“The New Wealth of Nations: Pension Superpowers”

– Nicolas Firzli, World Pensions Council

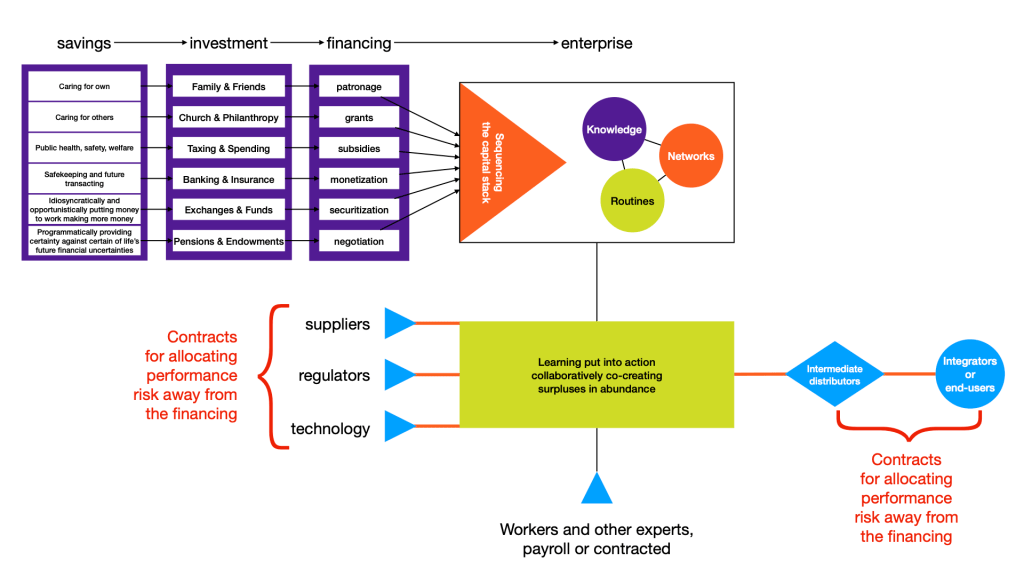

It’s about a new model for using Government Subsidies in combination with Pension Equity set free from Capital Markets Capture when sequencing the capital stack.

A new portal into Pensions as the inflection point for evolving prosperous adaptations to the circumstances now prevailing is opened up for us by Peter Elkins, founder of Project X, through this article published in thefutureeconomy.ca

Is Publicly Funded Venture Capital Failing to Serve Canadians?

https://thefutureeconomy.ca/op-eds/is-publicly-funded-venture-capital-failing-to-serve-canadians/

“Canada’s current commercialization strategy has largely mirrored that of our trading partners. We depend on public investments to fund broad research at post-secondary institutions and use a venture capital model—primarily publicly funded—as a means of funding commercialization. But this model inadvertently funnels successful Canadian innovations toward foreign buyers as our founders try to cross the domestic investment chasm, limiting the potential for domestic growth.

“As political ambitions increasingly lean towards retaining Canadian head offices, it’s clear our current publicly funded venture capital funding is not enough to compete with the allure of foreign investments, evidenced by an ongoing exodus of early-stage Canadian companies acquired by international interests.”

What’s the alternative?

American Sociologist Michael A. McCarthy tells us,

“few things impact our shared future more than how investments flow”

Few things are less well understood in our sociology of social choosing today than how investments flow.

When we encounter a point of failure in how investment is being made to flow – such as the failure of publicly funded venture capital to finance economic vitality in Canada – that creates an opportunity to stop and reflect on how investment can and should be made to flow, more broadly.

Who controls these flows?

How do they control the flow?

Why do they control the flow?

How do we hold them accountable for their How true to their Why?

Sociology today doesn’t really offer us an answer.

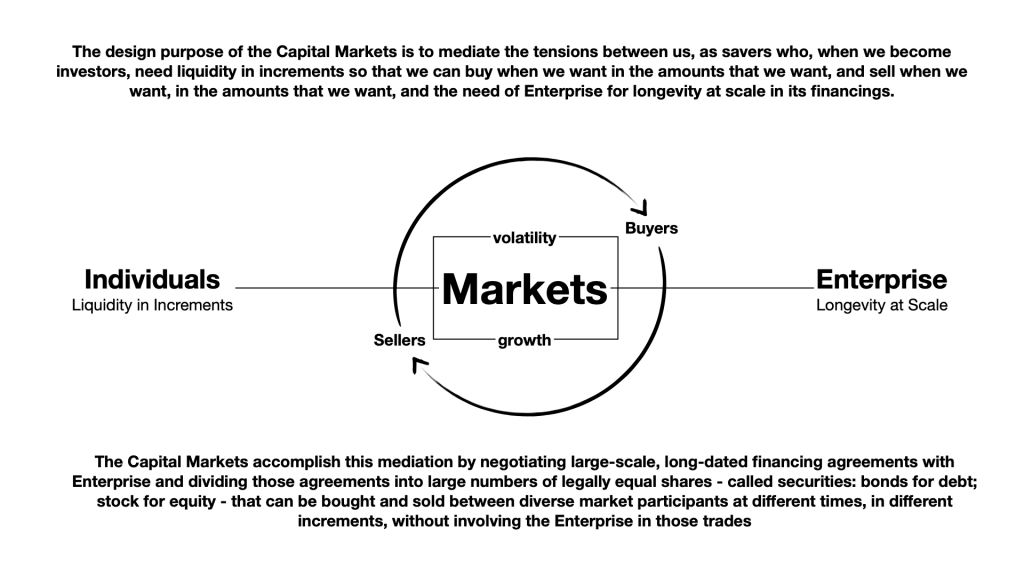

Economics today gives us only the Neo-Elitist, Neoliberal Financialization narrative of the Markets vs. Government Regulation debate (see George Layoff and Gil Duran, Framelab) that is confusing, because it talks about banks and insurance and investment, while only grudgingly acknowledging the role of taxpayers, barely acknowledging the existence of Philanthropy and presenting both Individuals and Pension Funds as only suppliers of money to banks, insurance, investment and government.

Also, there is this. The word “investment” is used in this prevailing narrative both generically, to refer to the flow of money into enterprise, and specifically, to refer to participation in the capital markets. This without taking the time to state clearly whether “investment” is being used generically or specifically.

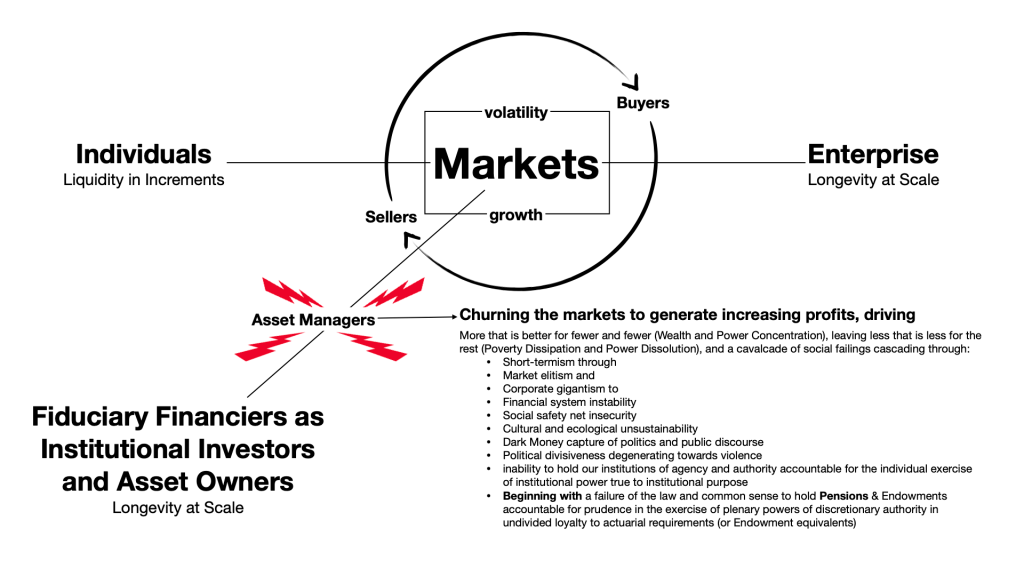

This little piece of linquistic legerdemain is the primary trick by which the Myth of Growth popularized by the Philosophy of Neoliberalism has financialized Pensions:

- replacing their legally constituted loyalty to income security in a dignified retirement for evergreen populations of current and future retired workers, directly, as a private benefit for some, that is also, of necessity, a dignified quality of life us all, as a public good, consequently,

- with a disloyal pursuit of outperformance in maximizing the highest possible purely pecuniary profit extraction through price-taking in the public, or financially engineering “value creation” in the private, alternative, capital markets, solely in the financial best interests of capital markets professionals, in reliance on the axiomatic assertion that more quantities of money for them will also always mean a better quality of life for us all.

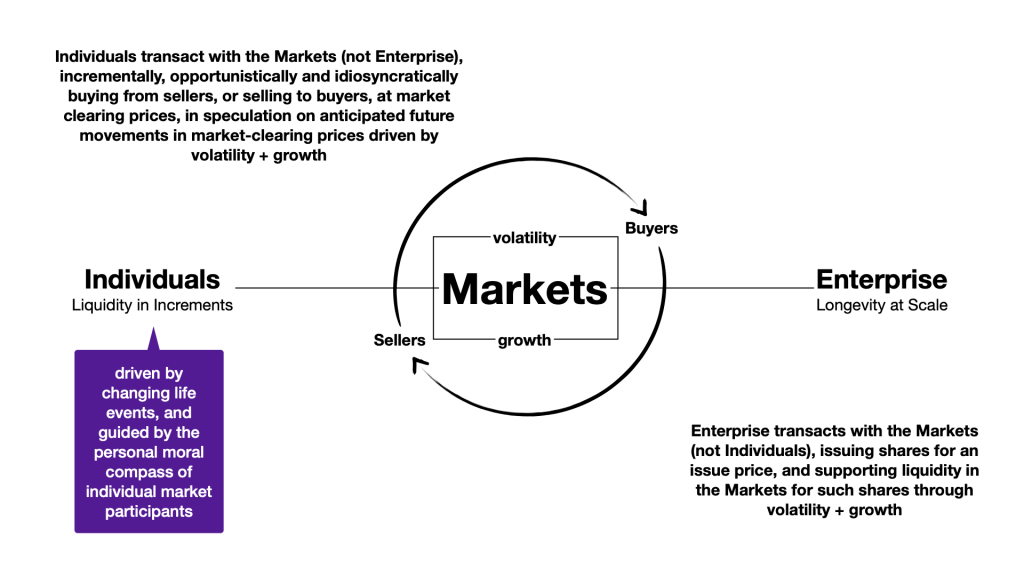

Through this financialization of the retirement provision, Neoliberalism has financialized the capital markets,

accelerating the stately pace of buy-and-hold of markets populated primarily by individuals motivated to buy and sell primarily by life events external to the markets, guided by our own personal morality when choosing what to buy, and when to sell,

into the buy-low-to-sell-high market-driven profit-taking of capital markets professionals motivate to buy and sell by price signals internal to the markets, guided by the mean-variance mathematics of Modern Portfolio Theory to mimic overall market returns through portfolio diversification.

This financialization of the capital markets drives the financialization of the corporation (Milton Friedman’s famous, and famously flawed, doctrine that the social responsibility of business is to increase profits: it is the social contract with the capital markets that requires corporations to increase profits; enterprises not financed by the capital markets have no imperative to grow, and neither does an economy that has not been financialized by capital markets monopolization of enterprise finance).

Financialized corporations drive financialization of enterprise more generally, by corrupting the rules of competition, which financializes the economy, which financializes society and our shared future.

The antidote to this Neo-Elitist Neoliberal Financialization of Everything, is the Hypothetical Prudent Steward of a Social Trust, as the legal avatar for the common sense of prudent people familiar with such matters under the circumstances than prevailing.

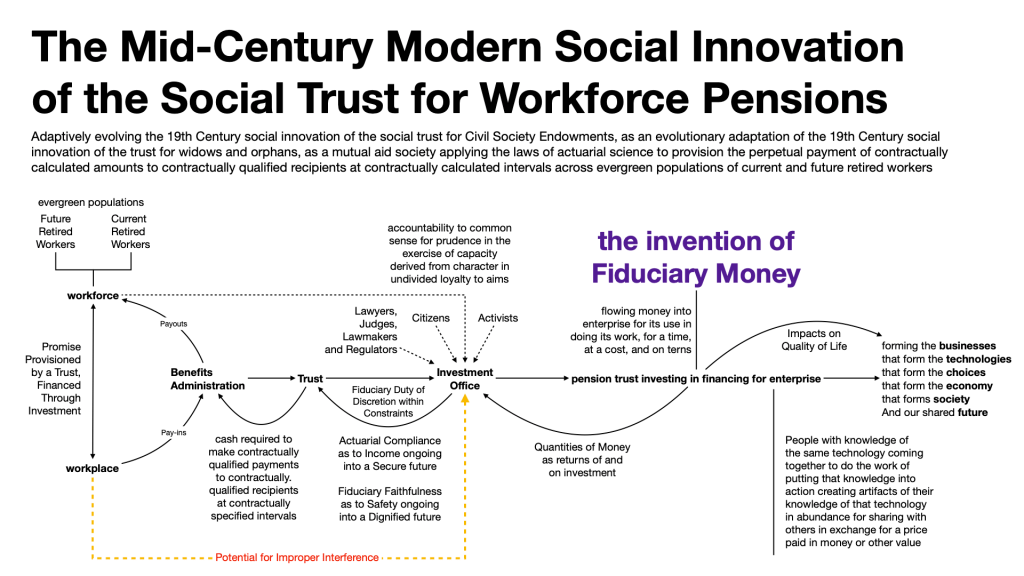

The social trust we are talking about is the Mid-Century Modern social innovation of the the Workforce Pension as a mutual aid society designed according to the laws of actuarial science for averaging the actual costs of paying contractually calculated amounts to contractually qualified recipients at contractually specified intervals, for income security sufficient to a dignified retirement, across evergreen populations of current and future retirees, by aggregating contributions into a trust, and investing that money for income as well as safety sufficient according to the actuaries to keep the trust ongoing, and able to make the payments it is constituted to make, in different amounts, to different recipients, each according to their contract, “every moth, forever”.

This innovation of the pension trust is an evolutionary adaptation of the late 19th Century social innovation of the social trust for endowing charitable, educational, research or cultural, civil society foundations, which was itself an evolutionary adaptation of the early 19th Century social innovation of the private trusts for widows and orphans, and other intergenerational transfers of private wealth, subject to conditions, which was itself an evolutionary adaptation of the long-standing practice of crusading (or otherwise errant) aristocrats transferring their estates in trust for safekeeping while they went off on their adventures, and return when they returned.

Other innovations in the use of the trust include land trusts, for conservation, and voting trusts, for control over an enterprise.

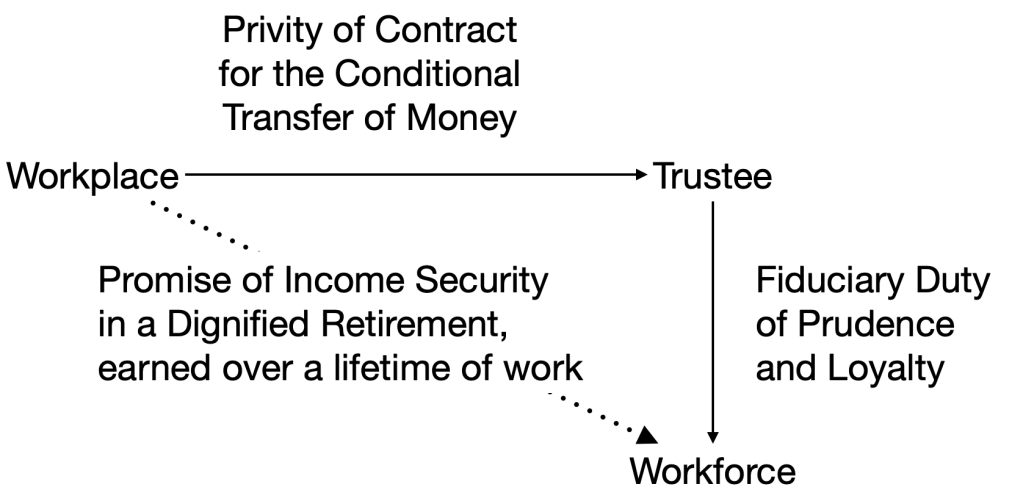

All trusts express a set of legal relationships between three primary parties:

- the creator of the trust (known in the law as the settlor or trustor);

- the holder of the trust (known in the law as the trustee); and

- the person or persons for whom the trust is created and continued (known in the law as the beneficiary/ies).

In the particular case of a pension trust,

- the workplace is the creator of the trust (also known as the sponsor of the plan

- a pension board (or individual) acts as trustee; and

- the workforce are the beneficiaries.

All trusts are governed by the law of fiduciary duty that recognizes discretionary control over the trust corpus (the money or other property held in trust), within the constraints of prudence in the exercise of capacity derived from the legally constituted character of the trust, in undivided loyalty to the legally constituted aims for which the trust was created and is continued.

The legal standard of prudence and loyalty is the common sense of prudent people familiar with such matters, under the circumstances then prevailing. These are matters of fact, to be determined by a trier of fact.

The matters of a private trust are private matters of private persons, judged against the legal standard of The Hypothetical Prudent Person.

The matters of a social trust are social matters of social choosing, judged against the legal standard of The Hypothetical Prudent Steward of a Social Trust.

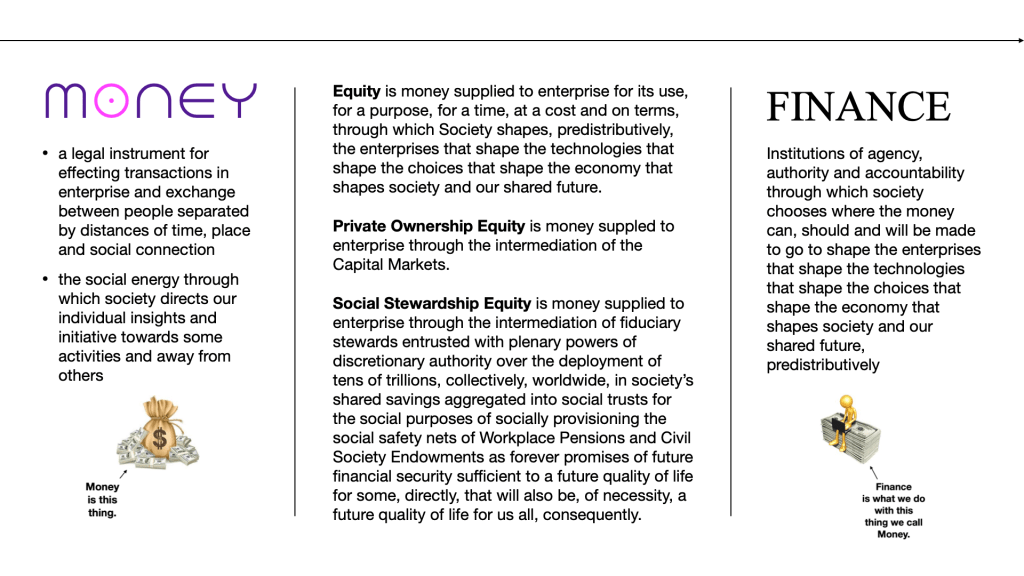

The corpus of a social trust is almost always money (a fact that Neoliberalism tries to hide from our common sense by referring to this money as “assets”, implying through this loose use of language that the corpus of a social trust is trading positions in the capital markets that they are constituted to trade, rather than money they are constituted to invest, which investment may be in assets traded in the capital markets, but does to have to be).

The purpose of a social trust is to invest the money entrusted to its control, sufficient to its own longevity, and its ongoing ability to make the payments it is constituted to make, to the persons it is constituted to make those payments to.

Prudence in the exercise of that control begins with the question of capacity: What are my choices?

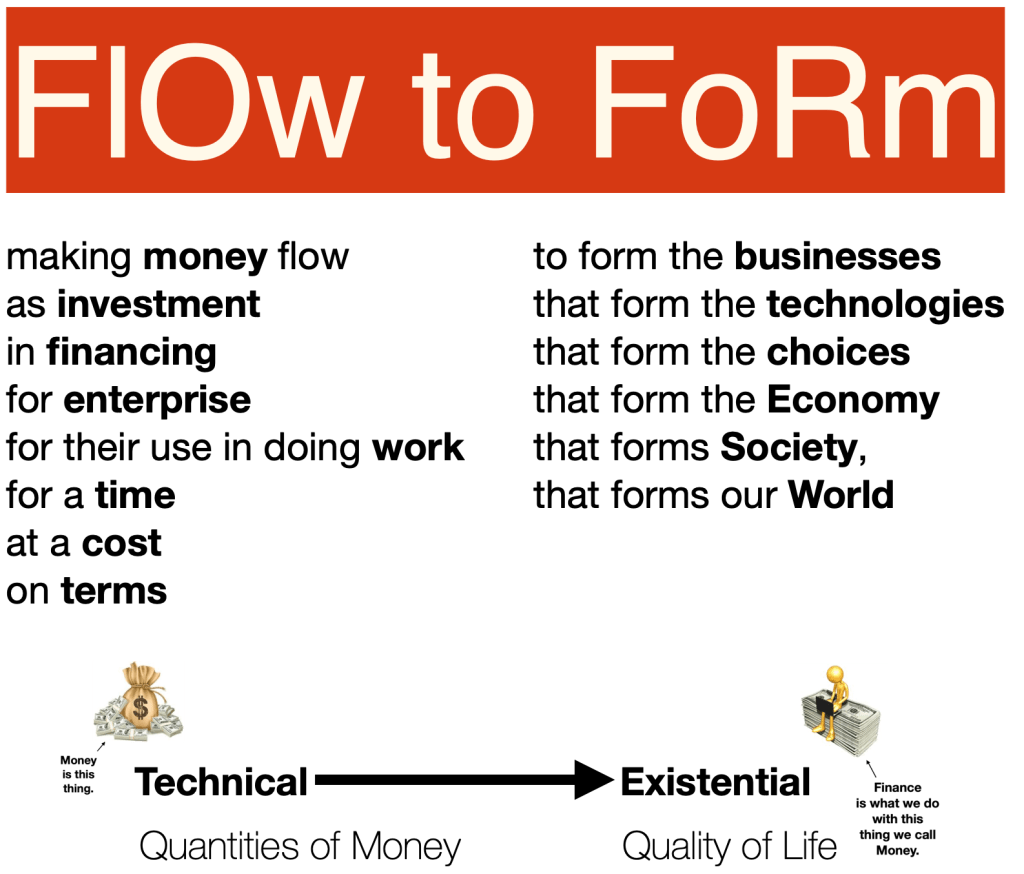

This question of choice in making investments of money to earn a sufficient return creates a space in our imaginations for inquiry in search of insight into how investment is made to flow:

- as money set aside by others, for a time, for a purpose,

- as savings for investment as financing for enterprise

- as money made to flow into enterprise

- for its use in doing its work

- for a time, and

- at a cost

- to inform the way that business does business

- to informs inform the expressions of technology for taking the world about us as we find it, and changing it to be more a way we choose to make it

- that inform the choices from which people can choose to construct our own personal and private worlds in which we live our own best lives, as best we can, under the circumstances then prevailing, personally and privately,

- that informs the connections for enterprise and exchange that is the economy

- that informs our relations in society

- that informs the future that is our new frontier for evolutionary adaption to life’s constant changes in the 21st Century, and beyond…

Individual savings are made to flow into investment in financing for enterprise through financial institutions constituted with agency, authority and accountability for

- aggregating money set aside by others for a purpose, for a time;

- allocating those aggregations as financing for enterprise as money made to flow into enterprises for their use in doing their work, at a cost and on terms;

- collecting the costs charged to enterprise for their use of that money; and

- sharing those costs with the savers whose savings are the original and ultimate source of the money made to flow into enterprise by its financiers.

Each institution of finance is constituted by the law of its creation with its own language and logic for aggregating savings, and allocating those aggregations as financing for enterprise, that determine what work that institution will finance, at what cost and on what terms.

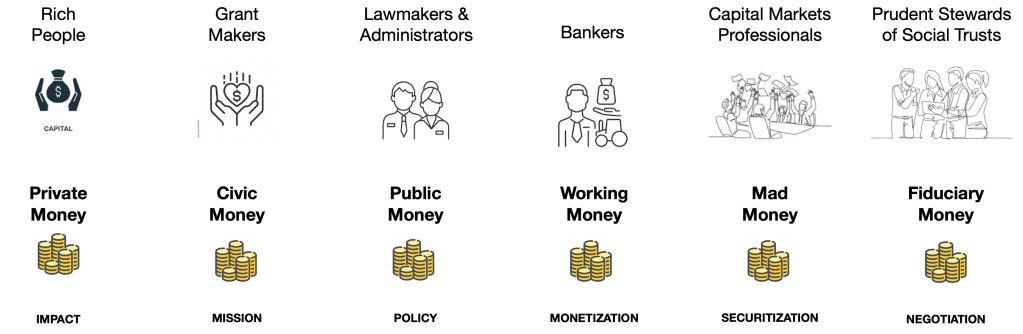

There are at least six different configurations of language and logic in Finance today. These are:

- Private Money financing enterprise through patronage for IMPACT;

- Civic Money financing enterprise through grants for MISSION;

- Public Money financing enterprise through subsidies for POLICY;

- Working Money financing enterprise through the monetization of PROPERTY;

- Mad Money financing enterprise through securitization of ownership into shares for speculation on SCALE/GROWTH; and

- Fiduciary Money financing enterprise through negotiation for SUFFICIENCY to fiduciary purpose.

This raises the question of, What is enterprise, that it can be financed in so many different ways?

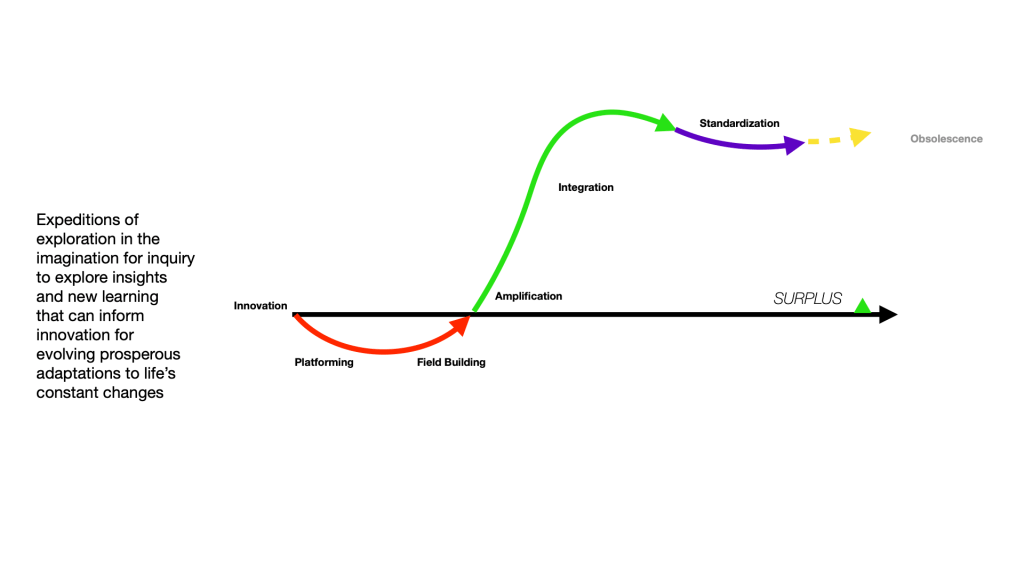

Venture Capital gives us a powerful point of view for seeing enterprise as a social configuration of physical Knowledge + Networks + Routines for putting technology as learning about how the world about us works, and how we can change the way the world works in some specific way, to make it work more a way we choose, put into action constructing an abundance of unique artifacts as particular expressions of that technology in surplus for sharing with others in exchange for a price paid in money, or other value, through a social contract that:

- begins with a vision of the possibilities for giving people a choice that will become popular as fit to the changing circumstances then prevailing;

- builds social proof of the value of tis choice to others;

- amplifies that proof, to achieve profitability through repeated exchanges;

- scales up to meet increasing demand as more and more people accept their choices as right for them;

- levels off as that choice becomes the standard choice within large and stable populations of chooser;

- before eventually fading into history as times change, and new choices become more popular.

The flourish and fade of this social contract between enterprise and popular choice creates different needs for different kinds of financing at different points along this journey from innovation to obsolesce.

The different kinds of money are well-suited to supply these different needs for financing for enterprise.

Innovation almost always begins with boot-strapping by the entrepreneurs who have the vision, financed by Private Money from Family & Friends who support the entrepreneur, more than the vision.

Private Money carries the enterprise through social proof building and amplification, in some cases, perhaps, supplemented by Civic Money investing for IMPACT that aligns with MISSION (as to building social proof), and Public Money providing subsides for POLICY for amplifying social proof, until breakeven is achieved, and the enterprise becomes bankable.

Scaling up attracts money from the Capital Markets, giving early investors the ability to realize substantial profits by selling the shares they bought early on into the public markets for much more than they paid.

Venture Capital provides an alternative path to the Capital Markets.

As Peter correctly points out in his article, the innovation that inspires new enterprise formation is often derived from inquiry for insight and new learning into the changing circumstances of the changing times. This inquiry is almost always funded by taxpayers, through their Government, or civil society foundations or the personal resources of individuals with a passion for that learning. It is never funded by Venture Capital.

Venture Capital will, however, step in early in the process of enterprise formation, to fund the building and application of social proof that the innovation as expressed by the enterprise is both technically feasible and commercially viable, speculating on the success of the enterprise in scaling up to the scale of the Capital Markets, at which time shares bought early by Venture Capital at low prices can be sold later at much, much higher prices into the Capital Markets.

The standard formula is 10-20x in 7-10 years.

This is classic Venture Capital anticipating the Capital Markets, executing an investment thesis based on ownership for profit extraction as gain on sale through price-taking in the public markets.

This is the source of the problem for Canada that Peter identifies in his article: once you invest as purchase for sale, your loyalties bend to the sale, and the profit that you can extract from that sale, and the risk that if you don’t “take the deal that is on the table”, you will miss the market, and not make a profit.

Public policies of keeping the enterprise in Canada, to continue contributing to the vitality of the economy in Canada, for the benefit of the Canadian taxpayers who funded the enterprise in its early, formative, years, get pushed out of the frame by the investment thesis of “getting out while the getting is good”.

But what if there was an alternative to the Capital Markets for taxpayer funded Venture Capital, that was more aligned with the public interest in keeping the business in the country?

What if Fiduciary Money for SUFFICIENCY to fiduciary purpose could be made available to pick up where Government subsidies leave off, so that instead of speculating on exit by sale in the Capital Markets, crown corporations (?) fund early stage enterprise in speculation on exit by sale back to the owners of the enterprise (or maybe to a Perpetual Purpose Trust) whose repurchase is financed by the Untaken Safer Alternative of Equity Paybacks for INCOME with IMPACT suppled by social trusts for Pensions & Endowments?

Private Equity in its other incarnation, as Buy-Out Funds, show us the way.

Venture Capital and Buy-Out Funds book-end the Public Markets, with Venture Capital financing enterprise in anticipation of entering the Public Markets, and Buy-Out Funds offering an (illusory) exit from the Public Markets through going-private transactions that lead to financial engineering of “value creation” as a euphemism for building up a selling price from which profit can be extracted through increased borrowing to pay fees and as gain on eventual sale back into the public markets, either directly, or more often by trade sale to a buyer that gets its financing from the public markets.

This is all pretty technical, and might be hard for non-professionals to understand, but it also provides social proof of the capacity of Pensions & Endowments, who are the primary, if not exclusive, source of funding for both VC and PE, to negotiate the cost and terms of their financing agreements with enterprise, directly.

VC and PE use this power to negotiate to purchase ownership shares for profit extraction as gain on sale, but Real Estate shows us an alternative, the Untaken Safer Alternative, of using this power to negotiate equity paybacks to a preferred return, plus opportunistic upside, from enterprise cash flows prioritized for suitability, longevity and fairness in how the business does business.

If we can shift Pensions & Endowments out of Private Ownership Equity as their investment thesis, and into this Untaken Safer Alternative of Equity Paybacks, we can match Publicly Funded Venture Capital, using ownership for profit extraction as an investment thesis, with Pensions & Endowments financing an exit-to-equity-payback alternative to exiting into the public markets as an investment thesis.

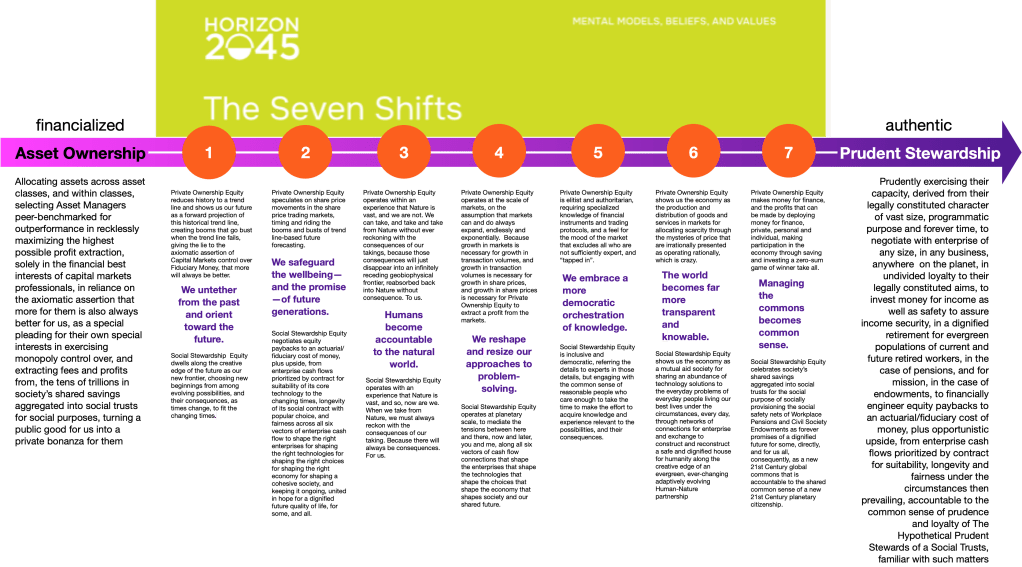

We can make this shift, from Ownership to Stewardship, in several steps, as follows.

- We untether from the past and orient toward the future.

- Private Ownership Equity reduces history to a trend line and shows us our future as a forward projection of this historical trend line, creating booms that go bust when the trend line fails, giving the lie to the axiomatic assertion of Capital Markets control over Fiduciary Money, that more will always be better.

- Social Stewardship Equity dwells along the creative edge of the future as our new frontier, choosing new beginnings from among evolving possibilities, and their consequences, as times change, to fit the changing times.

- We safeguard the wellbeing—and the promise—of future generations.

- Private Ownership Equity speculates on share price movements in the share price trading markets, timing and riding the booms and busts of trend line-based future forecasting.

- Social Stewardship Equity negotiates equity paybacks to an actuarial/fiduciary cost of money, plus upside, from enterprise cash flows prioritized by contract for suitability of its core technology to the changing times, longevity of its social contract with popular choice, and fairness across all six vectors of enterprise cash flow to shape the right enterprises for shaping the right technologies for shaping the right choices for shaping the right economy for shaping a cohesive society, and keeping it ongoing, united in hope for a dignified future quality of life, for some, and all.

- Humans become accountable to the natural world.

- Private Ownership Equity operates within an experience that Nature is vast, and we are not. We can take, and take and take from Nature without ever reckoning with the consequences of our takings, because those consequences will just disappear into an infinitely receding geobiophysical frontier, reabsorbed back into Nature without consequence. To us.

- Social Stewardship Equity operates with an experience that Nature is vast, and so, now are we. When we take from Nature, we must always reckon with the consequences of our taking. Because there will always be consequences. For us.

- We reshape and resize our approaches to problem-solving.

- Private Ownership Equity operates at the scale of markets, on the assumption that markets can and do always expand, endlessly and exponentially. Because growth in markets is necessary for growth in transaction volumes, and growth in transaction volumes is necessary for growth in share prices, and growth in share prices is necessary for Private Ownership Equity to extract a profit from the markets.

- Social Stewardship Equity operates at planetary scale, to mediate the tensions between here and there, now and later, you and me, along all six vectors of cash flow connections that shape the enterprises that shape the technologies that shape the choices that shape the economy that shapes society and our shared future.

- We embrace a moredemocratic orchestrationof knowledge.

- Private Ownership Equity is elitist and authoritarian, requiring specialized knowledge of financial instruments and trading protocols, and a feel for the mood of the market that excludes all who are not sufficiently expert, and “tapped in”.

- Social Stewardship Equity is inclusive and democratic, referring the details to experts in those details, but engaging with the common sense of reasonable people who care enough to take the time to make the effort to acquire knowledge and experience relevant to the possibilities, and their consequences.

- The world becomes far more transparent and knowable.

- Private Ownership Equity shows us the economy as the production and distribution of goods and services in markets for allocating scarcity through the mysteries of price that are irrationally presented as operating rationally, which is crazy.

- Social Stewardship Equity shows us the economy as a mutual aid society for sharing an abundance of technology solutions to the everyday problems of everyday people living our best lives under the circumstances, every day, through networks of connections for enterprise and exchange to construct and reconstruct a safe and dignified house for humanity along the creative edge of an evergreen, ever-changing adaptively evolving Human-Nature partnership.

- Managing the commons becomes common sense.

- Private Ownership Equity makes money for finance, and the profits that can be made by deploying money for finance, private, personal and individual, making participation in the economy through saving and investing a zero-sum game of winner take all.

- Social Stewardship Equity celebrates society’s shared savings aggregated into social trusts for the social purpose of socially provisioning the social safety nets of Workplace Pensions and Civil Society Endowments as forever promises of a dignified future for some, directly, and for us all, consequently, as a new 21st Century global commons that is accountable to the shared common sense of a new 21st Century planetary citizenship.

We can make this shift happen by speaking with the voice of The Hypothetical Prudent Steward of a Social Trust as the legal avatar for our common sense as prudent people familiar with such matters, under the circumstances then prevailing, that the law makes the standard of their fiduciary prudence and loyalty.

We can speak with such a voice in Citizens Assemblies adapted from lawmaking, as an alternative to electoral politics, to law-enforcing through popular participation in prudent stewardship as new 21st Century planetary citizens in a new 21st Century planetary commons of Fiduciary Money controlled by social trusts for Pensions & Endowments.

You can join this movement to adapt Citizens Assemblies for fiduciary accountability by Zooming in to the upcoming RSA Deliberation Gateway Network panel discussion on February 6, 2025.

Leave a comment