers and sellers. Hospicing is not growth. Destruction is not orderly. Or equitable. Or just.

We have to find another way.

But within the Neoliberal world view, there is no other way.

So we need to find another way to view the world, that will show us another way to take action, on climate, and other such things.

Turning towards the Untaken Safer Alternative

The problem is technical.

The consequences are existential.

Which means we have to engage at a technical level, in order to navigate the existential consequences.

Which does not mean we all have to become experts in the technical. Only that those of us who care do need to make ourselves familiar with the technical sufficient to engage with the experts in navigating the existential.

Which means we have to take the time to make the effort to make ourselves familiar with how the capital markets work, sufficient to see why it is that they are not working, so that we can also see our way to a new strategy that will work.

That’s a BIG story of how the code of the capital markets has become corrupted, and how the corruption of the capital markets has corrupted the corporation, and the corruption of the corporation has corrupted Enterprise, and how the corruption of Enterprise has corrupted Politics, and how the corruption of Politics is corrupting Civil Society, leaving us trapped in the correct execution of corrupted codes that cannot be rectified by social shaming or policy intervention.

Except in one place.

At the source of the corruption.

Which is the law of fiduciary duty.Which has become bent by the special pleading for the special interests of capital markets professionals in exercising monopoly control over the tens of trillions in society’s shared savings that have been aggregated since the early 20th Century into social trusts for the social purposes of socially provisioning the social safety nets of Workforce Pensions and Civil Society Endowments.

Which needs to be straightened out.Which requires policy intervention, to reboot the system, to reset the code, and purge the corruption.

Which requires social activism by people who care, to demand a reboot, and a reset.

That social activism begins with people who care taking the time to make the effort to make ourselves familiar with the capacity that these social trusts derive from their legally constituted purpose, and the possibilities for exercising that capacity true to their legally constituted aims, under the circumstances now prevailing.

Because the aims of the capital markets, and the aims of social trusts are not the same aims, even though the special pleadings for the special interests of capital markets professionals works to convince us that they are.

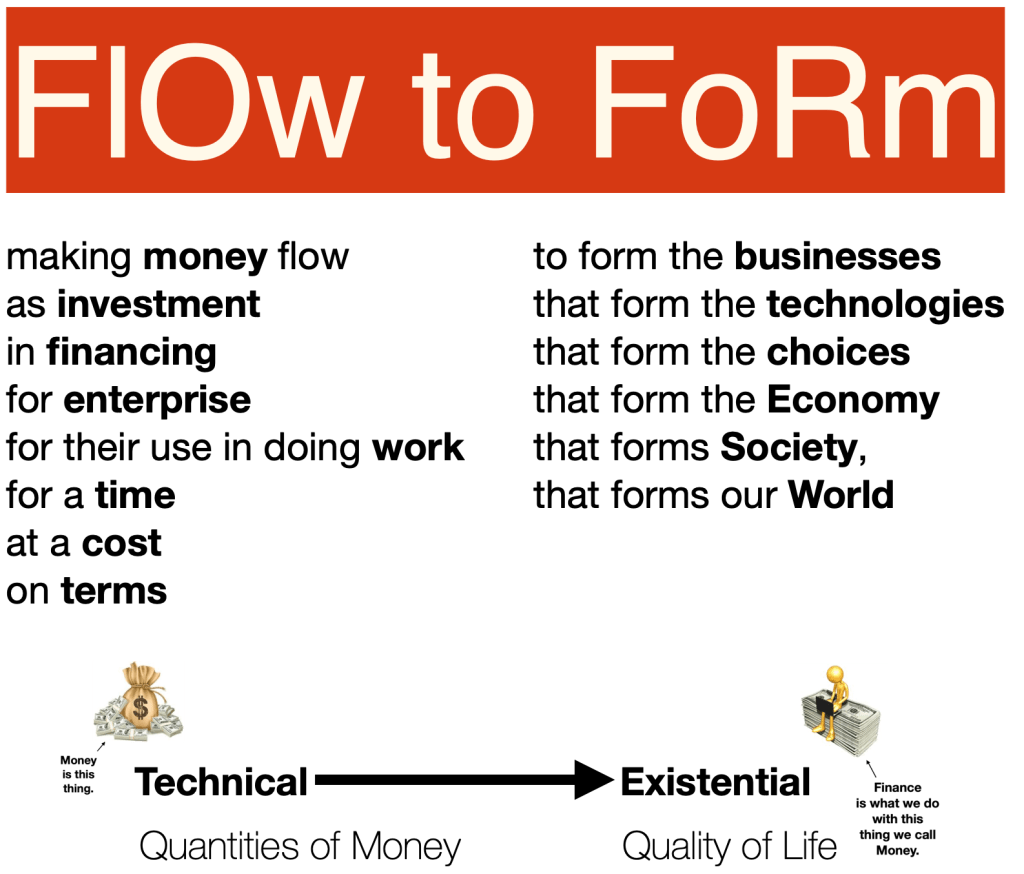

Money Matters

There is a logical inconsistency at the core of Neoliberalism that leaves those of us who are not acolytes of that ontology confused, and thinking that the problem is us.Neoliberalism asserts that the markets are the best way for society to make social choices, because we each are free to make the choices we feel are best for us for ourselves (nobody else can choose for us, or make us choose something we don’t want). But choices are made in the markets based on price. And prices are paid in money. And if you don’t have the money to pay the price, you cannot make that choice, no matter how much you feel it would be the best choice for you, if you were actually free to choose for yourself.In the markets, money matters.At the same time, Neoliberalism wants us to believe that money doesn’t matter. Only individual merit, and personal morality. If you are moral and have merit, you will prosper through the markets. if you do not prosper through the markets, then you must be deficient in some way, as to merit, or morals, or both.So, according to Neoliberalism, money both matters and doesn’t matter.Which leaves many of us scratching our head, and asking, Whaaat???

YOUR place in OUR economy

Let’s go back to the facts of lived experience, beginning with the experience we know best, which is our own personal and individual lived experience.

We each spend money to make choices in the markets by paying the price in an exchange with enterprise.

We earn the money that we spend by contributing to the work of enterprise in putting learning into action creating surpluses for sharing with others in exchange for a price.

We save money we control, but do not choose to spend.

We invest money we save in financing for enterprise.

We learn in order to earn, earn in order to spend, save what we do not spend, and invest what we save.

These are the points of our participation in the economy, through which we each construct for ourselves, personally and privately, a personal and private world in which to live our own best lives, as best we can under the circumstances then prevailing, personally and privately, out of the shared and public world of technology solutions to the every day problems of everyday people living our own best lives as best we can under the circumstances then prevailing, every day, that we all construct together, through enterprise and exchange, using money, out of the world of Nature into which we each and all are born.

A new social narrative of being human

Starting from the world that we make for ourselves, personally and privately, out of the world we make together, socially and publicly, out of the world of Nature into which we each and all are born shows us a new narrative of the economy as:

- a mutual aid society for sharing an abundance of technology solutions to the everyday problems of everyday people living our best lives, everyday

- through networks of connections for enterprise and exchange

- using money as a legal instrument for effecting transactions between people who are separated by distances of time, place and social connection (“you don’t have to trust the person, if you can trust their money”), that is also the social energy that directs our individual insights and initiative towards some activities (where there is money to be made) and away from others (where you cannot make any money)

- to construct and episodically de-construct to reconstruct, a safe and dignified house for humanity

- within built environments of Urban, Rural, Curated and Left-Alone landscapes

- along the creative edge of a constantly changing, adapting and evolving Human partnership with Nature

- choosing new beginnings from time to time, to fit the changing circumstances of the changing times

- through inquiry for insight and new learning that can inform innovation

- making new choices more popular as better fit to the circumstances then prevailing

- while letting previously popular choices fade into history, as a good fit to circumstance that prevailed at an earlier time

- driving the flourish and fade of the social contract between enterprise and popular choice that is the true engine of our prosperity and the real story of our human history.

A new sociology of social choosing

We choose our new beginnings, socially, through institutions of agency, authority and accountability

- inquisitively, through Civil Society for curating knowledge and culture;

- predistributively, through Finance for making money flow, from savers into enterprise;

- distributively, through Enterprise for sharing surplus for a price; and

- redistributively, through Politics for mobilizing the public fisc and public force, to right the wrongs of Finance and Enterprise (and conflicts between individuals over person and property) in accordance with the curated precepts and principles of Civil Society and the population more generally.

A new social contact

This new sociology of social choosing through institutions of Civil Society, Finance, Enterprise and Politics – that expands upon, and replaces, the incomplete and fundamentally flawed Neoliberal sociology of social choosing through Price or Policy in the Great Markets vs. Government Regulation (False) Debate – requires and informs a new social contract within humanity on a planetary scale for holding our institutions of agency and authority accountable for authenticity and integrity in their institutional exercises of authority/power true to their institutional agency/purpose/mission.

The inflection point for evolving this new social contract is the Mid-Century Modern social innovation of the social trust for provisioning the social safety net of Workforce Pensions as mutual aid societies designed according to the laws of actuarial science for averaging the actual cost of making contractually calculated payments to contractually qualified recipients at contractually specified intervals, to assure income security in a dignified retirement to evergreen populations of current and future retired workers.

Over the course of the 20th Century, society aggregated tens of trillions into these social trusts, giving the trustees who control those trusts discretion over vast amounts of money aggregated for a statistically programmed purpose over what is for all intents and purposes, forever time, constrained only by fiduciary duties of prudence in their exercise of the capacity they derive from their legally constituted character of vast size, programmatic purpose and forever time, in undivided loyalty to their legally constituted aims, to invest money for income as well as safety to assure income security in a dignified future to some, directly, as a private benefit, and to us all, consequently, as a public good, supported by us, as citizens, through a social and legal license to be, institutionally, and subsidized by us, as taxpayers, through tax exemptions on contributions and investment earnings, accountable to our common sense, as prudent people familiar with such matters, under the circumstances then prevailing, of prudence and loyalty.

This brings us to the pivotal question for our time, the answer to which opens up vast new possibilities for being human on a planetary scale in the 21st Century as new 21st Century planetary citizens in a new 21st Century planetary commons of Fiduciary Money:

What is the capacity that pension trusts derive, under the circumstances now prevailing, from their legally constituted character of vast size, programmatic purpose and forever time?

The conventional (Neoliberal) answer is that they have the power to own assets that are bought and sold at market clearing prices in the markets for maintaining market clearing prices on such assets, to extract profit as gain on sale, as Asset Owners Allocating Assets Across Asset Classes, and within classes, selecting Asset Managers peer-benchmarked by Consultants for outperformance in maximizing the highest possible purely pecuniary profit extraction, through price-taking in the public capital markets, managing the risk of missing the market through portfolio diversification using mean-variance mathematics and Modern Portfolio Theory, or through financially engineering “value creation” in the private, alternative capital markets, solely in the financial best interests of capital markets professionals, in reliance on the axiomatic assertion that more fees and profits for capital markets professionals also always mean a better quality of life for us, as the special pleading for the special interests of capital markets professionals in extracting fees and profits from markets engorged with these tens of trillions in forever money.

The innovative new answer is that pension trusts derive from their capacity of vast size, programmatic purpose and forever time the power to financially engineer equity paybacks to an actuarial/fiduciary cost of money, plus opportunistic upside, from enterprise cash flows that are prioritized by contract for:

- suitability of the technology to the circumstances then prevailing

- longevity of the social contact between the enterprise and popular choice and

- fairness in how the business does business across all six vectors of fairness in business, including:

- fairness to suppliers (Fair Trade)

- fairness to communities, of place and of interest (Fair Engagement)

- fairness to Nature, Society and our shared Future (Fair Reckoning)

- fairness to workers, and in the workplace (Fair Working)

- fairness to customers, and competitors (Fair Dealing)

- fairness to the savers whose savings are the original and ultimate source of the money made to flow into enterprise by its financiers (Fair Sharing).

There is not much we can say, as prudent people familiar with such matters, about investment policies and investment choices made in furtherance of those policies, for extracting profits from the capital markets. That is a business for experts with their fingers on the pulse of the markets, and we pretty much have to leave it to those experts.

There is a lot we can say, as prudent people familiar with such matters, about investment policies and practices for financially engineering equity paybacks for actuarial compliance as to income and fiduciary faithfulness as to safety, through technological suitability, enterprise longevity and, especially, fairness in how business does business, replacing the Friedman Doctrine that “the social responsibility of business is to increase its profits” with fiduciary support for business doing business in fairness sufficient to its own longevity and fairness in the economy sufficient to social cohesion and humanity’s longevity.

This innovation in fiduciary financing using equity paybacks informs the innovation of Fiduciary Activism, for popular participation as prudent people familiar with such matters, under the circumstances then prevailing, in holding social trust fiduciaries accountable for their exercise of discretion in the investment of money within the constraints, of prudence in their exercise of capacity derived from their legally constituted character, and of undivided loyalty to their legally constituted aims, as new 21st Century planetary citizens in a new 21st Century planetary commons of Fiduciary Money allocated to enterprise using equity paybacks.

Platform building to social proof

The first step in making these innovations in fiduciary financing, and the innovation of Fiduciary Activism, popular with people, generally, is building a platform for promoting the use of equity paybacks by Pensions & Endowments that provides social proof that

- equity paybacks are both possible and practical; and

- popular participation in holding Pension & Endowments trusts accountable for allocating money to enterprise through equity paybacks financially engineered for INCOME with IMPACT is also both possible and practical.

The currently common investment theses of Private Equity and Real Estate Partnerships demonstrate that Pensions & Endowments can financially engineer financing agreements with enterprise, directly, because that is what they are already doing, as allocators of their aggregations to Private Equity and Real Estate Partnerships.

The Canadian Model of Private Equity and Real Estate demonstrates that this financial engineering does not have to be outsourced to third party professionals, but can be done by Pensions & Endowments, directly.

Again, because they are already doing so.

Private Equity, of course, remains a variation on the capital markets investment thesis of equity as ownership for profit extraction, which bends the arc of fiduciary loyalty away from income and safety to assure security with dignity, and towards the sale, and the selling price.

Real Estate, however, pioneered the equity payback to a agreed cost of money, plus opportunistic upside, from enterprise cash flows prioritized by contract to align with the values that the financing institution values.

It’s a small step to:

- define the agreed cost of money for Pensions as the amount specified by the actuaries in their design of the trust as sufficient to the longevity of that trust, and its ongoing ability to fund contractually calculated payments to contractually qualified recipients at contractually specified intervals to assure income security in a dignified retirement to evergreen populations of current and future retired workers; and

- define the values that the financing institution values as suitability of the technology under the circumstances then prevailing, longevity of the social contract between the enterprise and popular choices, and fairness in how the business does business across all six sectors of fairness in business, for INCOME with IMPACT.

Social proof of popular participation in social choosing, directly, is provided through Citizens Assemblies and the movement towards Deliberative Democracy in politics and the exercise of the public fisc and public force for making laws within communities.

It will be a small step to adapt the proven practices and protocols of deliberation in governmental policy to deliberation on investment policy for Pension & Endowments fiduciaries exercising discretion within constraints in their financial engineering of equity paybacks for INCOME with IMPACT, after we complete the giant leap of facilitating learning by people who care enough to take the time to make the effort to make ourselves familiar with these matters of capacity to financially engineer equity paybacks that Pensions & Endowments derive from their legally constituted character of vast size, programmatic purpose and forever time, and their legally constituted aims, to invest money for income as well as safety to assure income security in a dignified future for some, directly, as a private benefit, and for us all, consequently, as a public good.

Field development to amplification

The next step is to catalyze a core network of professionals skilled in financially engineering equity paybacks and communities of people who care enough to participate in deliberations on INCOME with IMPACT to amplify these innovations in fiduciary finance and this innovation of Fiduciary Activism, to mobilize the shift of Fiduciary Money out of the non-fiduciary investment theses of equity as ownership for profit extraction, as the special pleading of the special intreats of capital markets professionals, and into equity as stewardship of INCOME with IMPACT, as the special pleading for the special interests of new 21st Century planetary citizens in this new 12st Century planetary commons of Equity Paybacks of Fiduciary Money.

Integration to form a New Normal

As a critical mass of professional and popular participation in Equity Paybacks and Deliberative Accountability accumulates, this new innovation in fiduciary finance and this new innovation of Fiduciary Activism will become integrated into common knowledge and common practice until social trust investing through Equity Paybacks and fiduciary accountability for INCOME with IMPACT to 21st Century planetary citizens in the 21st Century planetary commons of Equity Paybacks of Fiduciary Money through deliberative processes become the new norm of how it is done.

Balancing Quantities of Money and Quality of Life through Planetary citizenship in the 21st Century

In this new normal of 21st Century planetary citizenship in the 21st Century planetary commons of Equity Paybacks of Fiduciary Money for INCOME with IMPACT sufficient to social longevity, the existential connection between Quantities of Money and Quality of Life that has been severed by Neoliberal, and replaced with the axiomatic assertion that more (for them) = better (for us), as the special pleading for the special interests of capital markets professionals, will be remade, so that:

- the right money

- will be made to flow

- in the right way

- into the right enterprises

- for doing the right work

- in the right way

- for the right time

- at the right cost

- on the right terms

- to inform the right businesses

- for informing the right technologies

- for informing the right choices

- for informing the right economy

- for informing the right society

- for informing the right future

- for the circumstances then prevailing