This website is a passion project of Tim MacDonald, philosopher, lawyer and theorist of being human, together and apart, in society, through economy, using money on a planetary scale in the 21st Century, and beyond…

I am a Legal and Financial Theorist with a passion for the untapped capacity of pensions to financially engineer the right economy for a new planetary humanity in the 21st Century. I am inspired by a vision of a new 21st Century planetary citizenship in ongoing conversation with the Hypothetical Prudent Steward of a Social Trust, as the articulation of the common sense of reasonable people familiar with such matters, of prudence in the exercise of capacity in undivided loyalty to aims, under the circumstances then prevailing.

Self-described as a technician with a technical answer to a technical question, I draw on 30 years of “in the trenches” learning about law and finance and money and enterprise and the economy and society and our shared future, to call for a New Social Contract to be agreed within a New Sociology of Choosing and a new Social Narrative of what is right for our times as planetary humans in the 21st Century, and beyond…

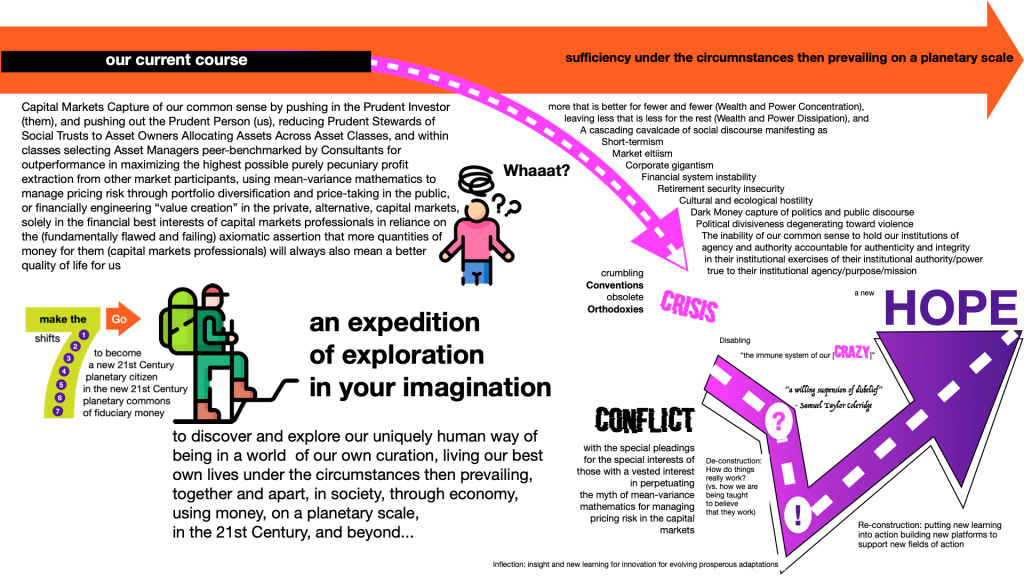

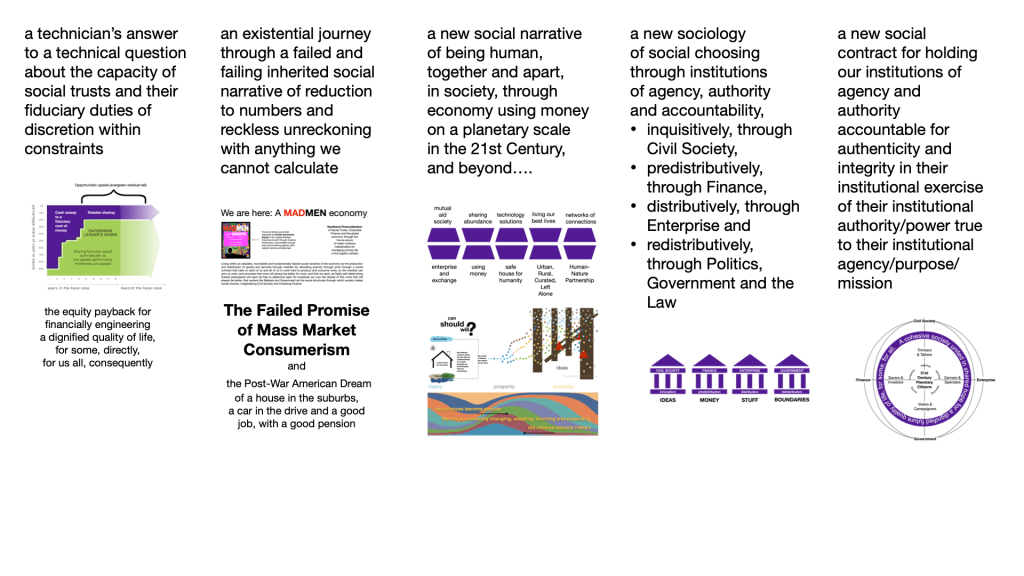

In this website I use the fractal design paradigm of web publishing to share a narrow, technical and legal answer to narrow, technical about how Pensions & Endowments can and should invest the money they control, that begins by going back to the text on money as savings for investment in financing for enterprise and ends opens up in a BIG existential discovery of:

- a new social narrative of being human in society through technology using money on a planetary scale in the 21st Century, and beyond…

- a new sociology of social choosing through institutions of agency, authority and accountability

- and a new social contract for holding our institutions of agency and authority accountable for authenticity and integrity of language and logic in their institutional exercises of their institutional authority/power true to their institutional agency/purpose/mission, and

- a new 21st Century planetary citizenship in the new 21st Century planetary commons of Fiduciary Money through innovations in fiduciary financing, and the innovation of Fiduciary Activism.

The hard part in getting started is finding an engaging place to start, that will draw people into this conversation about a new way of thinking and talking about money and savings and investment and financing and enterprise and technology and the economy and society and the future as our new frontier.

The Web offers the opportunity to present different portals that resonate with different communities of interest, each with its own fit-to-passion pathway for weaving together with other communities of other interests, to coalesce a new community of communities of interest with a shared interest in popular participation in prudent stewardship of society’s social trusts for the social purposes of socially provisioning the social safety nets of Workforce Pensions and Civil Society Endowments.

My Passion for Pensions: More Than Just Money

When people hear “pension,” they usually think of boring financial stuff. But for me, pensions are incredibly important – they’re about taking care of people and creating a safety net for families like mine.

My Personal Story

Let me tell you about my background. I’m a first-generation college graduate and lawyer. My dad was a firefighter in Massachusetts, and he passed away at a young age due to work-related issues. My mom was left to raise six children – me and my five siblings. It sounds like it could have been a total disaster, right?

But here’s where pensions became a real lifesaver. My dad had a pension with survivor benefits, which meant my mom continued to receive financial support after he was gone. This wasn’t just money – it was hope. It meant we could keep going, keep living, and stay together as a family. The emotional relief that this financial support brought to us is something that cannot be measured in numbers.

What Exactly Is a Pension?

Think of a pension like a mutual aid society. It’s not just about individual savings but about a whole group of people – like all the firefighters in a city – pooling their money together. The idea is simple: we all chip in and get taken care of when we retire.

Two Types of Retirement Savings

There are two main ways people prepare for retirement:

1. Retirement Savings (Individual Account):

o This is like your personal savings account

o You put money in, sometimes your employer matches your contribution o The money is always yours

o How much you get depends on how much you save

2. Pension (Mutual Aid Society):

o A promise to a whole group of workers

o Based on smart math called “actuarial science”

o Some people might die early, some might live longer

o But everyone contributes, and everyone gets what they need

Why Pensions Matter

Pensions aren’t about making tons of money. They’re about stability. Imagine a machine that needs to keep running smoothly, day after day, always paying the same amount. That’s a pension.

The problem today is that people are trying to make pensions work like the wild stock market, which is like trying to make a calm, steady bicycle ride feel like a roller coaster. It doesn’t make sense!

A Message for the Future

My goal is to help people see that pensions are more than numbers. They’re about creating fairness, supporting workers, and ensuring families survive tough times. They’re about building an economy that takes care of people and contributes to a fair and just society. Pensions are not just financial tools, they are a promise we make to each other, a way of saying, “We’ve got your back.”

When we invest pension money, we can actually influence how businesses behave. We can ensure they treat workers fairly, respect communities, and consider our planet’s future. This power of pensions to shape business practices is a testament to their potential to create a more equitable and sustainable future.

My Big Wish

My hope is that we’ll continue to protect and cherish pension systems. They’re not just financial tools – they’re a promise we make to each other, a way of saying, “We’ve got your back.”

Because, at the end of the day, a good pension isn’t about getting rich. It’s about living with dignity, knowing that after years of hard work, you’ll be taken care of.

Understanding Pensions, Equity, and the Fight for a Better Future

How might we use pension money to build a better future, especially when it comes to big challenges like climate change?

First, let’s start with some basics. Think of a business as a box where money flows in and out. Money comes in when a business sells something and goes out to cover costs like supplies, paying workers, and keeping the lights on. Sometimes, businesses need extra money to get started or grow, and they can get it in two ways: borrowing or equity.

When you borrow money, like from a bank, you agree to pay it back on a schedule with interest. If something goes wrong and you can’t make a payment, the loan can go into default, which can

be a disaster for the business. That’s why businesses try not to take on too much debt—they don’t want to risk losing everything if things don’t go as planned.

Equity works differently. Instead of promising to pay money back on a set schedule, businesses share a part of what they earn in the future. It’s more flexible. If the business has a tough time, there’s no immediate bill to pay. But when the business does well, it shares the success with those who provide the equity.

Here’s where pensions come in.

Pensions are long-term funds meant to pay for people’s retirement. Unlike mutual funds, which are a type of investment that pools money from many investors to buy stocks, bonds, or other securities, pensions aren’t trying to grow as much as possible; they just need to stay healthy so they can pay retirees every month forever. This makes pensions a perfect partner for businesses that need money but also want flexibility.

Imagine if pensions used their money to make profits and shape the economy in ways that align with values like fairness, sustainability, and dignity. For example, pensions could invest in businesses that create renewable energy, helping us move away from fossil fuels. This approach doesn’t just help the environment—it also creates a better future for the workers who rely on those pensions.

Right now, private equity firms control a lot of money and are all about making quick profits. But what if pensions took that same model—proven to work—and made it less focused on short- term gains and more on long-term benefits? This could transform how businesses operate, making them less pressured to grow unnaturally fast and more focused on doing what’s right for their communities and the planet.

Now, let’s talk about fairness. When I think about how businesses should operate, I think about six types of fairness:

- Fair Trade – Treating suppliers fairly.

- Fair Engagement – Respecting communities, governments, and regulators.

- Fair Reckoning – Taking responsibility for environmental and societal impacts.

- Fair Working – Ensuring workers are treated well.

- Fair Dealing – Being honest with customers and competitors.

- Fair Sharing – Making sure the savers, like pensioners, get their fair share of the

benefits.

If businesses followed these principles, we’d have a stronger foundation for creating a better world.

So, what’s the next step? It starts with conversations—simple, honest discussions about what pensions are capable of and how they can benefit everyone. We need to spread the idea that pensions can do more than just make money; they can help solve problems like climate change and create an economy that works for everyone.

This isn’t just a dream—it’s a movement. Discussing these ideas can help pension managers see the potential and make it happen. It’s not easy, but it’s possible. And when we align money with values, we can tackle even the biggest challenges together.